District of Columbia Unrestricted Charitable Contribution of Cash

Description

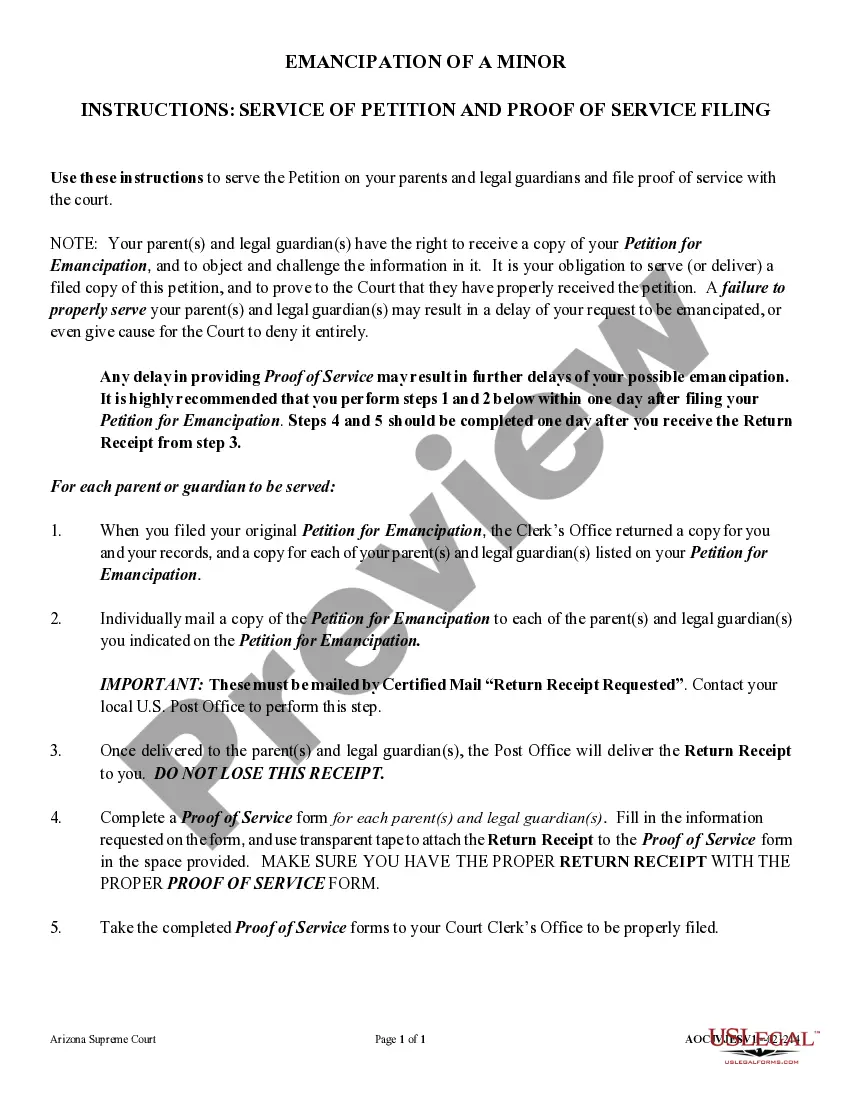

How to fill out Unrestricted Charitable Contribution Of Cash?

If you require extensive, acquire, or reproducing sanctioned document templates, utilize US Legal Forms, the largest collection of legal documents, available online.

Take advantage of the site’s user-friendly and efficient search to find the documents you need.

Various templates for commercial and personal use are organized by categories and jurisdictions, or keywords.

Every legal document format you purchase is yours indefinitely. You will have access to all documents you downloaded within your account. Go to the My documents section and select a document to print or download again.

Be proactive and obtain, and print the District of Columbia Unrestricted Charitable Contribution of Cash with US Legal Forms. There are numerous professional and state-specific templates available for your business or personal needs.

