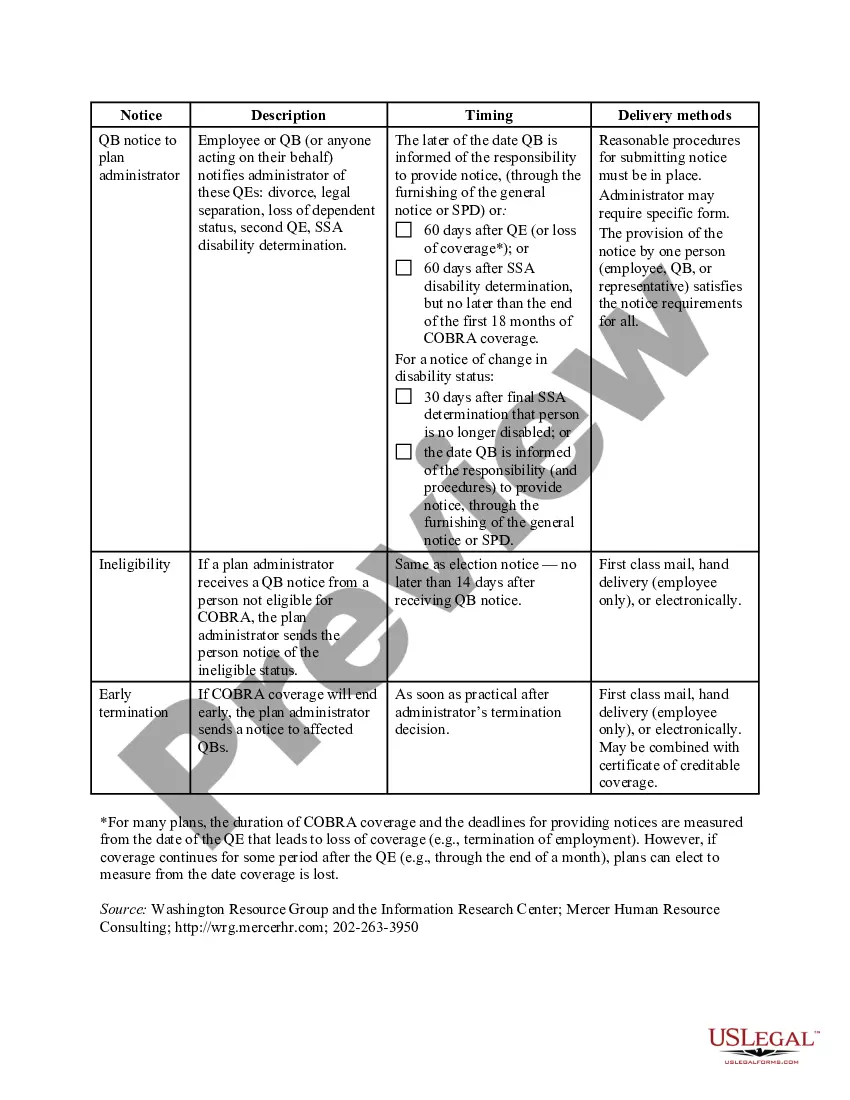

District of Columbia COBRA Notice Timing Delivery Chart

Description

How to fill out COBRA Notice Timing Delivery Chart?

Are you in a situation where you require documents for possibly corporate or personal purposes nearly every day.

There are countless legitimate document templates accessible online, but finding ones you can rely on is not easy.

US Legal Forms provides a vast array of form templates, such as the District of Columbia COBRA Notice Timing Delivery Chart, designed to meet federal and state requirements.

When you locate the appropriate form, simply click Purchase now.

Choose the pricing plan you prefer, enter the necessary details to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the District of Columbia COBRA Notice Timing Delivery Chart template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct area/state.

- Use the Review option to check the form.

- Read the description to ensure you have selected the right form.

- If the form is not what you are looking for, utilize the Search area to find a form that fits your needs and requirements.

Form popularity

FAQ

4. When does COBRA continuation coverage start. COBRA is always effective the day after your active coverage ends. For most, active coverage terminates at the end of a month and COBRA is effective on the first day of the next month.

COBRA allows a 30-day grace period. If your premium payment is not received within the 30-day grace period, your coverage will automatically be terminated without advance warning. You will receive a termination letter at that time to notify you of a lapse in your coverage due to non-payment of premiums.

If You Do Not Receive Your COBRA PaperworkReach out to the Human Resources Department and ask for the COBRA Administrator. They may use a third-party administrator to handle your enrollment. If the employer still does not comply you can call the Department of Labor at 1-866-487-2365.

Conclusion. Anyone eligible for COBRA insurance benefits has 2 months following the date of the end of their coverage, or the day they receive a COBRA notification, to enroll in a COBRA coverage plan.

If you need further information about COBRA, ACA, HIPAA, or ERISA, visit the Employee Benefits Security Administration's (EBSA) Website at dol.gov/ebsa/complianceassistance.html. Or you may contact EBSA electronically at askebsa.dol.gov or call toll free 1-866-444-3272.

Initial COBRA notices must generally be provided within 14 days of the employer notifying the third-party administrator (TPA) of a qualifying event.

Consider the following facts to help decide if COBRA coverage is right for you: COBRA covers group health plans only when sponsored by an employer who has at least 20 employees. Additionally, the employees must have been employed for more than 50% of the business days the previous year.

Employers who fail to comply with the COBRA requirements can be required to pay a steep price. Failure to provide the COBRA election notice within this time period can subject employers to a penalty of up to $110 per day, as well as the cost of medical expenses incurred by the qualified beneficiary.

Under the Consolidated Omnibus Budget Reconciliation Act (COBRA) , continuation of health coverage starts from the date the covered employee's health insurance ends and, depending on the type of qualifying event, may last for 18 months, 29 months or 36 months.

The Consolidated Omnibus Budget Reconciliation Act (COBRA) gives workers and their families who lose their health benefits the right to choose to continue group health benefits provided by their group health plan for limited periods of time under certain circumstances such as voluntary or involuntary job loss,