District of Columbia Approval of authorization of preferred stock

Description

How to fill out Approval Of Authorization Of Preferred Stock?

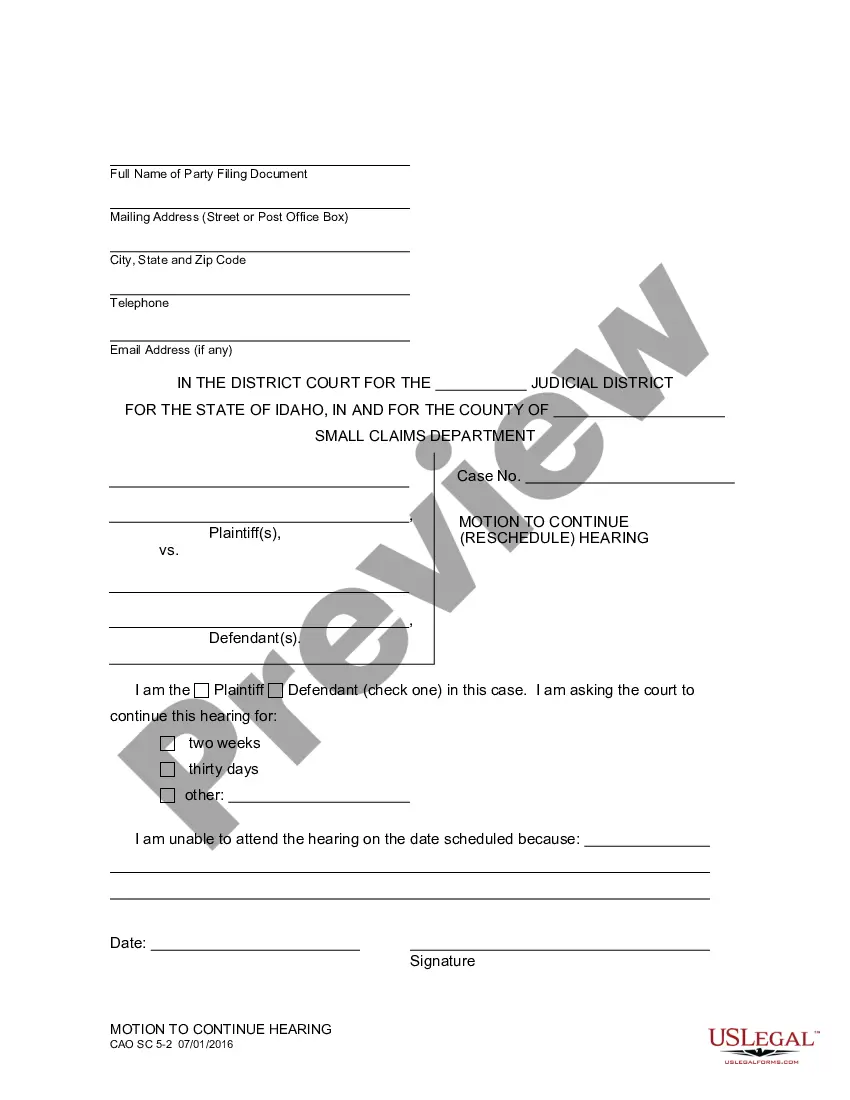

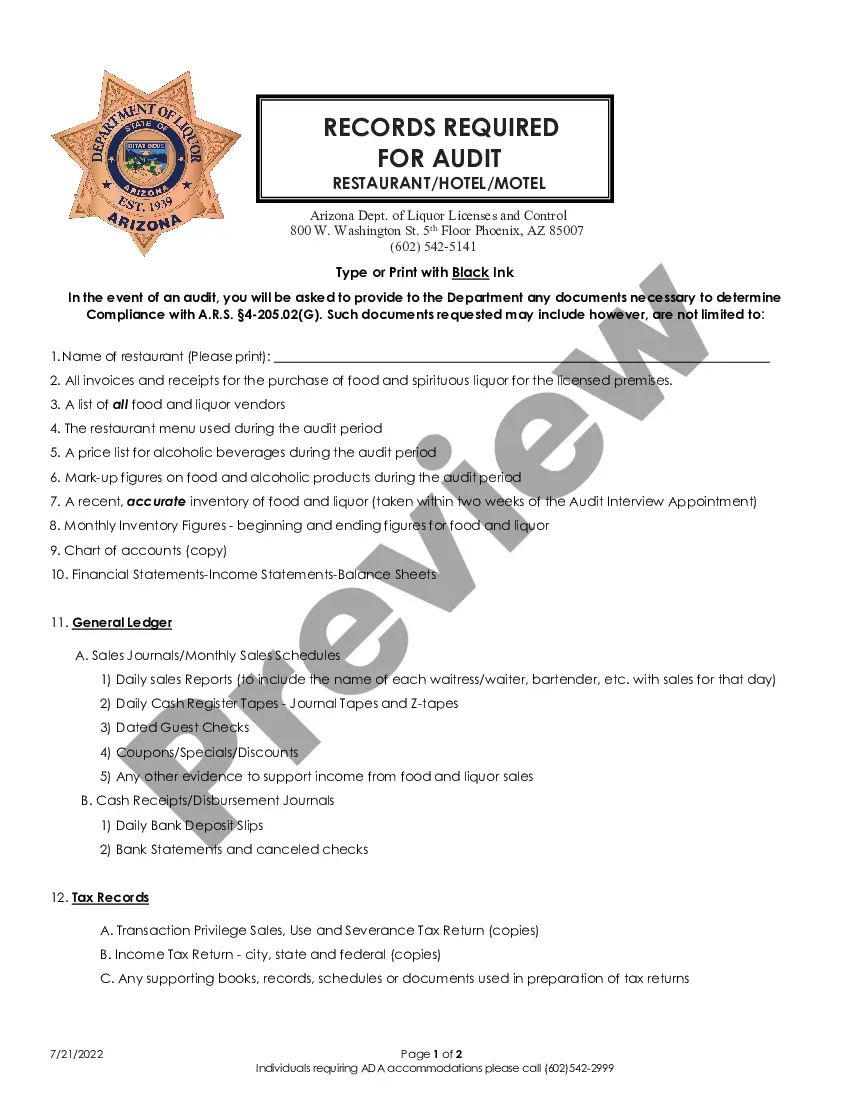

Choosing the right legitimate papers format can be a battle. Of course, there are plenty of layouts available on the Internet, but how do you get the legitimate develop you will need? Utilize the US Legal Forms web site. The service offers a huge number of layouts, such as the District of Columbia Approval of authorization of preferred stock, which you can use for company and private requires. All the varieties are examined by pros and meet up with state and federal specifications.

If you are previously authorized, log in for your bank account and click the Download button to have the District of Columbia Approval of authorization of preferred stock. Utilize your bank account to appear throughout the legitimate varieties you might have acquired previously. Check out the My Forms tab of your respective bank account and have one more backup in the papers you will need.

If you are a fresh customer of US Legal Forms, listed here are straightforward directions for you to comply with:

- Very first, make sure you have chosen the appropriate develop for the metropolis/area. You can look over the form using the Review button and browse the form explanation to make certain this is basically the best for you.

- If the develop fails to meet up with your expectations, take advantage of the Seach field to discover the proper develop.

- Once you are sure that the form would work, click the Acquire now button to have the develop.

- Select the costs plan you need and enter the required details. Create your bank account and pay money for the order with your PayPal bank account or charge card.

- Opt for the document structure and download the legitimate papers format for your product.

- Complete, change and print out and sign the received District of Columbia Approval of authorization of preferred stock.

US Legal Forms is definitely the most significant catalogue of legitimate varieties for which you can discover a variety of papers layouts. Utilize the service to download appropriately-manufactured papers that comply with state specifications.

