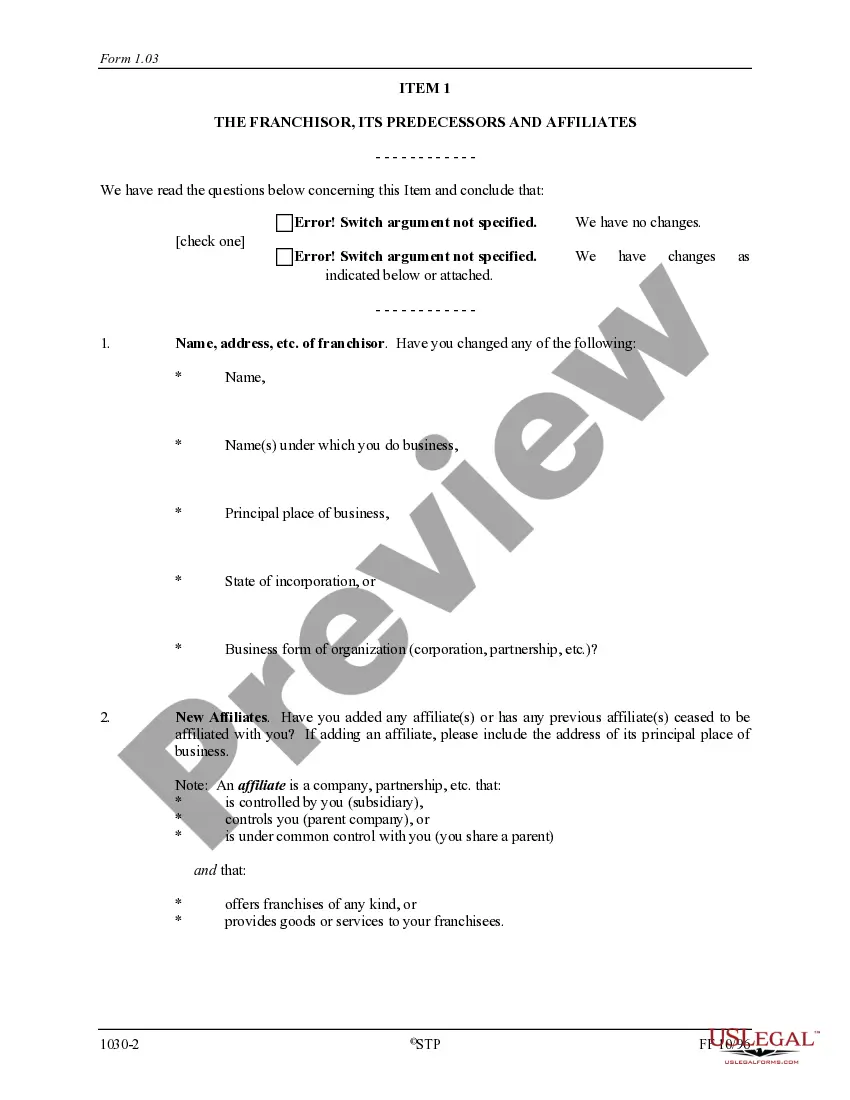

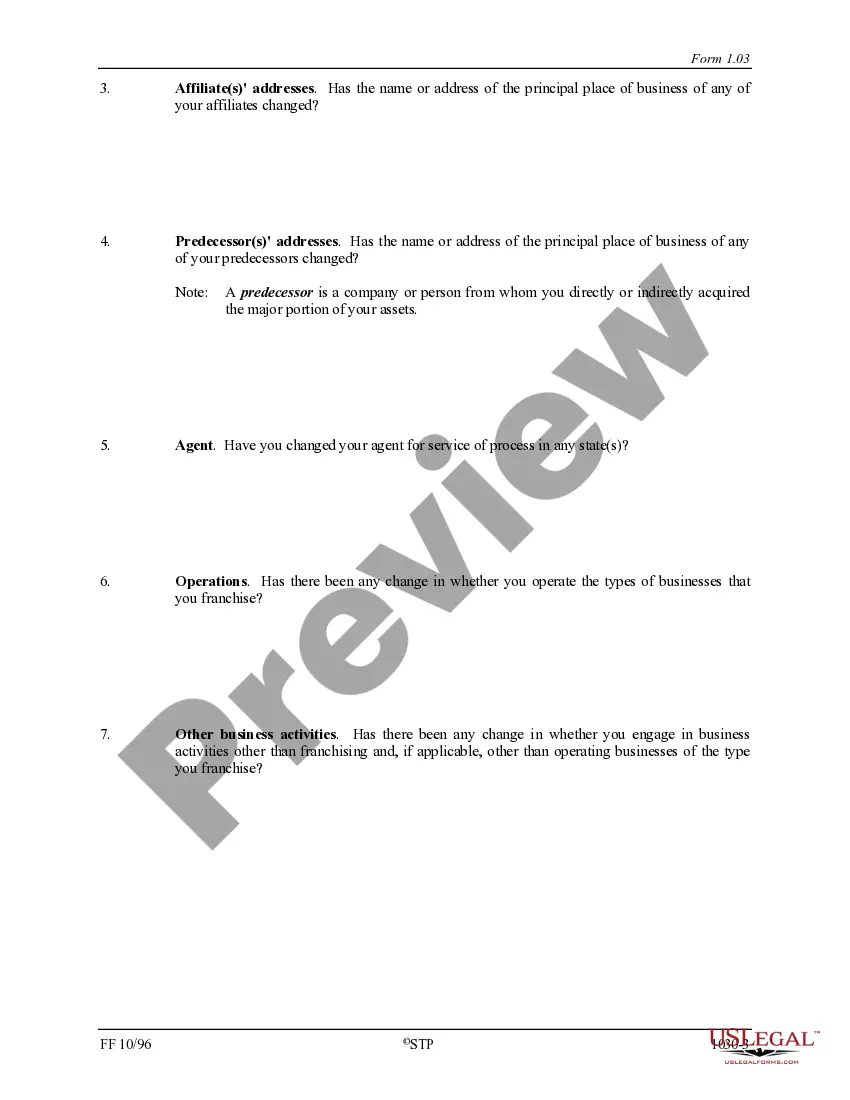

District of Columbia Franchise Registration Renewal Questionnaire

Description

How to fill out Franchise Registration Renewal Questionnaire?

If you wish to complete, obtain, or print out authorized record templates, use US Legal Forms, the biggest collection of authorized varieties, which can be found on-line. Take advantage of the site`s easy and handy lookup to discover the files you want. Different templates for company and person uses are sorted by categories and says, or keywords. Use US Legal Forms to discover the District of Columbia Franchise Registration Renewal Questionnaire in a handful of mouse clicks.

If you are previously a US Legal Forms buyer, log in in your profile and click on the Download button to find the District of Columbia Franchise Registration Renewal Questionnaire. You can also access varieties you previously acquired within the My Forms tab of your profile.

If you are using US Legal Forms the very first time, refer to the instructions below:

- Step 1. Make sure you have selected the form for that appropriate town/region.

- Step 2. Take advantage of the Preview method to examine the form`s content material. Never forget about to read the outline.

- Step 3. If you are unsatisfied with the type, utilize the Research field towards the top of the display to get other models in the authorized type web template.

- Step 4. Upon having identified the form you want, click on the Acquire now button. Opt for the rates strategy you prefer and add your credentials to sign up to have an profile.

- Step 5. Approach the financial transaction. You may use your credit card or PayPal profile to perform the financial transaction.

- Step 6. Find the format in the authorized type and obtain it on your own product.

- Step 7. Total, change and print out or indication the District of Columbia Franchise Registration Renewal Questionnaire.

Each and every authorized record web template you get is your own property permanently. You possess acces to each type you acquired within your acccount. Click on the My Forms portion and pick a type to print out or obtain once more.

