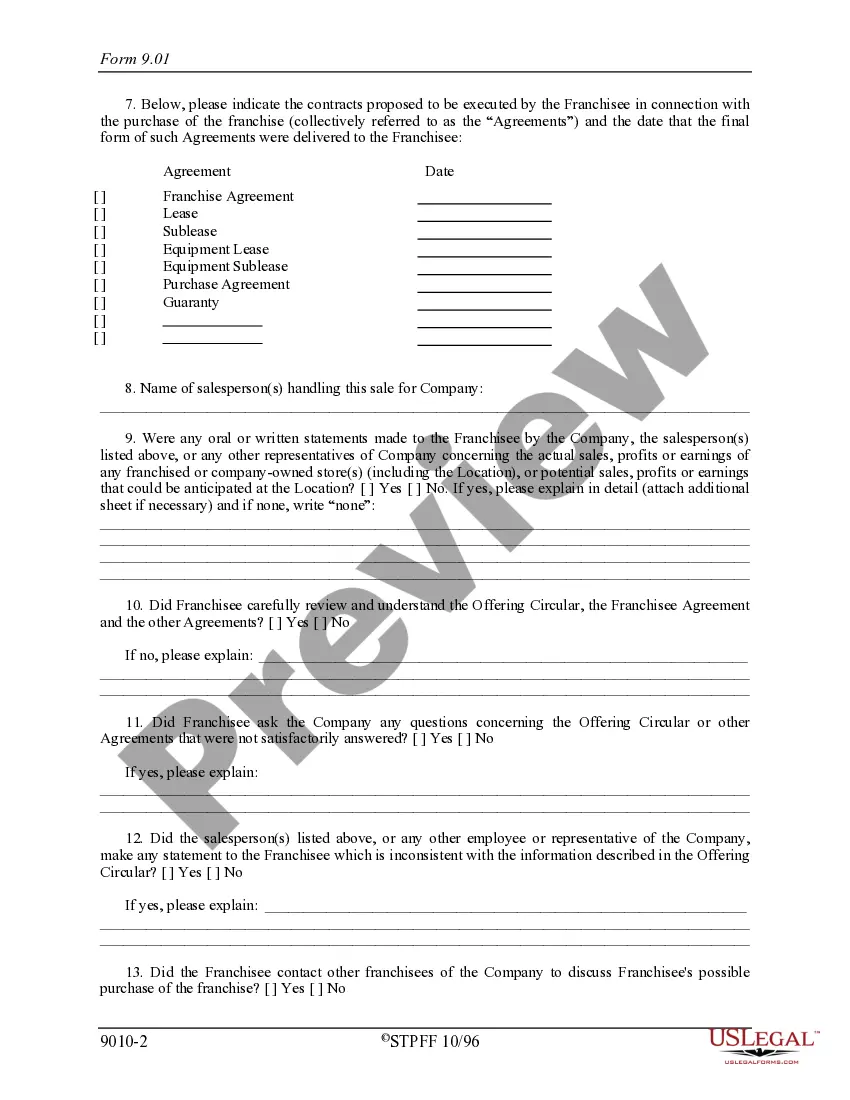

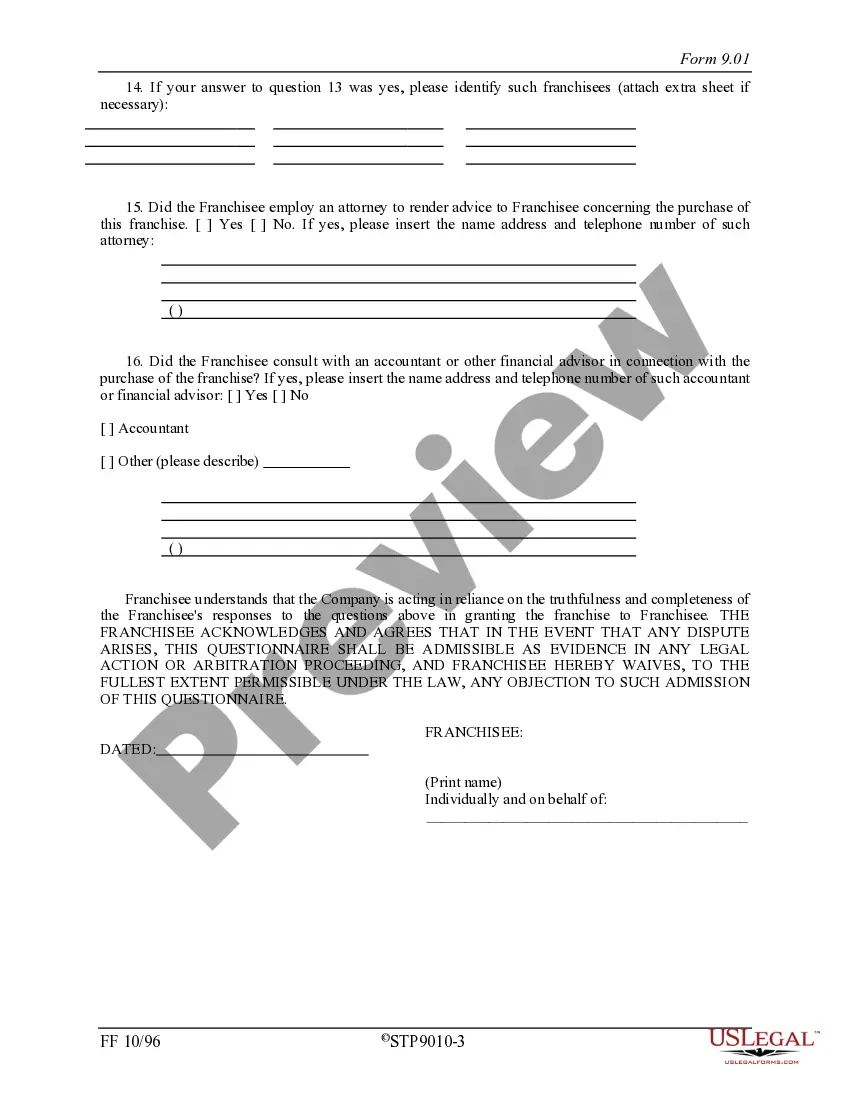

District of Columbia Franchisee Closing Questionnaire

Description

How to fill out Franchisee Closing Questionnaire?

You are able to spend hrs on the web trying to find the lawful file web template that fits the state and federal specifications you will need. US Legal Forms supplies a large number of lawful kinds which are evaluated by specialists. You can actually download or produce the District of Columbia Franchisee Closing Questionnaire from the service.

If you already possess a US Legal Forms accounts, you are able to log in and click on the Acquire key. After that, you are able to total, revise, produce, or sign the District of Columbia Franchisee Closing Questionnaire. Each and every lawful file web template you buy is yours eternally. To get another duplicate for any purchased type, visit the My Forms tab and click on the related key.

If you are using the US Legal Forms web site the very first time, adhere to the basic directions under:

- Very first, be sure that you have chosen the best file web template to the area/metropolis of your choice. Browse the type explanation to make sure you have picked out the appropriate type. If accessible, utilize the Preview key to check throughout the file web template too.

- In order to discover another variation of your type, utilize the Look for area to find the web template that fits your needs and specifications.

- After you have found the web template you want, just click Purchase now to proceed.

- Choose the pricing strategy you want, key in your credentials, and register for your account on US Legal Forms.

- Complete the transaction. You may use your Visa or Mastercard or PayPal accounts to fund the lawful type.

- Choose the format of your file and download it to the device.

- Make modifications to the file if needed. You are able to total, revise and sign and produce District of Columbia Franchisee Closing Questionnaire.

