District of Columbia Complex Will - Maximum Unified Credit to Spouse

Description

How to fill out Complex Will - Maximum Unified Credit To Spouse?

You may invest hrs on-line searching for the legal document format which fits the state and federal specifications you will need. US Legal Forms offers 1000s of legal types that happen to be examined by specialists. It is possible to download or printing the District of Columbia Complex Will - Maximum Unified Credit to Spouse from your services.

If you already possess a US Legal Forms bank account, you are able to log in and then click the Download button. Next, you are able to total, edit, printing, or indication the District of Columbia Complex Will - Maximum Unified Credit to Spouse. Each legal document format you get is your own eternally. To get another version for any purchased kind, proceed to the My Forms tab and then click the related button.

If you work with the US Legal Forms web site the first time, keep to the easy recommendations listed below:

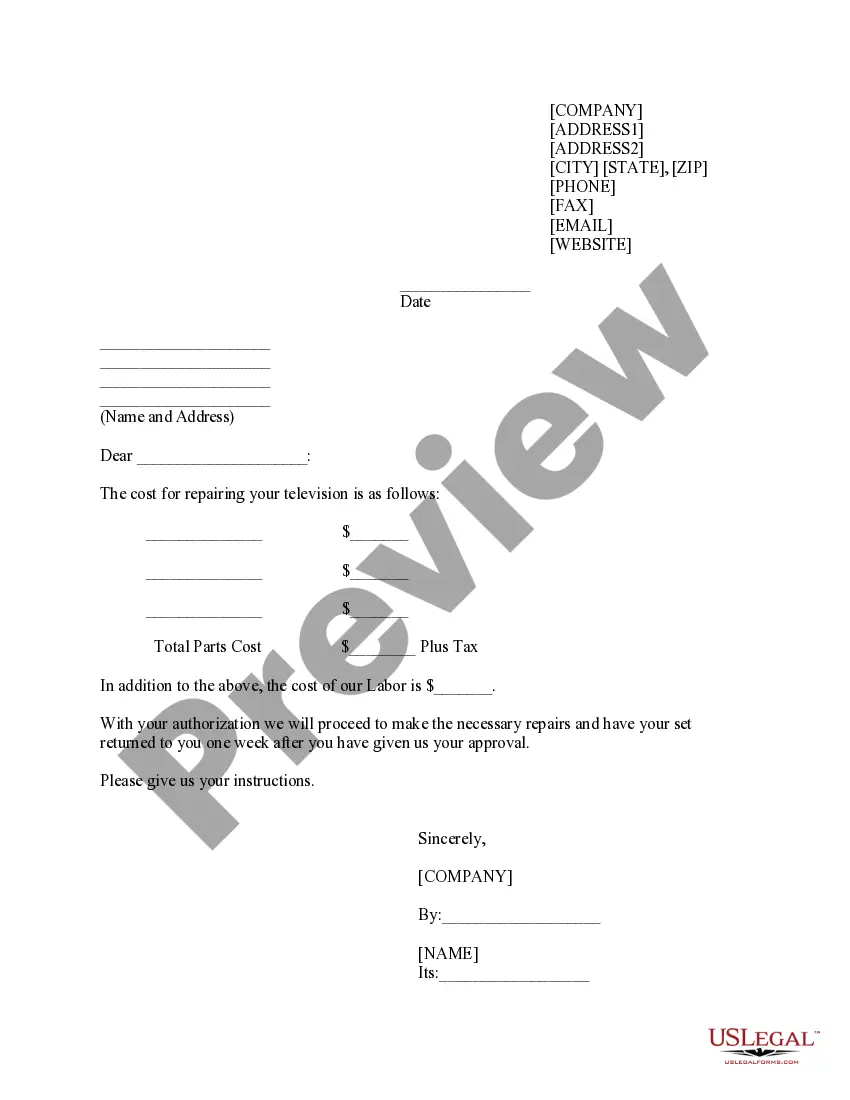

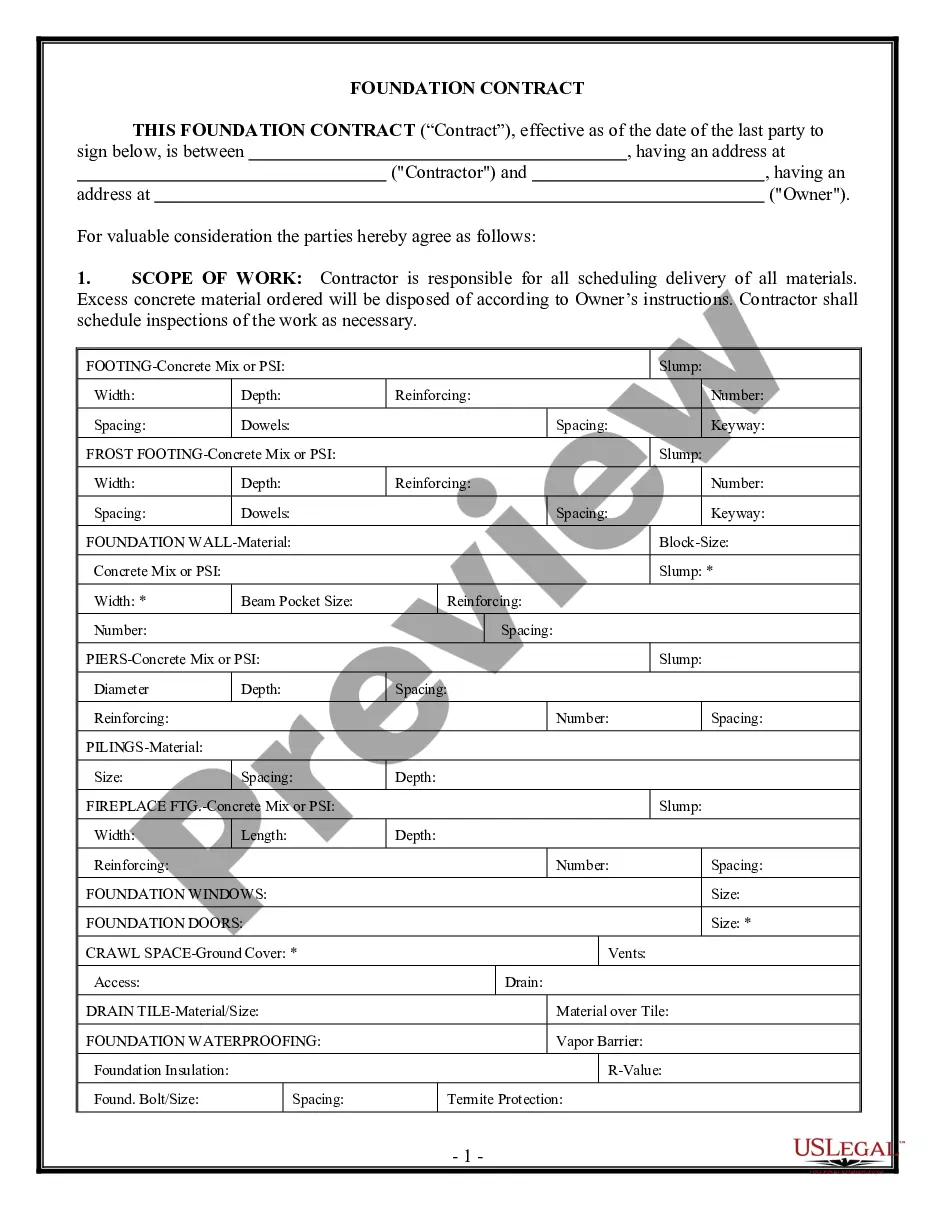

- Initial, make sure that you have selected the best document format for that state/area that you pick. See the kind outline to ensure you have picked the appropriate kind. If offered, utilize the Review button to search throughout the document format at the same time.

- If you want to locate another edition of the kind, utilize the Search discipline to find the format that fits your needs and specifications.

- When you have identified the format you would like, click on Purchase now to move forward.

- Choose the costs program you would like, type your qualifications, and register for an account on US Legal Forms.

- Complete the deal. You may use your Visa or Mastercard or PayPal bank account to fund the legal kind.

- Choose the file format of the document and download it in your product.

- Make alterations in your document if necessary. You may total, edit and indication and printing District of Columbia Complex Will - Maximum Unified Credit to Spouse.