Compete and obtain, and print out the District of Columbia Franchise Registration Renewal Questionnaire with US Legal Forms. There are millions of expert and status-particular varieties you can use for your company or person demands.

Form popularity

FAQ

2. FP-31 Tax Return. The FP-31 tax return is essential for individuals who use property for business purposes in D.C. This includes rental property owners, freelancers, contractors, and 1099-NEC employees.

A business is exempt if more than 80% of gross income is derived from personal services rendered by the members of the entity and capital is not a material income-producing factor. A trade, business or professional organization that by law, customs or ethics cannot be incorporated is exempt.

Do I have to file a DC income tax return? You must file a DC tax return if: You were a resident of the District of Columbia and you were required to file a federal tax return. Your permanent residence was in the District of Columbia for either part of or the full taxable year.

How is the 183 days residency rule applied to tax returns? Every day that a taxpayer is in the District of Columbia and maintains a place of residency for an aggregate of 183 days or more, including days of temporary absence is counted towards the 183 days residency rule.

(a) Each year the district shall levy a tax against every person on the tangible personal property owned or held in trust in that person's trade or business in the District. The rate of tax shall be $3.40 for each $100 of value of the taxable personal property, in excess of $225,000 in value.

The following organization types (domestic or foreign) must file Articles of Incorporation, Articles or Organization, or Certificate of Amended Registration with the DCRA Corporations Division: (a) For-profit corporation including professional and benefit corporation; (b) non-profit corporation; (c) limited liability ...

Who Must File? Individuals, corporations, partnerships, executors, administrators, guardians, receivers, and trustees that own or hold personal property in trust in the District of Columbia must file a DC personal property tax return.

Exemption organizations may renew their exemptions at MyTax.DC.gov. For questions and assistance, exempt organizations may contact OTR's e-Service Unit at e-services.otr.dc.gov.