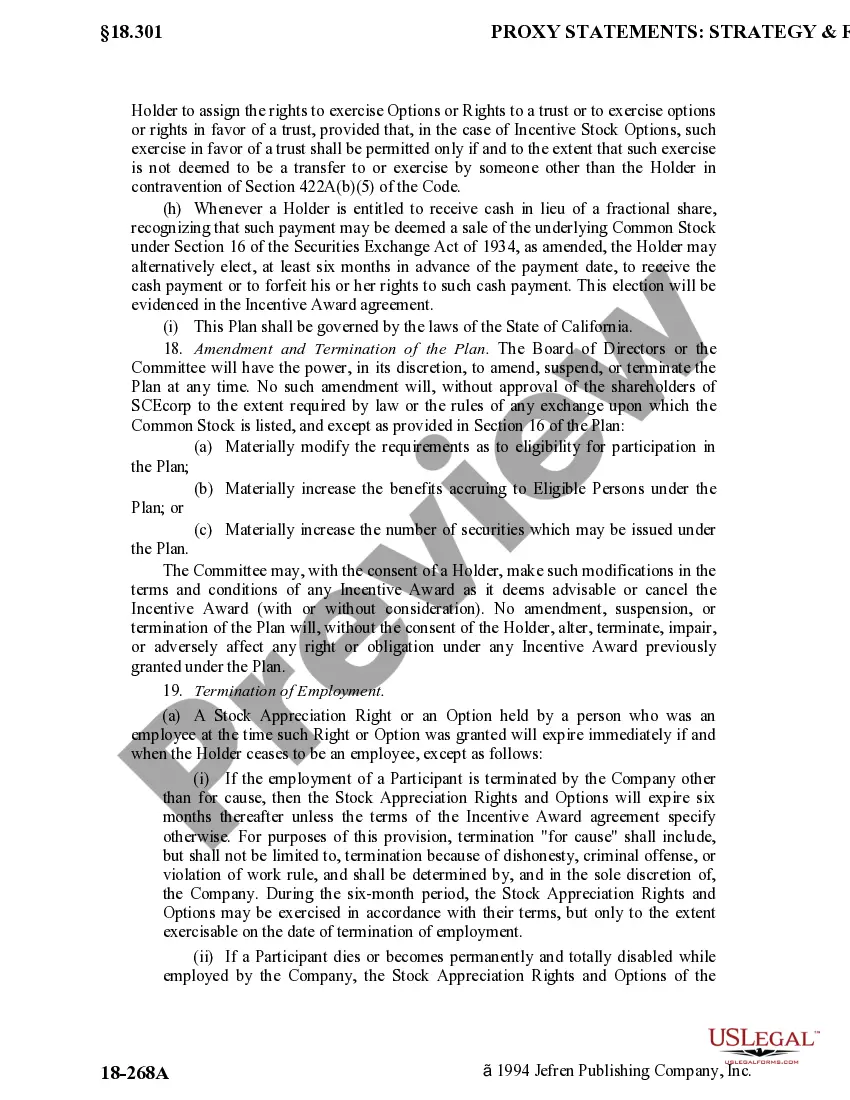

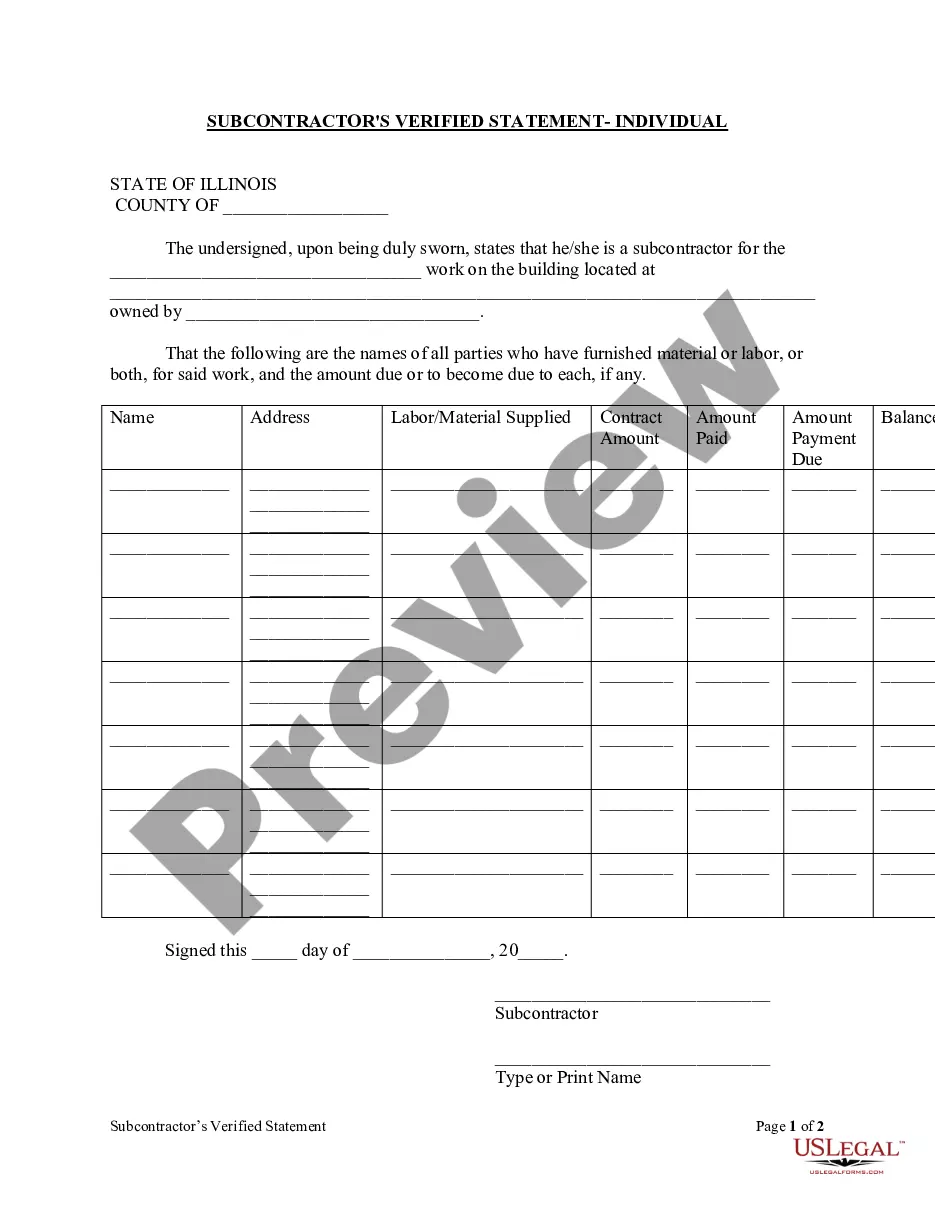

District of Columbia Officer Long Term Incentive Compensation Plan for Southern California Edison Co.

Description

How to fill out Officer Long Term Incentive Compensation Plan For Southern California Edison Co.?

US Legal Forms - one of many largest libraries of legal kinds in America - provides an array of legal document web templates you are able to obtain or produce. Using the website, you may get 1000s of kinds for organization and personal reasons, sorted by groups, suggests, or search phrases.You can get the newest models of kinds much like the District of Columbia Officer Long Term Incentive Compensation Plan for Southern California Edison Co. within minutes.

If you have a subscription, log in and obtain District of Columbia Officer Long Term Incentive Compensation Plan for Southern California Edison Co. from your US Legal Forms collection. The Obtain option will show up on every single develop you perspective. You get access to all previously delivered electronically kinds from the My Forms tab of the accounts.

If you wish to use US Legal Forms the first time, listed here are simple guidelines to get you started off:

- Ensure you have picked out the best develop for your metropolis/region. Select the Review option to examine the form`s articles. Read the develop description to actually have chosen the proper develop.

- If the develop doesn`t satisfy your needs, make use of the Look for discipline near the top of the monitor to find the one that does.

- When you are content with the form, verify your option by simply clicking the Get now option. Then, choose the prices prepare you like and give your qualifications to sign up on an accounts.

- Process the purchase. Make use of bank card or PayPal accounts to complete the purchase.

- Select the formatting and obtain the form on your system.

- Make changes. Fill out, modify and produce and sign the delivered electronically District of Columbia Officer Long Term Incentive Compensation Plan for Southern California Edison Co..

Each template you put into your money does not have an expiration particular date and it is your own eternally. So, in order to obtain or produce an additional copy, just check out the My Forms area and click on the develop you want.