Acquire and produce a large number of file templates making use of the US Legal Forms Internet site, that provides the biggest variety of lawful kinds. Use specialist and status-distinct templates to handle your organization or personal requirements.

Form popularity

FAQ

The Federal/State E-File program allows taxpayers to file their federal and DC returns electronically at the same time. (Electronic filing does not increase the probability of being audited).

Generally, an unincorporated business, with gross income (Line 11) more than $12,000 must file a D 30 (whether or not it has net income). This includes any business carrying on and/or engaging in any trade, business, or commercial activity in DC with income from DC sources.

Who Must File? Individuals, corporations, partnerships, executors, administrators, guardians, receivers, and trustees that own or hold personal property in trust in the District of Columbia must file a DC personal property tax return.

Generally, every corporation or financial institution must file a Form D-20 (including small businesses, professional corporations, and S corporations) if it is carrying on or engaging in any trade, business, or commercial activity in the District of Columbia (DC) or receiving income from DC sources.

MyTax.DC.gov Offers the ability to file online the D 30/Schedules to registered taxpayers provided you are not filing a Combined Report or short year return.

Generally, an unincorporated business, with gross income (Line 11) more than $12,000 from District sources, must file a D-30 (whether or not it has net income).

Modernized e-File (MeF) - Unincorporated business franchise taxpayers that have a Federal Employer Identification Number (FEIN) are encouraged to e-file the D-30 Unincorporated Business Franchise Tax Return through MeF.

DC. Option 2: If you owe D.C. income taxes, you will either have to submit a D.C. tax return or extension by the tax deadline in order to avoid late filing penalties. You can only eFile and IRS tax extension, but not a Washington, D.C. extension.