District of Columbia Personnel Status Change Worksheet

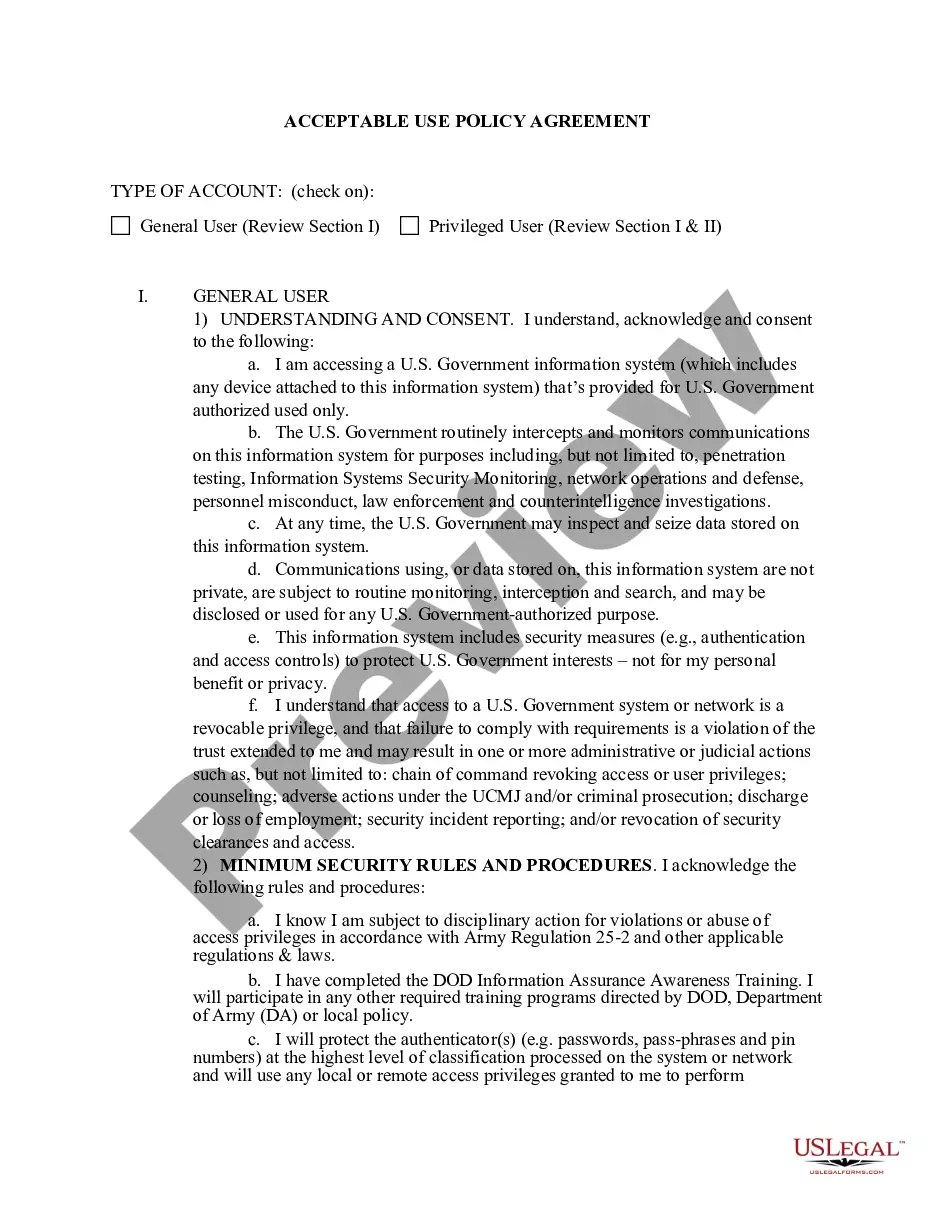

Description

How to fill out Personnel Status Change Worksheet?

You can devote effort online attempting to locate the valid document format that adheres to the state and federal criteria you require.

US Legal Forms provides a vast collection of legal documents that are reviewed by specialists.

You can download or print the District of Columbia Personnel Status Change Worksheet from our service.

Review the form details to confirm that you have chosen the appropriate one.

- If you already possess a US Legal Forms account, you can sign in and then select the Download option.

- Then, you can complete, modify, print, or sign the District of Columbia Personnel Status Change Worksheet.

- Every legal document format you receive becomes your property indefinitely.

- To obtain another copy of the purchased form, navigate to the My documents section and click the corresponding option.

- If this is your first time using the US Legal Forms site, follow the straightforward instructions below.

- Firstly, ensure you have selected the correct document format for the area/region of your choice.

Form popularity

FAQ

Are CA PFL benefits taxable? Family leave insurance benefits are subject to federal income tax and to federal rules on reporting income and paying taxes. CA PFL benefits are not subject to California state income tax. Benefits paid directly from the state of California are reported on Form 1099-G.

If you are not a resident of DC you must file a Form D-4A with your employer to establish that you are not subject to DC income tax withholding. You qualify as a nonresident if: Your permanent residence is outside DC during all of the tax year and you do not reside in DC for 183 days or more in the tax year.

THE ANSWER: D.C., Maryland and Virginia have a reciprocity agreement, which means that their tax laws make it so that if you work in one state and live in another, you only need to file one return in the state where you live.

If an employee takes PFL, the wages they receive are subject to federal income tax, but not Social Security and Medicare taxes, or federal unemployment tax. The employee will receive a 1099-G, which will need to be added to their annual 1040 if the employee claims for the state PFL benefits.

Who must file a Form D-4? Every new employee who resides in DC and is required to have DC income taxes withheld, must fill out Form D-4 and file it with his/her employer.

District of Columbia Income Tax WithholdingThe District of Columbia law requires employers to withhold state income tax from employee's wages and remit the amounts withheld to the Office of Tax and Revenue.

To be exempt from withholding, both of the following must be true:You owed no federal income tax in the prior tax year, and.You expect to owe no federal income tax in the current tax year.

You must file a DC tax return if: You were a resident of the District of Columbia and you were required to file a federal tax return. (A resident is an individual domiciled in DC at any time during the taxable year);

If the individual is domiciled in the state at anytime, you are considered to be a DC resident. A DC Nonresident is an individual that did not spend any time domiciled in the state.

What you need to know about paid family leave and taxes: Benefits you receive under this program are taxable and included in your federal and District gross income. You will receive a Form 1099-G from the District reporting the payments you received during the year.