District of Columbia Proposed Client Intake Sheet - General

Description

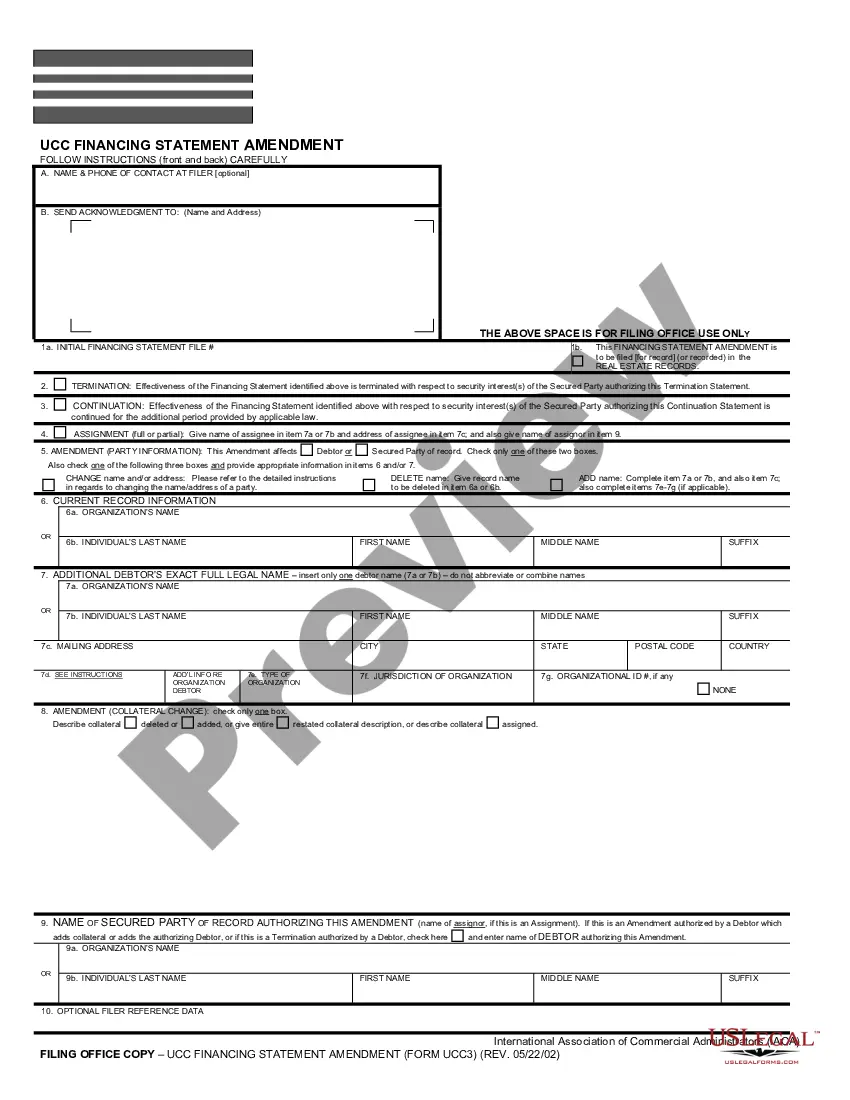

How to fill out Proposed Client Intake Sheet - General?

If you wish to comprehensive, down load, or produce authorized document themes, use US Legal Forms, the biggest variety of authorized varieties, which can be found on the Internet. Utilize the site`s simple and easy handy research to get the papers you need. A variety of themes for enterprise and specific reasons are sorted by categories and states, or key phrases. Use US Legal Forms to get the District of Columbia Proposed Client Intake Sheet - General in a couple of mouse clicks.

When you are presently a US Legal Forms buyer, log in to your bank account and then click the Obtain key to get the District of Columbia Proposed Client Intake Sheet - General. Also you can access varieties you earlier saved in the My Forms tab of the bank account.

If you are using US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have chosen the form for that appropriate metropolis/country.

- Step 2. Make use of the Review solution to look through the form`s articles. Don`t forget about to read the outline.

- Step 3. When you are unhappy together with the form, use the Lookup field near the top of the screen to find other models of your authorized form web template.

- Step 4. Upon having found the form you need, go through the Purchase now key. Opt for the rates strategy you like and include your accreditations to sign up to have an bank account.

- Step 5. Process the deal. You can utilize your bank card or PayPal bank account to finish the deal.

- Step 6. Find the formatting of your authorized form and down load it on your system.

- Step 7. Total, edit and produce or sign the District of Columbia Proposed Client Intake Sheet - General.

Every authorized document web template you buy is yours forever. You possess acces to each and every form you saved within your acccount. Go through the My Forms section and choose a form to produce or down load once more.

Remain competitive and down load, and produce the District of Columbia Proposed Client Intake Sheet - General with US Legal Forms. There are millions of skilled and express-certain varieties you can use for your personal enterprise or specific demands.

Form popularity

FAQ

(a) Each year the district shall levy a tax against every person on the tangible personal property owned or held in trust in that person's trade or business in the District. The rate of tax shall be $3.40 for each $100 of value of the taxable personal property, in excess of $225,000 in value.

Do I have to file a DC income tax return? You must file a DC tax return if: You were a resident of the District of Columbia and you were required to file a federal tax return. Your permanent residence was in the District of Columbia for either part of or the full taxable year.

On the MyTax.DC.gov homepage, locate the Business section. Click ?Register a New Business ? Form FR-500?. You will be navigated to our FR-500 New Business Registration Form.

Who Must File? Individuals, corporations, partnerships, executors, administrators, guardians, receivers, and trustees that own or hold personal property in trust in the District of Columbia must file a DC personal property tax return.

How do I obtain a Certificate of Clean Hands? You can request a Certificate of Clean Hands online at MyTax.DC.gov. If you have a District tax obligation, a MyTax.DC.gov account is required and the Certificate of Clean Hands can be generated from within your MyTax.DC.gov account.

Standard Deduction: From $12,550 to $12,950 for single and married/registered domestic partner filers filing separately. From $18,800 to $19,400 for head of household filers. From $25,100 to $25,900 for married/registered partners filing jointly and qualifying widow(er) with dependent child(ren) filers.

Personal Property Tax Form FP-31 may be filed online by signing up for a MyTax.DC.gov account. Form FP-31 Instructions are available and include information on exemptions, due dates, payment options, and penalties and interest. This helpful User Guide will walk you through the process of filling out Form FP-31.

2. FP-31 Tax Return. The FP-31 tax return is essential for individuals who use property for business purposes in D.C. This includes rental property owners, freelancers, contractors, and 1099-NEC employees.