Form popularity

FAQ

Preferred typically have no voting rights, whereas common stockholders do. Preferred stockholders may have the option to convert shares to common shares but not vice versa. Preferred shares may be callable where the company can demand to repurchase them at par value.

Board approval, either by written consent or at a board meeting (for more about the differences between board consents and board meetings, please see our article), is required for every issuance of a security, whether that security is common stock, preferred stock, a warrant, an option or a note that is convertible ...

Issuing new shares typically requires approval from the company's shareholders. This may involve holding a vote at a shareholder meeting or obtaining written consent from a majority of shareholders. The approval process will depend on the company's bylaws and state laws governing the issuance of new shares.

A preferred stock certificate is a document that identifies the ownership share of an investor in a corporation.

Blank check preferred stock facilitates the ability of the company to adopt a "white squire" defense when faced with a hostile bid, which involves sale to a friendly party (i.e., a party that is interested in making an investment in, but presumably is not seeking to gain control of, the target) of a block of the ...

The most common issuers of preferred stocks are banks, insurance companies, utilities and real estate investment trusts, or REITs. Companies issuing preferreds may have more than one offering for you to vet. Often you may find several different offerings of preferreds from the same issuer but with different yields.

Issuance of Preferred Stock: When a company issues preferred stock, it debits (increases) the cash account on the balance sheet for the total value received and credits (increases) the ?preferred stock? account in the equity section of the balance sheet.

Under current Section 312.03(b), shareholder approval is required when a company sells shares to a related party if the amount to be issued exceeds 1% of the number of shares or voting power outstanding before issuance.