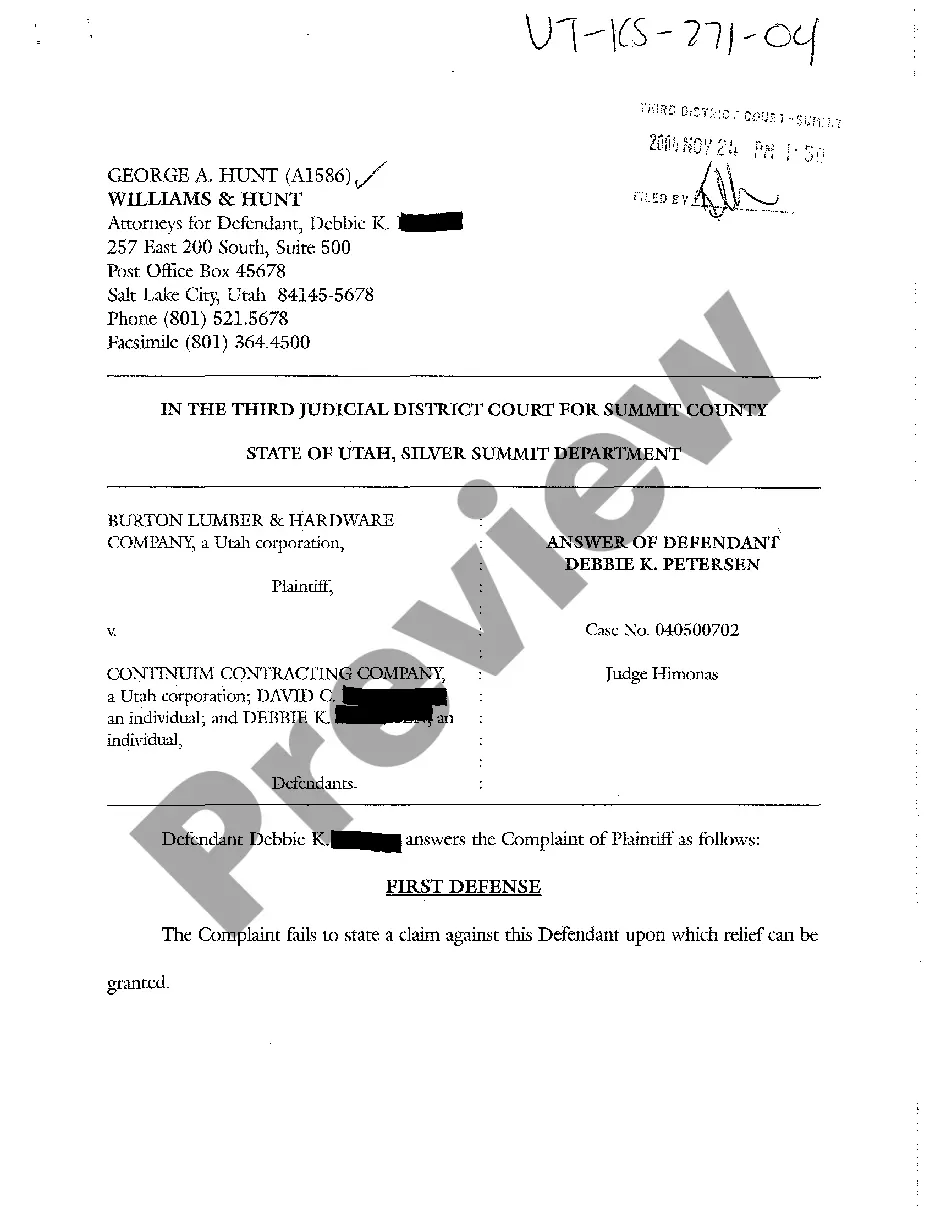

District of Columbia Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent

Description

How to fill out Domestic Subsidiary Security Agreement Regarding Ratable Benefit Of Lenders And Agent?

US Legal Forms - one of several biggest libraries of lawful varieties in the USA - gives a variety of lawful papers layouts you can acquire or printing. Utilizing the web site, you can get a large number of varieties for company and personal functions, categorized by types, states, or keywords and phrases.You can find the most recent models of varieties such as the District of Columbia Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent in seconds.

If you already have a membership, log in and acquire District of Columbia Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent from the US Legal Forms catalogue. The Download key will show up on every develop you view. You gain access to all formerly delivered electronically varieties within the My Forms tab of your bank account.

If you want to use US Legal Forms the very first time, listed here are easy recommendations to obtain started out:

- Be sure you have picked out the best develop for your personal area/county. Click the Review key to review the form`s content. See the develop information to actually have chosen the correct develop.

- In case the develop does not suit your requirements, take advantage of the Look for field on top of the screen to get the one who does.

- Should you be content with the shape, affirm your decision by clicking the Get now key. Then, pick the rates prepare you favor and supply your credentials to sign up for an bank account.

