District of Columbia Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights

Description

How to fill out Stock Option Plan Which Provides For Grant Of Incentive Stock Options, Nonqualified Stock Options And Stock Appreciation Rights?

You may commit time on the Internet trying to find the lawful document design that meets the federal and state needs you will need. US Legal Forms offers a large number of lawful forms that happen to be reviewed by professionals. You can easily down load or print the District of Columbia Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights from your services.

If you have a US Legal Forms account, you are able to log in and click on the Down load button. Afterward, you are able to complete, modify, print, or indicator the District of Columbia Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights. Every single lawful document design you get is your own property permanently. To get yet another version of the acquired develop, check out the My Forms tab and click on the related button.

Should you use the US Legal Forms site initially, stick to the straightforward instructions under:

- First, be sure that you have chosen the correct document design for the area/area of your choosing. Look at the develop outline to ensure you have picked the correct develop. If readily available, take advantage of the Review button to search through the document design also.

- If you want to get yet another variation of your develop, take advantage of the Search field to find the design that suits you and needs.

- After you have discovered the design you want, just click Get now to continue.

- Select the costs strategy you want, type your qualifications, and register for an account on US Legal Forms.

- Full the financial transaction. You can use your bank card or PayPal account to pay for the lawful develop.

- Select the format of your document and down load it to the system.

- Make changes to the document if required. You may complete, modify and indicator and print District of Columbia Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights.

Down load and print a large number of document templates while using US Legal Forms web site, which offers the greatest collection of lawful forms. Use specialist and express-distinct templates to handle your company or person needs.

Form popularity

FAQ

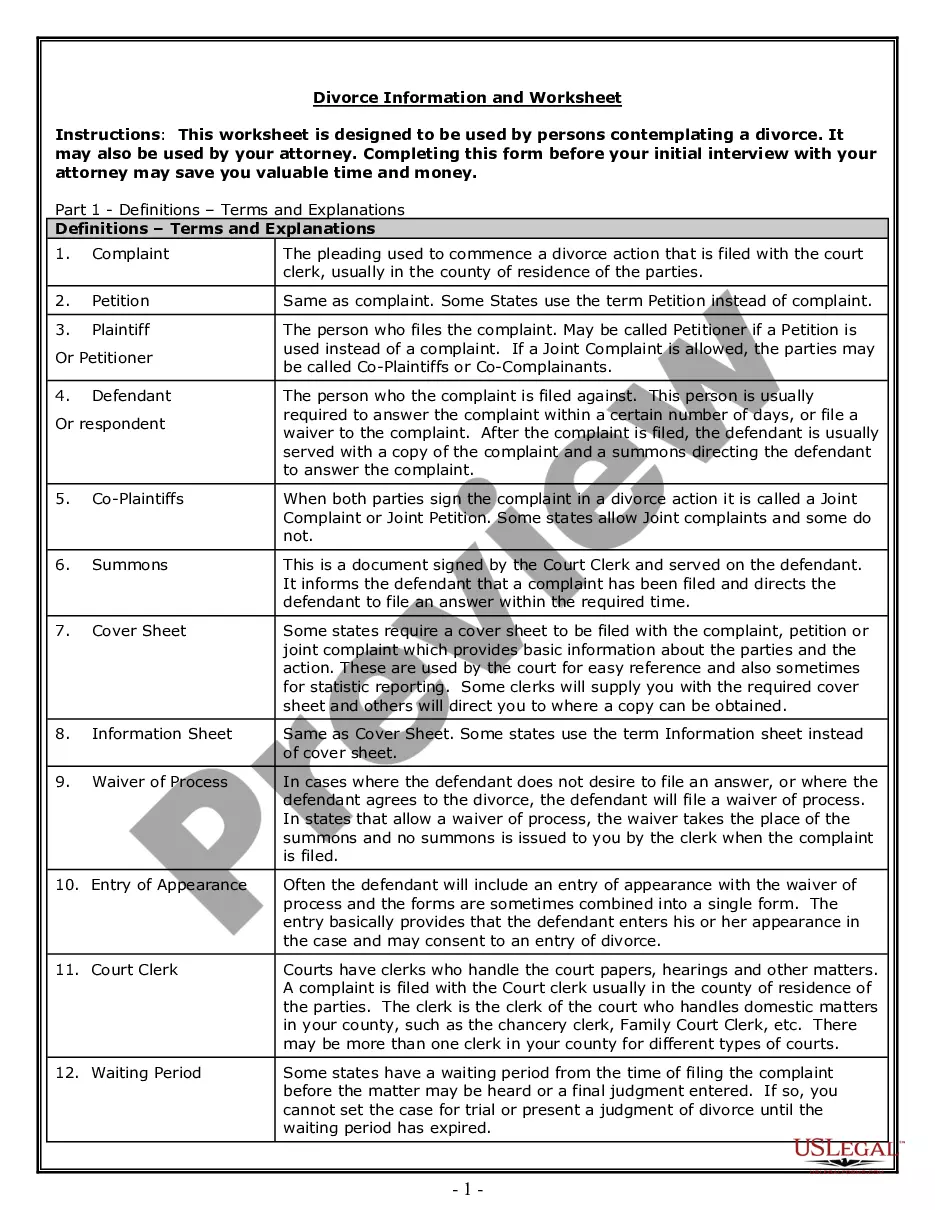

What is the difference between restricted and unrestricted stock? Restricted stocks are unregistered shares the holder cannot transfer until certain conditions are met. In contrast, unrestricted stocks are not subject to such restrictions for ownership transferability.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price.

When you're granted stock options, you have the option to purchase company stock at a specific price before a certain date. Whether you actually purchase the stock is entirely up to you. RSUs, on the other hand, grant you the stock itself once the vesting period is complete. You don't have to purchase it.

A stock grant provides the recipient with value?the corporate stock. By contrast, stock options only offer employees the opportunity to purchase something of value. They can acquire the corporate stock at a set price, but the employees receiving stock options still have to pay for those stocks if they want them.

The grant date for your ISO is the date you are awarded the options. The value of the shares on the grant date helps determine your exercise price. The vesting date is the first date your options become available.

Generally, ISO stock is awarded only to top management and highly-valued employees. ISOs also are called statutory or qualified stock options.

Stock Options are usually better for both employee and employer at an early stage company. For a later stage company, RSUs are usually better for both.

For example, if you're based in the US, you can offer ISOs to your domestic employees. However, as you cannot use an EOR to offer ISOs to foreign employees, you would need to offer an alternative, such as NSOs, RSUs, or VSOs.