District of Columbia Sample Letter for Attempt to Collect Debt before Legal Action

Description

How to fill out Sample Letter For Attempt To Collect Debt Before Legal Action?

Choosing the right lawful document web template can be a battle. Naturally, there are tons of layouts available online, but how do you get the lawful form you want? Make use of the US Legal Forms website. The services gives thousands of layouts, including the District of Columbia Sample Letter for Attempt to Collect Debt before Legal Action, that you can use for company and private requires. All the forms are checked by pros and fulfill federal and state requirements.

In case you are presently registered, log in to your bank account and then click the Down load key to obtain the District of Columbia Sample Letter for Attempt to Collect Debt before Legal Action. Use your bank account to search throughout the lawful forms you have purchased formerly. Check out the My Forms tab of your own bank account and have another copy of your document you want.

In case you are a whole new user of US Legal Forms, here are easy instructions that you can stick to:

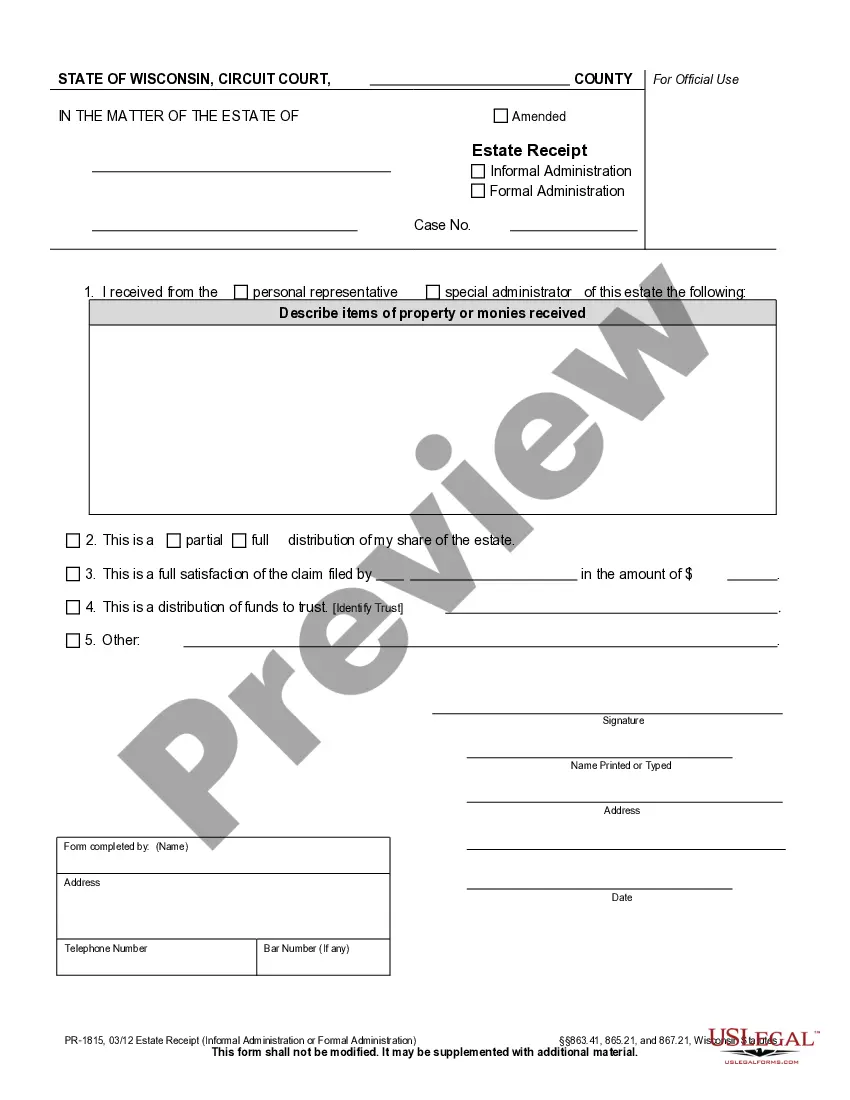

- First, ensure you have selected the correct form for your personal town/region. You are able to check out the form utilizing the Review key and study the form outline to make certain this is basically the best for you.

- In case the form will not fulfill your needs, use the Seach field to discover the appropriate form.

- When you are positive that the form is proper, click the Buy now key to obtain the form.

- Choose the rates strategy you desire and type in the essential info. Make your bank account and buy the order using your PayPal bank account or Visa or Mastercard.

- Choose the data file structure and download the lawful document web template to your gadget.

- Comprehensive, change and print out and signal the obtained District of Columbia Sample Letter for Attempt to Collect Debt before Legal Action.

US Legal Forms is definitely the biggest collection of lawful forms that you will find different document layouts. Make use of the company to download expertly-manufactured paperwork that stick to status requirements.

Form popularity

FAQ

Include your full name, company name, and mailing address. Address the letter to your client by their full name. State the problem: Specify and provide proof of the debt in question. Reference the original contract or agreement that states the services the client owes you for.

You should dispute a debt if you believe you don't owe it or the information and amount is incorrect. While you can submit your dispute at any time, sending it in writing within 30 days of receiving a validation notice, which can be your initial communication with the debt collector.

Dear Sir/Madam: I am writing in regards to the above-referenced debt to inform you that I am disputing this debt. Please verify the debt as required by the Fair Debt Collection Practices Act. I am disputing this debt because I do not owe it.

The collection dispute letter to debt collectors should include the following information: Your details ? name, address, official email address, etc. Request for more information about the creditor. Amount of debt owed. A request note to not report the matter to the credit reporting agency until the matter is resolved.

One significant amendment in the bill passed Tuesday clarifies that a debt collector or debt buyer may only send text messages, emails or private messages on social media after sending the required written notice to consumers.

Your debt settlement proposal letter must be formal and clearly state your intentions, as well as what you expect from your creditors. You should also include all the key information your creditor will need to locate your account on their system, which includes: Your full name used on the account. Your full address.

Dispute in writing, and include any evidence that supports your claims (such as copies of cancelled checks showing you paid the debt or a police report in the case of identity theft). If the debt collector knows that you don't owe the money, it should not try to collect the debt.

An effective debt collection letter should include all of the following: The total amount the client owes you. The original date the balance was due. Instructions detailing how to make the overdue payment. The new due date, whether a specific date or as soon as possible.