Are you presently in a situation where you frequently require documents for either business or personal purposes? There is a plethora of legal form templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, including the District of Columbia Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Falsely Representing the Character, Amount, or Legal Status of any Debt, designed to comply with federal and state requirements.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the District of Columbia Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Falsely Representing the Character, Amount, or Legal Status of any Debt template.

Choose a convenient paper format and download your copy.

Access all the form templates you have purchased in the My documents section. You can obtain another copy of the District of Columbia Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Falsely Representing the Character, Amount, or Legal Status of any Debt at any time, if necessary. Just select the desired form to download or print the template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/area.

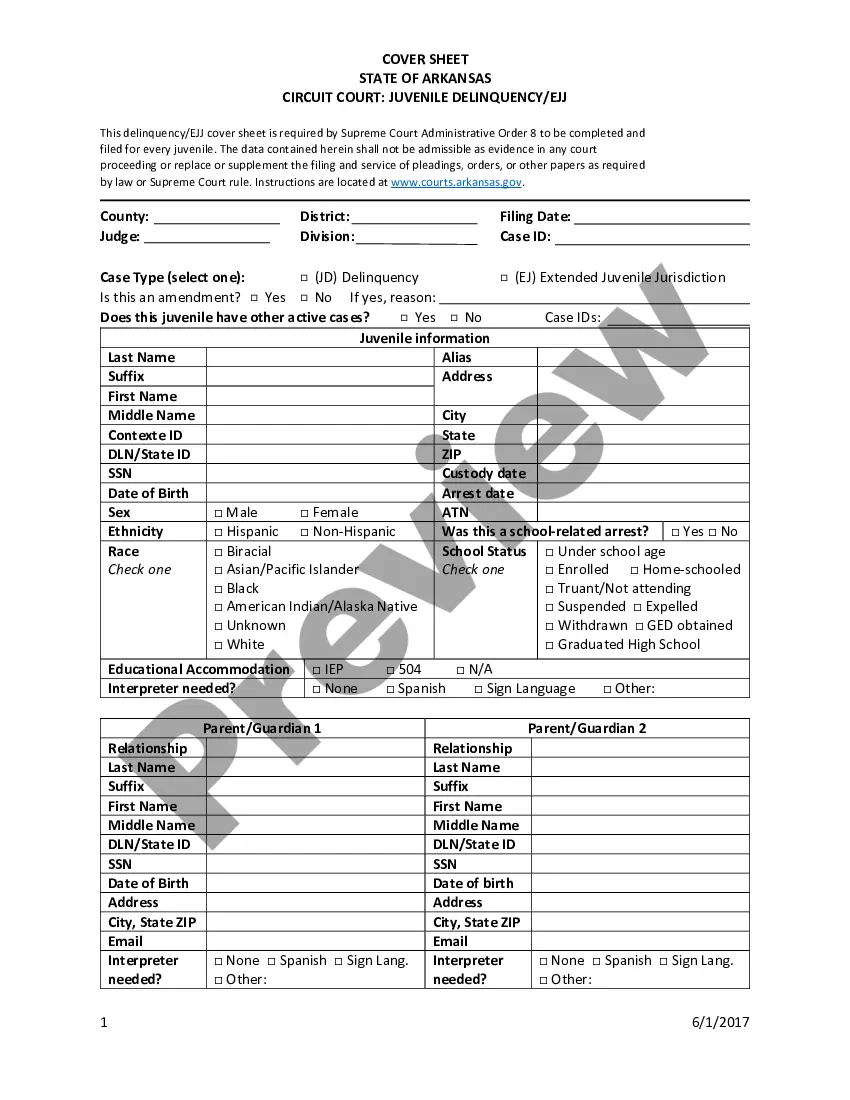

- Utilize the Review option to analyze the form.

- Check the information to confirm that you have chosen the correct template.

- If the template is not what you are looking for, use the Lookup field to find the form that fits your needs and requirements.

- Once you find the appropriate form, click Get now.

- Select the pricing plan you prefer, fill in the necessary details to create your account, and finalize your purchase using PayPal or credit card.