The Revised Model Nonprofit Corporation Act allows a registered agent to resign.

Wisconsin Certificate of Resignation of Resident Agent of Nonprofit Corporation

Description

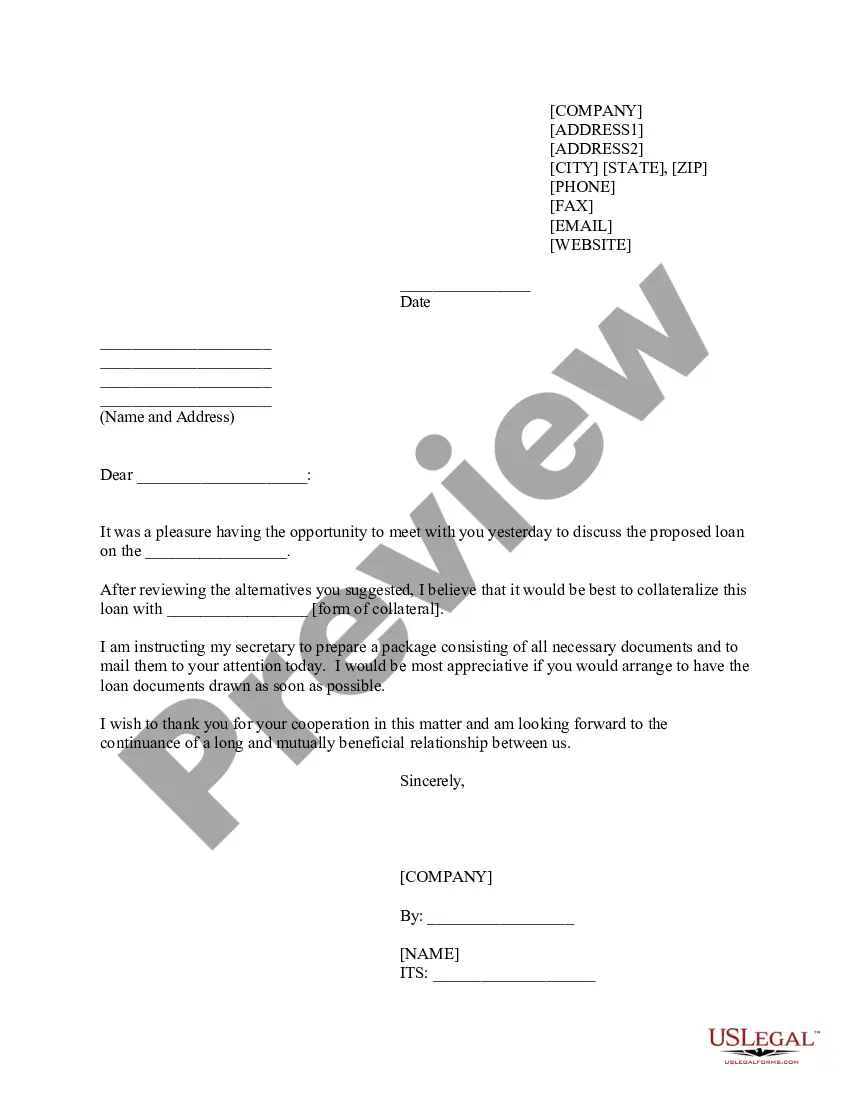

How to fill out Certificate Of Resignation Of Resident Agent Of Nonprofit Corporation?

It is possible to commit time on the web attempting to find the lawful file template which fits the state and federal demands you need. US Legal Forms offers a huge number of lawful varieties which are evaluated by professionals. You can easily download or printing the Wisconsin Certificate of Resignation of Resident Agent of Nonprofit Corporation from the assistance.

If you already possess a US Legal Forms bank account, you can log in and click on the Down load key. Next, you can comprehensive, revise, printing, or indicator the Wisconsin Certificate of Resignation of Resident Agent of Nonprofit Corporation. Each lawful file template you get is the one you have eternally. To have yet another duplicate of any bought develop, visit the My Forms tab and click on the related key.

Should you use the US Legal Forms internet site the first time, follow the simple directions below:

- Initial, make sure that you have chosen the best file template for your state/town of your liking. See the develop description to make sure you have picked out the proper develop. If available, make use of the Preview key to look throughout the file template too.

- If you want to get yet another model of the develop, make use of the Research field to find the template that meets your requirements and demands.

- After you have found the template you want, click Purchase now to continue.

- Pick the rates prepare you want, type your accreditations, and register for your account on US Legal Forms.

- Total the purchase. You can use your credit card or PayPal bank account to cover the lawful develop.

- Pick the structure of the file and download it to the device.

- Make changes to the file if required. It is possible to comprehensive, revise and indicator and printing Wisconsin Certificate of Resignation of Resident Agent of Nonprofit Corporation.

Down load and printing a huge number of file themes utilizing the US Legal Forms web site, which offers the largest variety of lawful varieties. Use professional and condition-specific themes to take on your business or person requirements.

Form popularity

FAQ

All Wisconsin corporations,nonprofits, LLCs, and LLPs need to file a Wisconsin Annual Report each year.

The form 5 is mandatory and must be used to file the REQUIRED ANNUAL REPORT for a Domestic or Foreign Nonstock Corporation and Domestic or Foreign Limited Liability Company. Failure to file this report may result in administrative dissolution for domestic entities under ss. 181.1420 & 183.0708, Wis.

When forming a corporation or limited liability company (LLC) in Wisconsin you'll need to appoint a registered agent on your formation documents. Wisconsin's business act requires all business entities formed in or authorized to do business in the state to appoint a Wisconsin registered agent.

Submit one original to State of WI-Dept. of Financial Institutions, Box 93348, Milwaukee WI, 53293-0348, together with a check for the $10.00 filing fee, payable to the Department of Financial Institutions. (If sent by express or priority U.S. mail, please mail to State of WI-Dept.

A business can change its Wisconsin registered agent on its annual report or by filing a form with the Wisconsin Department of Financial Institutions: Division of Corporate and Consumer Services (DFI). You can also change your Wisconsin registered agent online at the DFI website.

Do you have to pay an annual fee for a Wisconsin LLC? Yes, all Wisconsin LLCs need to pay $25 per year for the Annual Report. These state fees are paid to the Wisconsin DFI. You have to pay this to keep your LLC in good standing.

Domestic Wisconsin Corporation Annual Report Requirements: $25 online or $40 by mail. Due: Annually by the end of the registration anniversary quarter. If you incorporated or foreign-qualified on February 15, then your annual report is due every year by the end of the first quarter on March 31.

Annual Requirements in Wisconsin A $25 filing fee is required. Two years after your initial registration, you must renew your business tax registration each year and pay the $10 renewal fee. Your business will also be required to pay state and federal income tax yearly and remit sales tax.