Download and printing 1000s of document themes using the US Legal Forms website, which offers the most important collection of legal types. Use skilled and state-specific themes to tackle your business or person requires.

Form popularity

FAQ

Spousal Planning As stated, each person has a unified credit. This means that each spouse in a marriage has a unified credit and that by using both of those credits a married couple may exempt from transfer taxes a marital estate worth up to $10.86 million.

The unified credit in 2023 will be $12,920,000, up from $12,060,000 in 2022. Since the credit can be shared between spouses, when used correctly, a married couple can transfer up to a combined $25,840,000 without incurring gift or estate tax.

The spouse exemption is unlimited if neither of the spouses or civil partners is UK domiciled or if a non-UK domiciled individual makes gifts to a UK domiciled spouse or civil partner. However, the spouse exemption is capped when a UK domiciled individual gives assets to a non-UK domiciled spouse or civil partner.

The unlimited marital deduction is a provision in the US estate tax law that allows a married individual to transfer an unlimited amount of assets to their spouse, both during life and at death, without incurring any federal estate or gift taxes.

The unlimited marital deduction is a provision in the U.S. Federal Estate and Gift Tax Law that allows an individual to transfer an unrestricted amount of assets to their spouse at any time, including at the death of the transferor, free from tax.

The tax credit unifies the gift and estate taxes into one tax that decreases the tax bill of the individual or estate, dollar for dollar. The lifetime gift and estate tax exemption for 2022 is $12.06 million for individuals and $24.12 million for married couples filing jointly.

The marital deduction defers the estate tax until the surviving spouse's death; therefore, the estate taxes of both spouses must be considered.

The unified tax credit provides every American taxpayer with a set amount that they can gift during their lifetime or pass on as part of their estate. That amount will be exempt from gift and estate taxes.