District of Columbia Franchise Registration Questionnaire

Description

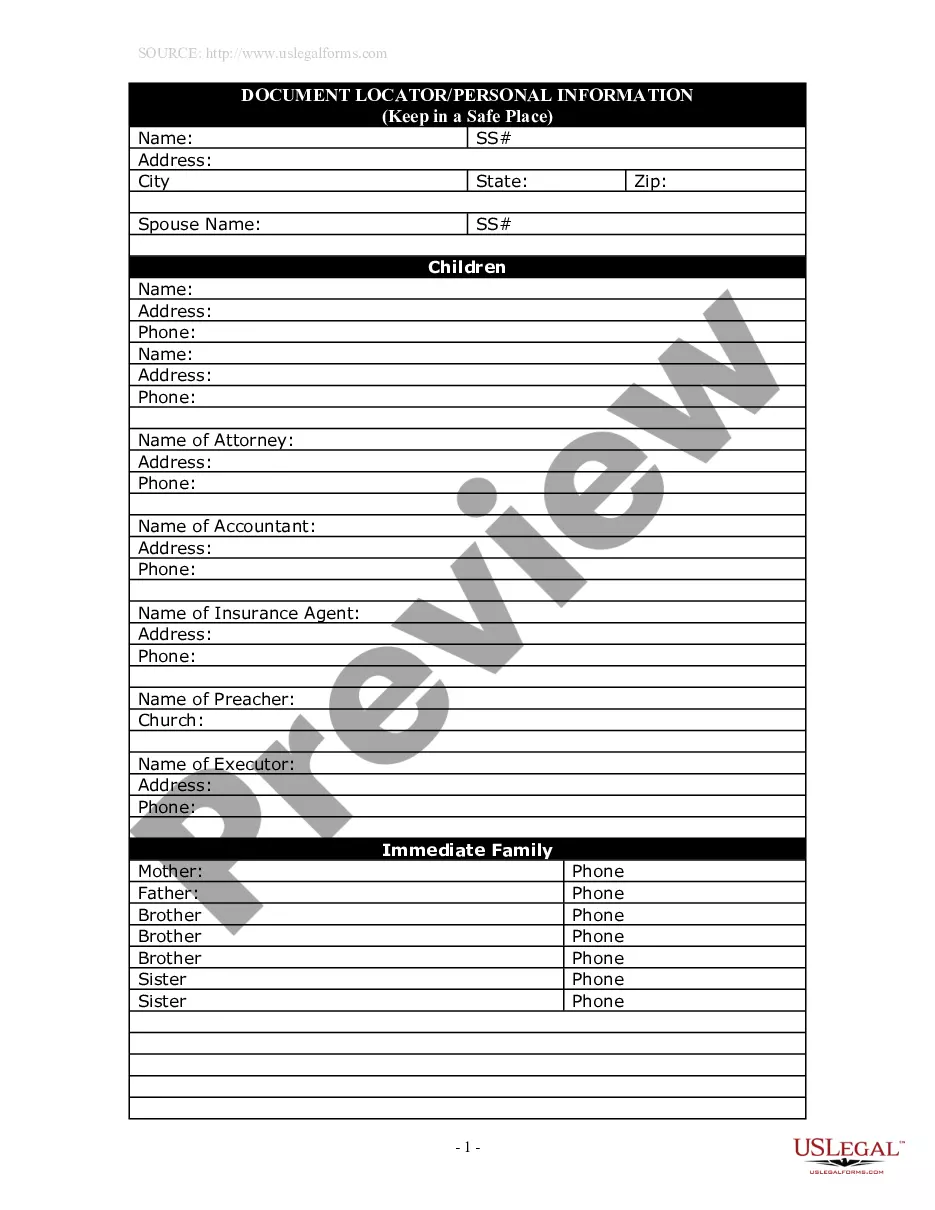

How to fill out Franchise Registration Questionnaire?

It is possible to invest hours online looking for the legitimate papers format which fits the federal and state requirements you want. US Legal Forms offers a huge number of legitimate types that happen to be examined by professionals. You can easily obtain or print the District of Columbia Franchise Registration Questionnaire from my services.

If you have a US Legal Forms bank account, you are able to log in and then click the Acquire button. Afterward, you are able to total, revise, print, or sign the District of Columbia Franchise Registration Questionnaire. Each legitimate papers format you buy is yours permanently. To have one more backup for any acquired form, visit the My Forms tab and then click the corresponding button.

Should you use the US Legal Forms internet site for the first time, stick to the easy directions listed below:

- Very first, make certain you have selected the best papers format for the state/city that you pick. See the form outline to make sure you have picked the proper form. If readily available, use the Preview button to search throughout the papers format also.

- If you would like find one more model from the form, use the Look for field to get the format that meets your requirements and requirements.

- Once you have discovered the format you would like, click on Acquire now to move forward.

- Pick the costs prepare you would like, type in your qualifications, and sign up for an account on US Legal Forms.

- Complete the deal. You may use your charge card or PayPal bank account to pay for the legitimate form.

- Pick the format from the papers and obtain it to your gadget.

- Make modifications to your papers if needed. It is possible to total, revise and sign and print District of Columbia Franchise Registration Questionnaire.

Acquire and print a huge number of papers themes making use of the US Legal Forms Internet site, that offers the biggest assortment of legitimate types. Use professional and status-particular themes to tackle your company or individual requirements.

Form popularity

FAQ

Who Must File? Individuals, corporations, partnerships, executors, administrators, guardians, receivers, and trustees that own or hold personal property in trust in the District of Columbia must file a DC personal property tax return.

The following organization types (domestic or foreign) must file Articles of Incorporation, Articles or Organization, or Certificate of Amended Registration with the DCRA Corporations Division: (a) For-profit corporation including professional and benefit corporation; (b) non-profit corporation; (c) limited liability ...

A business is exempt if more than 80% of gross income is derived from personal services rendered by the members of the entity and capital is not a material income-producing factor. A trade, business or professional organization that by law, customs or ethics cannot be incorporated is exempt.

(a) Each year the district shall levy a tax against every person on the tangible personal property owned or held in trust in that person's trade or business in the District. The rate of tax shall be $3.40 for each $100 of value of the taxable personal property, in excess of $225,000 in value.

Do I have to file a DC income tax return? You must file a DC tax return if: You were a resident of the District of Columbia and you were required to file a federal tax return. Your permanent residence was in the District of Columbia for either part of or the full taxable year.

Who must file Form D-30? Generally, an unincorporated business, with gross income (Line 11) more than $12,000 must file a D 30 (whether or not it has net income). This includes any business carrying on and/or engaging in any trade, business, or commercial activity in DC with income from DC sources.

How is the 183 days residency rule applied to tax returns? Every day that a taxpayer is in the District of Columbia and maintains a place of residency for an aggregate of 183 days or more, including days of temporary absence is counted towards the 183 days residency rule.

2. FP-31 Tax Return. The FP-31 tax return is essential for individuals who use property for business purposes in D.C. This includes rental property owners, freelancers, contractors, and 1099-NEC employees.