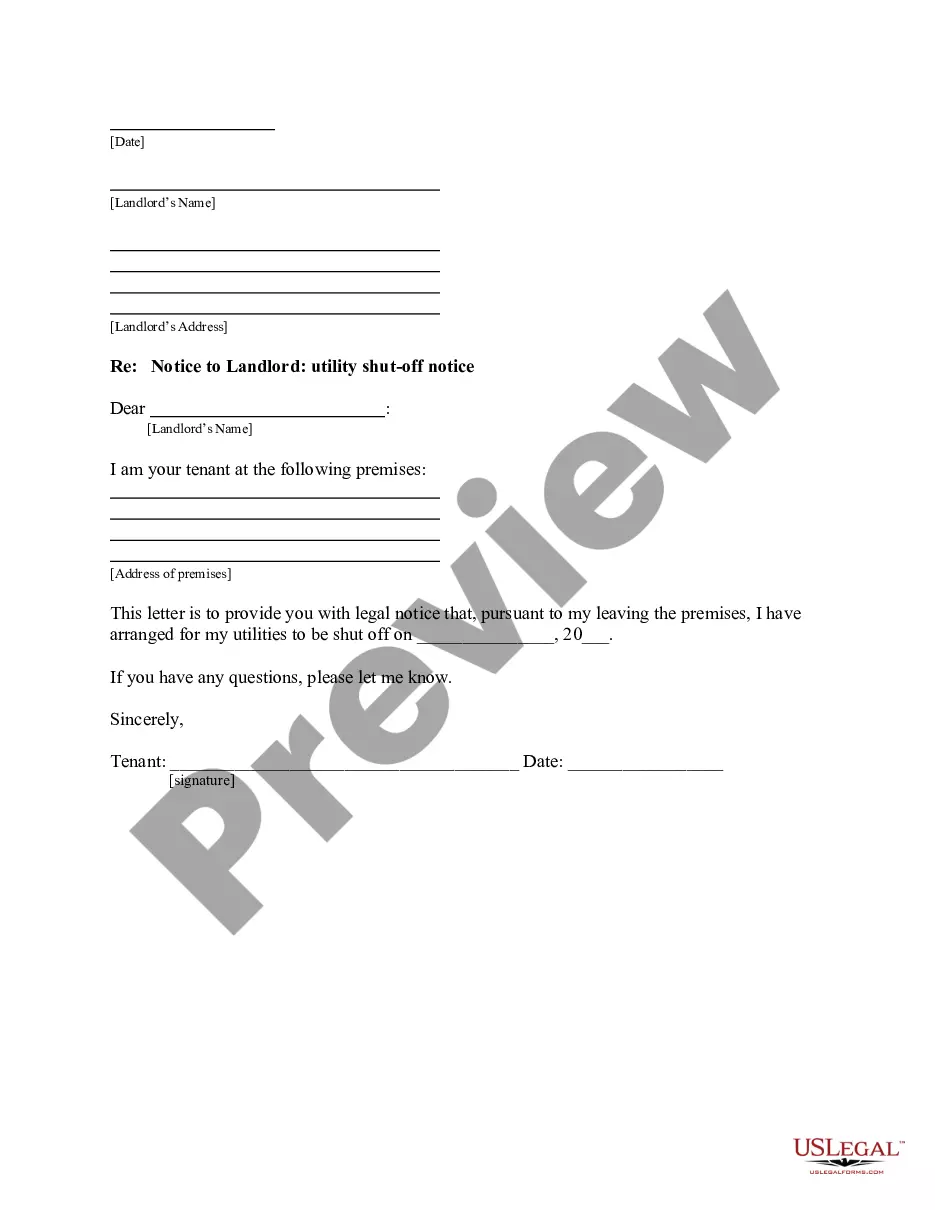

This form is a sample letter in Word format covering the subject matter of the title of the form.

District of Columbia Sample Letter for Collection Efforts

Description

How to fill out Sample Letter For Collection Efforts?

Selecting the finest legitimate document template can be quite a challenge. Obviously, there are numerous designs available online, but how do you find the legitimate form you need? Utilize the US Legal Forms website. The service offers a vast array of templates, including the District of Columbia Sample Letter for Collection Efforts, that you can employ for both business and personal needs. Each of the forms is reviewed by experts and complies with federal and state regulations.

