This form is an outline of issues that the due diligence team should consider when determining the feasibility of the proposed transaction.

District of Columbia Outline of Considerations for Transactions Involving Foreign Investors

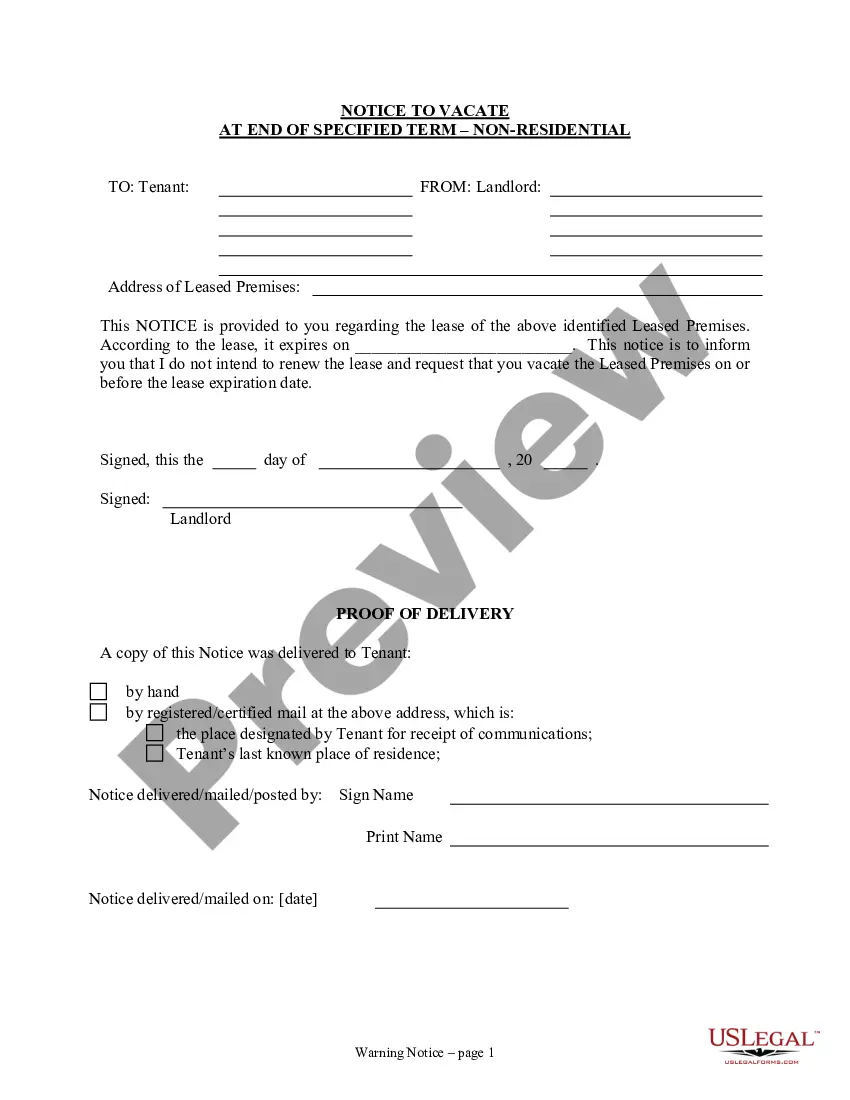

Description

How to fill out Outline Of Considerations For Transactions Involving Foreign Investors?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a variety of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for both commercial and personal purposes, organized by type, claim, or keywords. You can obtain the most current versions of documents like the District of Columbia Summary of Considerations for Transactions Involving Foreign Investors in moments.

If you have an active subscription, Log In to access the District of Columbia Summary of Considerations for Transactions Involving Foreign Investors from the US Legal Forms library. The Download button will be available on every form you view. You can find all previously downloaded forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to finalize the payment.

Select the format and download the form to your device. Edit. Fill out, modify, and print or sign the downloaded District of Columbia Summary of Considerations for Transactions Involving Foreign Investors.

