District of Columbia Termination and Severance Pay Policy

Description

How to fill out Termination And Severance Pay Policy?

Are you currently in a circumstance where you require documents for either business or personal purposes regularly.

There are many legal document templates accessible online, but finding reliable ones isn't straightforward.

US Legal Forms offers numerous template forms, such as the District of Columbia Termination and Severance Pay Policy, which are designed to comply with state and federal regulations.

Once you've located the appropriate form, click on Get now.

Select the pricing plan you prefer, fill in the required information to create your account, and pay for the order using PayPal or a credit card.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased from the My documents section.

You can download an additional copy of the District of Columbia Termination and Severance Pay Policy whenever needed; just click on the form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the District of Columbia Termination and Severance Pay Policy template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

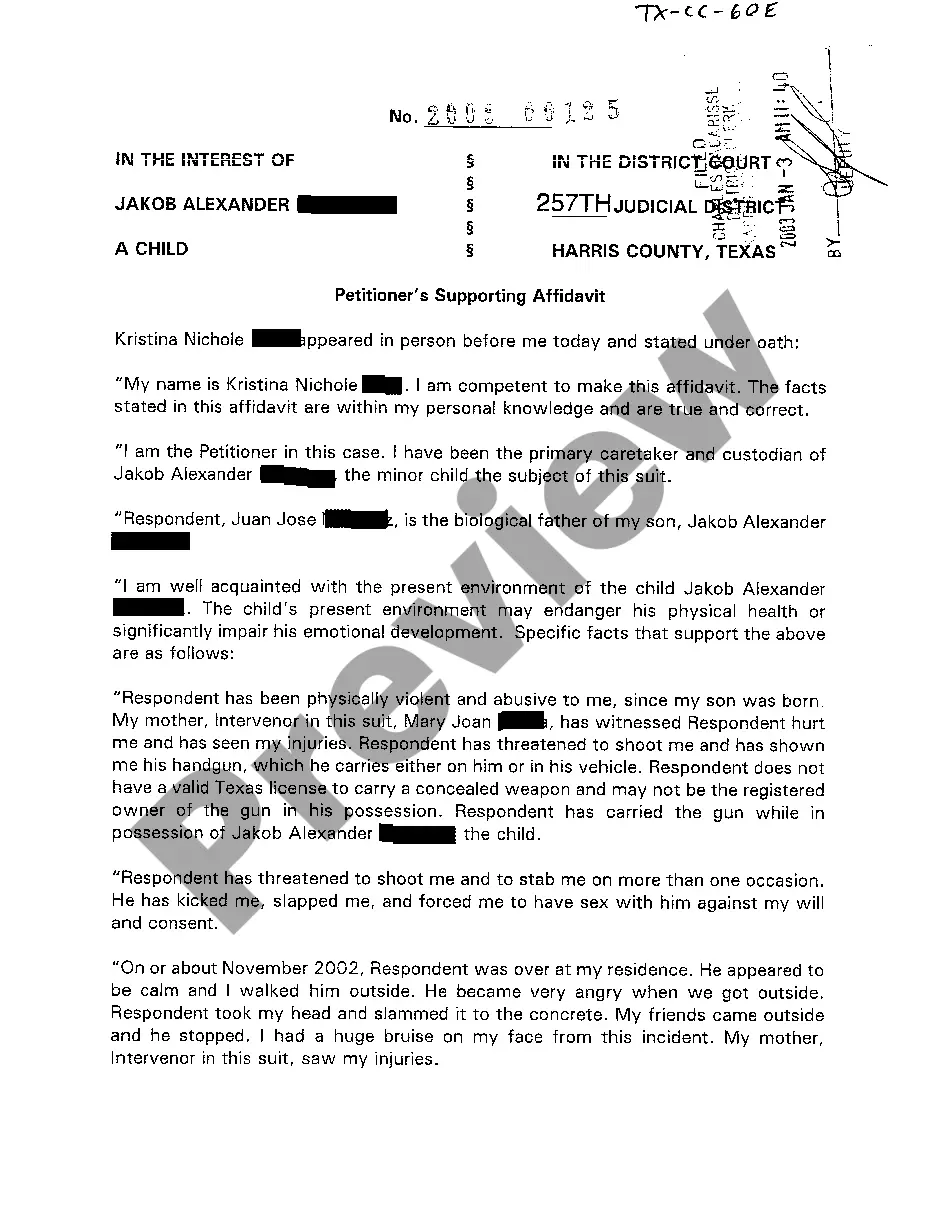

- Use the Preview button to check the form.

- Review the description to confirm you've selected the correct form.

- If the form isn't what you are looking for, utilize the Search field to find the form that meets your needs.

Utilize US Legal Forms, the most extensive collection of legal documents, to save time and avoid errors.

The service offers well-crafted legal document templates that you can use for various purposes.

Create an account on US Legal Forms and start making your life a bit easier.

Form popularity

FAQ

Severance laws in Washington DC are guided by local statutes alongside the District of Columbia Termination and Severance Pay Policy. Employers are not legally required to offer severance pay, but when they do, it often outlines specific conditions and eligibility criteria. It's essential for employees to review their employment contracts and company policies governing severance. Resources like US Legal Forms can assist you in understanding your rights and obligations in the context of these laws.

The District of Columbia does not impose a specific severance tax on employees who receive severance pay. However, severance benefits are generally subject to state and federal income taxes. Understanding how taxes impact your severance can be complex, but the District of Columbia Termination and Severance Pay Policy can provide guidance. For more insights on this topic, you may want to consult resources like US Legal Forms.

The termination policy in Washington DC allows employers considerable flexibility, yet they must adhere to specific regulations. Typically, they can terminate at-will employees without prerequisite notice, provided there is no violation of anti-discrimination laws. However, employees should be aware of their rights under the District of Columbia Termination and Severance Pay Policy, which aims to protect workers. If you need more detailed information, US Legal Forms can help clarify these policies.

In the District of Columbia, you may qualify for unemployment benefits even if you receive severance pay. However, the amount and duration of your benefits may be affected by the severance payments. Generally, the Department of Employment Services evaluates your situation based on the District of Columbia Termination and Severance Pay Policy. For personalized guidance, consider using platforms like US Legal Forms to navigate your specific case.

Yes, you can still receive severance if you get fired, depending on the terms set out in your employment contract and the District of Columbia Termination and Severance Pay Policy. Often, companies offer severance to assist employees during their transition, even in termination cases. It is wise to consult your HR department or review your employment agreement for specific entitlements.

When you are fired and you receive severance, it usually means you will receive a lump sum payment or continued pay for a specific duration. This payment acts as a financial buffer as you transition to new employment. Revisit the District of Columbia Termination and Severance Pay Policy to understand your rights and the potential impact on any future employment benefits.

Not everyone receives severance when fired, as it often depends on the terms of your employment and the company's policies. Many businesses in DC provide severance according to their District of Columbia Termination and Severance Pay Policy, but this is not a universal requirement. It’s crucial to check your employment agreement and company handbook to understand your entitlements.

Yes, you can receive both severance pay and unemployment benefits in Washington, DC. However, the severance may affect your unemployment benefits, as the state considers your severance pay as wages for a period. It's essential to understand how the District of Columbia Termination and Severance Pay Policy interacts with unemployment benefits to ensure you receive what you deserve.

To ask for severance after termination, start by reviewing your employment contract or company policy regarding the District of Columbia Termination and Severance Pay Policy. Prepare a formal request outlining your understanding of the policy and include any relevant details of your employment. It’s advisable to communicate directly with your HR department or manager, as they can provide clarity on the process.