Get access to the District of Columbia Officer Long Term Incentive Compensation Plan for Southern California Edison Co. with US Legal Forms, probably the most considerable collection of legal document web templates. Use 1000s of professional and condition-specific web templates that fulfill your small business or personal demands and needs.

Form popularity

FAQ

Executive bonus plans are often popular with top-level employees, but they also provide benefits to your company. In some cases, they can be a more tax-efficient way to reward top talent. They give employees additional compensation with a lower current cost to the employer than some other types of benefits.

Setting performance-based criteria Whether cash-based or equity-based, most long-term incentive compensation is based on strategic drivers that will encourage or discourage certain behaviors by executives. Long-term incentives should focus on and align your executives with your company's and owners' long-term goals.

A typical executive compensation package has financial and non-financial components. They are salary, benefits, bonuses and equity. Commonly, an executive would get more amount of equity than a normal worker and a normal worker quite often wouldn't get any equity in a private company.

As a rule of thumb, the base salary constitutes 30% of total compensation, the annual incentive another 20%, the benefits about 10% and long-term incentives or the wealth creation portion of the compensation about 40%.

An Executive Bonus Plan, also referred to as Section 162 Plan, is a non-qualified plan used by employers to provide special compensation to key executives. The employers' contribution to an executive bonus plan is considered salary to the executive and is therefore subject to taxation.

The median estimated compensation for executives at Southern California Edison including base salary and bonus is $203,470, or $97 per hour. At Southern California Edison, the most compensated executive makes $652,000, annually, and the lowest compensated makes $65,000.

Incentive compensation is a form of variable compensation in which a salesperson's (or other employee's) earnings are directly tied to the amount of product they sell, the success of their team, or the organization's success.

An employee bonus plan provides compensation beyond annual salary to employees as an incentive or reward for reaching certain predetermined individual or team goals. The purpose of bonus plans is to provide recognition for employees who go above and beyond normal work obligations.