District of Columbia Personal Guaranty of Employment Agreement Between Employer and Employee - Individual Employer

Description

How to fill out Personal Guaranty Of Employment Agreement Between Employer And Employee - Individual Employer?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal form templates you can download or print.

By using this platform, you can access numerous forms for both commercial and personal purposes, organized by categories, states, or keywords. You will find the latest versions of forms such as the District of Columbia Personal Guaranty of Employment Agreement Between Employer and Employee - Individual Employer in just a few minutes.

If you have a membership, Log In to download the District of Columbia Personal Guaranty of Employment Agreement Between Employer and Employee - Individual Employer from your US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

When you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select your preferred pricing plan and provide your information to register for an account.

Complete the payment. Use your credit card or PayPal account to finalize the transaction. Choose the format and download the form to your device. Make modifications. Complete, edit, and print the downloaded District of Columbia Personal Guaranty of Employment Agreement Between Employer and Employee - Individual Employer, signing it as necessary. Every template you add to your account has no expiration date and belongs to you permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the document you need. Access the District of Columbia Personal Guaranty of Employment Agreement Between Employer and Employee - Individual Employer with US Legal Forms, the most comprehensive collection of legal form templates. Utilize numerous professional and state-specific templates that meet your business or personal requirements and needs.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have chosen the correct form for your city/state.

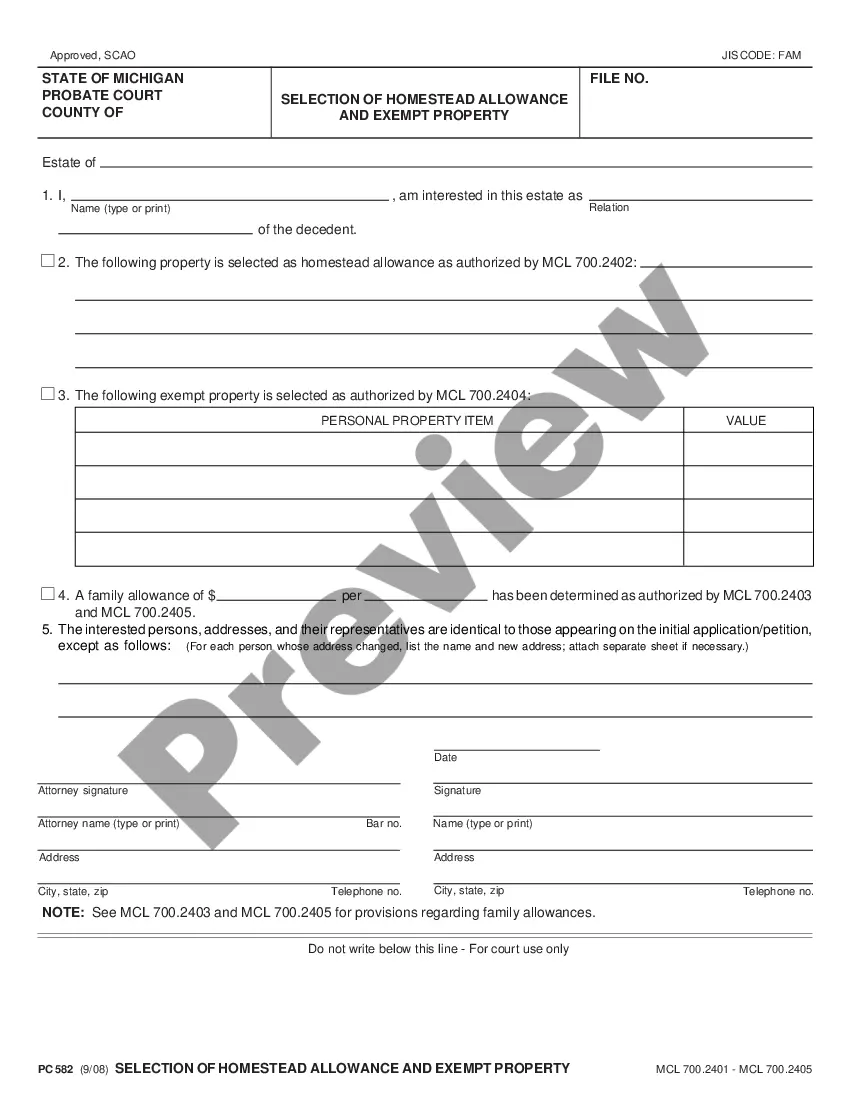

- Click on the Review button to examine the form's content.

- Check the form details to confirm that you have selected the right document.

- If the form does not meet your requirements, utilize the Search bar at the top of the screen to find one that does.

Form popularity

FAQ

Mr. , residing at , collectively referred to as the Parties. The Company has employed Mr./Ms. since/from and this agreement is intended to protect the confidential information disclosed by the Company in the course of employment to Mr.

5 Key Elements Every Employment Agreement Should HaveScope of Employment. Put simply, this explains what the job will entail.Term and Termination.Compensation.Benefits.Confidentiality and Non-Compete Provisions.

An employment contract doesn't always have to be in writing to be enforceable. While that may be the case, written agreements are certainly easier to enforce and not subject to certain limitations that oral agreements are. Oral agreements are still subject to the requirements of what it takes to form a basic contract.

An employment contract is a written, binding agreement between an employer and a prospective or current employee that, when properly drafted, can be a highly effective way of protecting a company's financial and intellectual resources. Not every employment relationship will require a contract.

In California, Employment contracts are legally binding agreements that create the employer-employee relationship. An employment contract can either be created by writing, verbal agreement, or because of implied circumstances.

Typically, the information you need to write an Employment Contract includes: Party details: List the employee's and the employer's name and contact information. Include the place of employment's address as well. Job description: Describe the position title, initial duties, and obligations.

A verbal job offer, which is made and accepted formally, is legally binding on both the parties. However, it's a bit more complicated than a written agreement since you must establish the terms of employment at the time of the offer.

Only where the promise expressly limits the employer's right to terminate will there be an enforceable contract. Further, the oral promise or statement must be attributable to the employer.

Duties Implied by Law The duties of an employer implied by law include: providing a safe work environment for your employees; paying employees for their work performed; and. reimbursing your employees for any reasonable and necessary expenses incurred on behalf of the business.