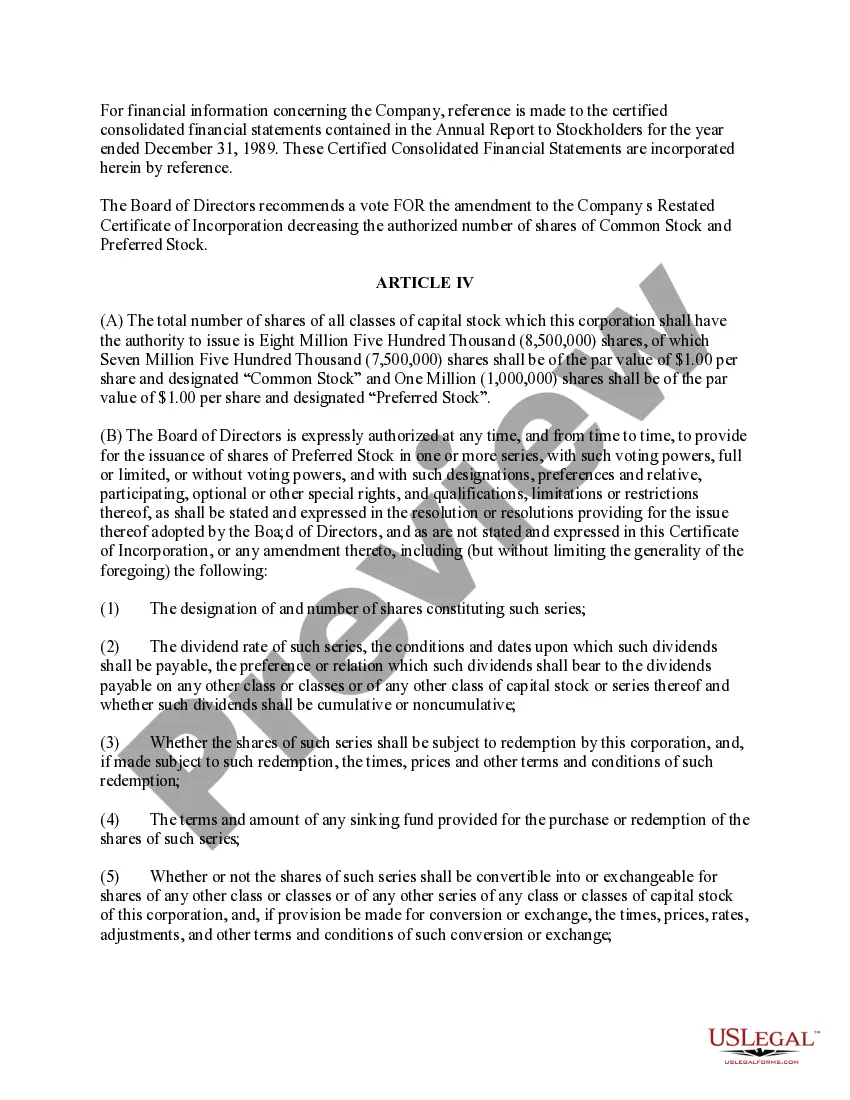

District of Columbia Proposal to decrease authorized common and preferred stock

Description

How to fill out Proposal To Decrease Authorized Common And Preferred Stock?

You may commit hours on-line searching for the lawful file template that meets the federal and state requirements you require. US Legal Forms supplies a huge number of lawful varieties that happen to be examined by specialists. It is simple to obtain or produce the District of Columbia Proposal to decrease authorized common and preferred stock from your support.

If you currently have a US Legal Forms bank account, it is possible to log in and click the Down load option. Afterward, it is possible to complete, edit, produce, or sign the District of Columbia Proposal to decrease authorized common and preferred stock. Each and every lawful file template you get is your own property eternally. To acquire yet another backup of any bought type, check out the My Forms tab and click the corresponding option.

If you are using the US Legal Forms internet site initially, follow the basic instructions below:

- Initially, be sure that you have chosen the right file template for that county/metropolis of your choice. Read the type description to ensure you have chosen the proper type. If readily available, take advantage of the Review option to appear through the file template as well.

- If you wish to find yet another model from the type, take advantage of the Search industry to get the template that meets your requirements and requirements.

- When you have located the template you would like, click on Acquire now to continue.

- Find the costs prepare you would like, enter your credentials, and register for a merchant account on US Legal Forms.

- Comprehensive the purchase. You can utilize your credit card or PayPal bank account to fund the lawful type.

- Find the format from the file and obtain it for your gadget.

- Make modifications for your file if possible. You may complete, edit and sign and produce District of Columbia Proposal to decrease authorized common and preferred stock.

Down load and produce a huge number of file templates using the US Legal Forms site, which offers the largest variety of lawful varieties. Use expert and status-specific templates to deal with your company or person demands.

Form popularity

FAQ

A stock split increases the number of shares outstanding and lowers the individual value of each share. While the number of shares outstanding change, the overall market capitalization of the company and the value of each shareholder's stake remains the same. Say you have one share of a company's stock.

For example, a common stock split ratio is a forward 2-1 split (i.e., 2 for 1), where a stockholder would receive 2 shares for every 1 share owned. This results in an increase in the total number of shares outstanding for the company, though no change in a shareholder's proportional ownership.

The split increases the number of shares outstanding, but the company's overall value does not change. Immediately following the split the share price will proportionately adjust downward to reflect the company's market capitalization.

Shareholders who wish to estimate the total number of shares that they will own after a stock split can use the following formula: Total number of shares post stock split = number of shares held * number of new shares issued for each existing share.

What Are Issued Shares? Issued shares are the subset of authorized shares that have been sold to and held by the shareholders of a company, regardless of whether they are insiders, institutional investors, or the general public (as shown in the company's annual report).

AMC's Reverse Stock Split A shareholder vote approved the reverse split proposal ? along with the proposal to convert AMC Preferred Equity (APE) units to common shares ? in March. AMC management's main objective is to raise more cash through equity.

The AMC reverse split happened on August 24. AMC shareholders who owned 100 shares before the split had 10 shares after the split. APE shares were converted into AMC shares on August 25.

Stock splits can improve trading liquidity and make the stock seem more affordable. In a stock split the number of outstanding shares increases and the price per share decreases proportionately, while the market capitalization and the value of the company do not change.