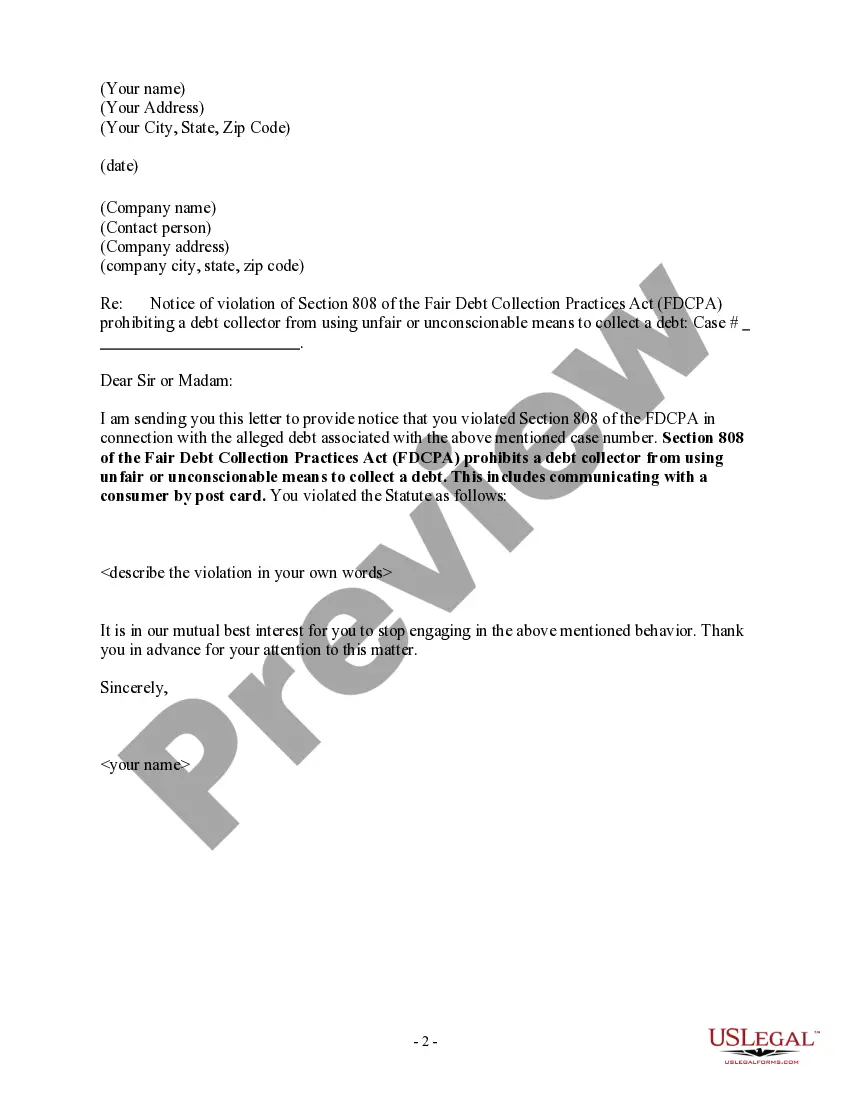

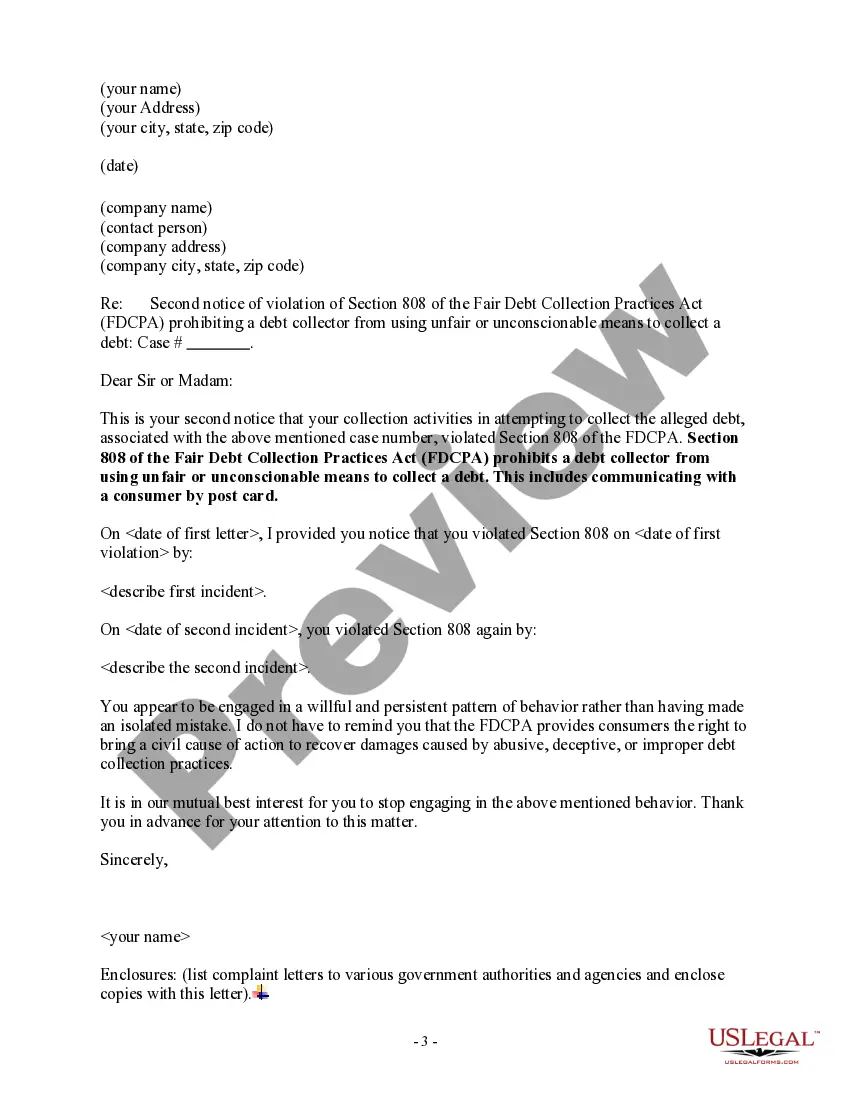

District of Columbia Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard

Description

How to fill out Notice Of Violation Of Fair Debt Act - Unlawful Contact By Postcard?

US Legal Forms - one of the largest collections of legal templates in the USA - provides a range of legal document formats you can download or print.

By using the website, you will access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms such as the District of Columbia Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard in just seconds.

Click the Preview option to review the form's details.

Read the form summary to confirm that you have selected the correct document. If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you have a subscription, Log In to download the District of Columbia Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard from the US Legal Forms catalog.

- The Download option will appear on every form you view.

- You have access to all previously acquired forms from the My documents section of your account.

- To use US Legal Forms for the first time, here are simple guidelines to get started.

- Ensure you have selected the correct form for your city/county.

Form popularity

FAQ

An example of a letter to verify debt includes your personal information, the debt collector's details, and a clear request for verification. You should state that you are invoking your rights under the District of Columbia Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard. This letter should demand documentation proving the debt’s legitimacy. This way, you are taking the first step toward resolving any disputes regarding the debt.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

5 Things Debt Collectors Are Forbidden to DoPretend to Work for a Government Agency. The FDCPA prohibits debt collectors from pretending to work for any government agency, including law enforcement.Threaten to Have You Arrested.Publicly Shame You.Try to Collect Debt You Don't Owe.Harass You.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

Deceptive And Unfair Practices Calling you collect so that you have to pay to accept the call is an example of an unfair practice. Engaging in any practice that forces you to pay additional money other than the debt you owe is considered an FDCPA violation.

The FDCPA broadly defines a debt collector as "any person who uses any instrumentality of interstate commerce or the mails in any business the principal purpose of which is the collection of any debts, or who regularly collects or attempts to collect, directly or indirectly, debts owed or due or asserted to be owed or

The FDCPA prohibits debt collectors from engaging in harassment or abuse, making false or misleading representations, and engaging in unfair practices.

The FDCPA forbids harassing, oppressive, and abusive conductno matter what kind of communication media the debt collector uses. So, this prohibition applies to in-person interactions, telephone calls, audio recordings, paper documents, mail, email, text messages, social media, and other electronic media.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.