Each template you add to your account never expires and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the District of Columbia Summary of Considerations for Transactions Involving Foreign Investors through US Legal Forms, one of the most extensive libraries of legal form templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and specifications.

- First, ensure you’ve selected the correct form for your city/region.

- Click the Review button to examine the content of the form.

- Check the form description to confirm you have chosen the appropriate document.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, choose your preferred pricing plan and provide your information to register for an account.

Form popularity

FAQ

Regulation D does apply to foreign investors, but there are specific conditions and exemptions to consider. Under Reg D, foreign investors can participate in private placements under certain circumstances, which are often detailed in the District of Columbia Outline of Considerations for Transactions Involving Foreign Investors. Being aware of these guidelines helps foreign investors better understand their options and adhere to U.S. securities laws. Utilizing platforms like uslegalforms can simplify the process and provide clarity on required documentation.

Transactions that involve foreign investment in U.S. businesses, especially those that affect national security, are subject to CFIUS review. This includes mergers, acquisitions, and certain equity investments. It's crucial for foreign investors to understand the implications laid out in the District of Columbia Outline of Considerations for Transactions Involving Foreign Investors to navigate these regulations effectively. Engaging with professionals can ensure compliance and address any potential risks.

A mandatory CFIUS filing is a requirement for certain transactions that involve foreign investors and could impact national security. Under the District of Columbia Outline of Considerations for Transactions Involving Foreign Investors, transactions that fall within specific criteria must be reported to the Committee on Foreign Investment in the United States (CFIUS). This process ensures that the U.S. government can review and address any potential risks. To navigate these complexities, using a platform like uslegalforms can help you prepare the necessary documentation and ensure compliance with all regulations.

Foreign investment restrictions are regulations that limit or control the ability of non-U.S. investors to invest in certain sectors or industries within the United States. In the context of the District of Columbia Outline of Considerations for Transactions Involving Foreign Investors, these restrictions can vary depending on the nature of the investment and the potential impact on national security. Understanding these restrictions is crucial for foreign investors to ensure compliance and avoid legal complications. The USLegalForms platform can assist you in navigating these regulations effectively.

Investors require comprehensive information pertaining to market conditions, financial performance, and legal obligations. The District of Columbia Outline of Considerations for Transactions Involving Foreign Investors outlines essential data that helps investors assess opportunities and risks. Access to accurate, up-to-date information ensures informed decision-making and optimal investment returns.

Guidelines for foreign investment in the District of Columbia focus on compliance with local laws, understanding market dynamics, and aligning with government policies. Foreign investors should be familiar with the necessary registrations and permits, as outlined in the District of Columbia Outline of Considerations for Transactions Involving Foreign Investors. Adhering to these guidelines can facilitate smoother transactions.

Due diligence is the most critical factor when considering foreign investments. This includes comprehensive research on legal, financial, and cultural aspects. The District of Columbia Outline of Considerations for Transactions Involving Foreign Investors serves as a guide to understand the risks and opportunities inherent in international transactions.

Key factors include understanding the legal framework, assessing economic stability, and evaluating potential risks and returns. The District of Columbia Outline of Considerations for Transactions Involving Foreign Investors suggests investigating local market trends and demand. Establishing connections with local experts can also provide valuable insights and ease the investment process.

Yes, the District of Columbia does allow section 179 depreciation, which benefits businesses investing in qualifying equipment and properties. This can significantly reduce taxable income for foreign investors, making DC an attractive location. It is advisable for investors to consult tax professionals to fully understand how section 179 can apply to their specific investment circumstances.

Foreign investors often seek opportunities in developing countries due to favorable economic conditions, potential for high returns, and emerging markets. The District of Columbia Outline of Considerations for Transactions Involving Foreign Investors highlights the importance of stability, infrastructure development, and access to local talent. Investors must also consider government incentives that encourage foreign direct investment.