- Use US Legal Forms to download the District of Columbia Unrestricted Charitable Contribution of Cash in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to retrieve the District of Columbia Unrestricted Charitable Contribution of Cash.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, refer to the following instructions.

- Step 1. Ensure that you have selected the form for the appropriate city/state.

- Step 2. Use the View option to examine the document’s content. Remember to read the details.

- Step 3. If you are dissatisfied with the document, utilize the Search bar at the top of the page to find other documents in the legal document format.

- Step 4. Once you have found the necessary form, click the Get Now button. Choose the payment plan you prefer and submit your information to register for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the District of Columbia Unrestricted Charitable Contribution of Cash.

Form popularity

FAQ

Claiming charitable contributions begins with collecting your receipts and summarizing your donations. You can claim contributions through your tax return by following the guidelines provided by the IRS. The process of claiming a District of Columbia unrestricted charitable contribution of cash is straightforward when you use platforms like US Legal Forms, which guide you through the necessary documentation and filing methods.

To deduct charitable contributions, you need to keep accurate records of your donations. You will report your contributions on Schedule A of your tax return if you itemize deductions. Ensure you include documentation for any unrestricted charitable contribution of cash, as this can enhance the clarity of your filings and maximize your benefits.

In the District of Columbia, the maximum you can deduct for charitable donations depends on your adjusted gross income and the type of charity you support. Generally, you can write off up to 60% of your adjusted gross income for cash contributions to qualifying organizations. If you make an unrestricted charitable contribution of cash, these guidelines help you maximize your tax benefits while supporting causes you care about.

Form 8282 and Form 8283 are both used for reporting charitable contributions, but they serve different purposes. Form 8282 is used by charities to report the sale of donated property valued at more than $500, while Form 8283 is used by donors to report noncash charitable contributions exceeding $500, including the District of Columbia Unrestricted Charitable Contribution of Cash. Understanding the distinctions ensures you report your charitable contributions correctly. You can rely on resources like uslegalforms to navigate these forms accurately.

Without proof, you can generally claim up to $300 in charitable contributions for the tax year. When donating cash, especially related to the District of Columbia Unrestricted Charitable Contribution of Cash, it’s advisable to obtain documentation for anything exceeding this amount. To ensure compliance and avoid issues, use resources like uslegalforms to get precise information on necessary records.

The highest amount you can deduct for charitable donations varies based on your adjusted gross income and the type of charity. Generally, you may deduct up to 60% of your adjusted gross income for cash contributions to public charities, such as those related to the District of Columbia Unrestricted Charitable Contribution of Cash. It’s important to understand these limits to maximize your deductions effectively. Consider using uslegalforms to find accurate forms and detailed information.

Yes, you can claim charitable contributions, including the District of Columbia Unrestricted Charitable Contribution of Cash, on your tax return. Make sure to keep accurate records and receipts for all donations you make. Additionally, you should consult the IRS guidelines for specific limits and requirements regarding your contributions. Utilizing a platform like uslegalforms can help guide you through the documentation process.

To record a District of Columbia Unrestricted Charitable Contribution of Cash, the journal entry typically debits the donation expense account and credits the cash or bank account you used for the donation. This entry reflects the decrease in cash and acknowledges the expense for your accounting records. Keeping proper documentation helps substantiate your entries during tax filing.

The maximum amount you can deduct for charitable contributions, including a District of Columbia Unrestricted Charitable Contribution of Cash, generally depends on your adjusted gross income (AGI). Typically, individuals can deduct donations up to 60% of their AGI for cash contributions made to qualified charities. Monitoring these limits is crucial for optimizing your tax benefits.

For noncash charitable contributions, you'll need to use Form 8283, 'Noncash Charitable Contributions.' This form facilitates the reporting of items like property or goods you donate. If your contribution exceeds a certain amount, additional details are required, so it’s wise to consult with a tax professional to ensure compliance.