- Approach the deal. Make use of your credit card or PayPal bank account to accomplish the deal.

- Find the formatting and acquire the shape on the gadget.

- Make changes. Load, modify and printing and indication the delivered electronically District of Columbia Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent.

Each and every template you included with your money lacks an expiration time and it is the one you have for a long time. So, in order to acquire or printing one more version, just visit the My Forms portion and click about the develop you need.

Get access to the District of Columbia Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent with US Legal Forms, probably the most comprehensive catalogue of lawful papers layouts. Use a large number of professional and status-certain layouts that meet your business or personal demands and requirements.

Form popularity

FAQ

The omnibus loan agreement involves a well-defined contract between the debtor and the creditor, which outlines the necessary conditions and terms of accommodation of credit regardless of the type of loan product.

The five Cs of credit are important because lenders use these factors to determine whether to approve you for a financial product. Lenders also use these five Cs?character, capacity, capital, collateral, and conditions?to set your loan rates and loan terms.

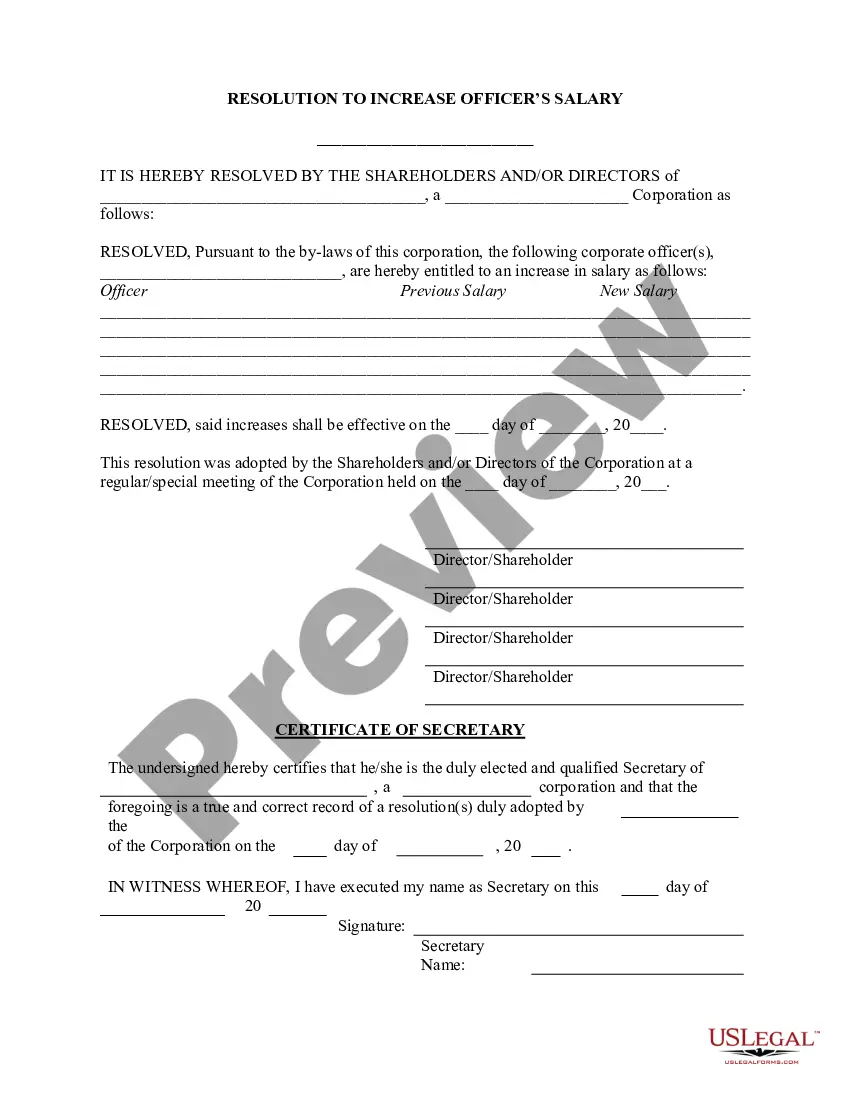

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

As owners of FP&A processes, today's accounting teams must be well-versed in the four C's of financial planning: context, collaboration, continuity, and communication. Today, financial planning and budgeting are more important than ever.

Standards may differ from lender to lender, but there are four core components ? the four C's ? that lenders will evaluate in determining whether they will make a loan: capacity, capital, collateral and credit.

At the end of the day, securing a home loan comes down to the four C's: credit, capacity, capital, and collateral. Whether it's down payment assistance, free credit coaching, or a trustworthy realtor, there's plenty of support so you don't have to go through the process alone.

Collateral. Collateral is an asset you can pledge to the lender as an additional form of security, should you not be able to repay the loan. Collateral can help a borrower secure the financing they need and can help the lender recoup their investment if the borrower defaults on the loan.

Note: This is one of five blogs breaking down the Four Cs and a P of credit worthiness ? character, capital, capacity, collateral, and purpose.