If you are currently registered, Log In to your account and click on the Download button to obtain the District of Columbia Sample Letter for Collection Efforts. Use your account to search through the legitimate forms you may have acquired previously. Navigate to the My documents tab of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the appropriate form for the city/state. You can review the form using the Review button and read the form description to confirm it is the right one for you. If the form does not meet your requirements, use the Search field to find the correct form. Once you are certain the form is suitable, click on the Purchase now button to acquire the form. Choose the pricing plan you prefer and provide the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legitimate document template to your device. Complete, modify, print, and sign the obtained District of Columbia Sample Letter for Collection Efforts.

US Legal Forms is an excellent resource for obtaining dependable legal documents that can assist in your professional and personal endeavors.

- US Legal Forms is the largest repository of legitimate forms where you can find various document templates.

- Take advantage of the service to download professionally crafted paperwork that comply with state requirements.

- Ensure that all details are correctly inputted during the account creation and payment process.

- Use the search function effectively to locate the specific forms you require quickly.

- Review all form descriptions thoroughly to ensure they meet your needs before downloading.

- Consider using customer support if you encounter any issues while navigating the website.

Form popularity

FAQ

In Washington D.C., the statute of limitations on debt collection is generally three years for most types of debts. This means that after three years, creditors typically cannot sue you to collect a debt. Knowing this limit can be crucial when dealing with old debts, and using a District of Columbia Sample Letter for Collection Efforts can help you communicate effectively with collectors. Always be aware of your rights and the timeline associated with your debts.

The 777 rule refers to the practice where debt collectors must provide proof of the debt within seven days of your request. This rule ensures that you have the right to question and verify any outstanding debts. Utilizing a District of Columbia Sample Letter for Collection Efforts can help you formally request this information from the collector, ensuring that you are fully informed about your financial obligations. Understanding this rule empowers you to take control of your debt situation.

To write a letter of dispute to a collection agency, start by clearly stating your intent to dispute the debt. Include your account number, the name of the collection agency, and a brief explanation of why you believe the debt is incorrect. You can use a District of Columbia Sample Letter for Collection Efforts to ensure your letter includes all necessary details and follows the right format. This approach helps you clearly communicate your position and keeps a record of your dispute.

To write a good collection letter, start with a professional header and a clear subject line. Specify the debt amount, provide relevant details, and express your willingness to discuss payment options. A District of Columbia Sample Letter for Collection Efforts can guide you in structuring your letter to achieve the best possible response.

A nice collection letter is one that balances firmness with politeness, thanking the recipient for their attention while reminding them of their financial obligation. It often includes a payment plan option or alternative solutions. You can refer to a District of Columbia Sample Letter for Collection Efforts to see how to maintain this balance effectively.

An example of a letter of collection includes a clear statement of the amount owed, the original creditor's details, and a call to action for payment. It should maintain a professional tone throughout. For your convenience, a District of Columbia Sample Letter for Collection Efforts can serve as an excellent model for crafting your own letter.

To write a nice collection email, start with a polite greeting and clearly state the purpose of your message. Be direct yet courteous, providing all necessary details regarding the debt. Utilizing a District of Columbia Sample Letter for Collection Efforts as a template can simplify this process and ensure you cover all key points.

The 11-word phrase to stop debt collectors is, 'I do not owe this debt, please cease communication.' This statement can be effective in halting unwanted collection efforts. For more detailed guidance, consider a District of Columbia Sample Letter for Collection Efforts that incorporates this phrase.

A collection dispute letter serves to contest a debt you believe is incorrect. It should include your details, a reference to the debt, and a concise explanation of the dispute. You can find a helpful District of Columbia Sample Letter for Collection Efforts that illustrates how to structure this letter for maximum impact.

Collection letters typically have a formal structure, including your name, address, and the creditor's information. They often state the amount owed, the purpose of the letter, and any deadlines for payment. A District of Columbia Sample Letter for Collection Efforts will clearly outline these elements, making it easy for the recipient to understand their obligations.