District of Columbia Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

How to fill out Irrevocable Trust For Future Benefit Of Trustor With Income Payable To Trustor After Specified Time?

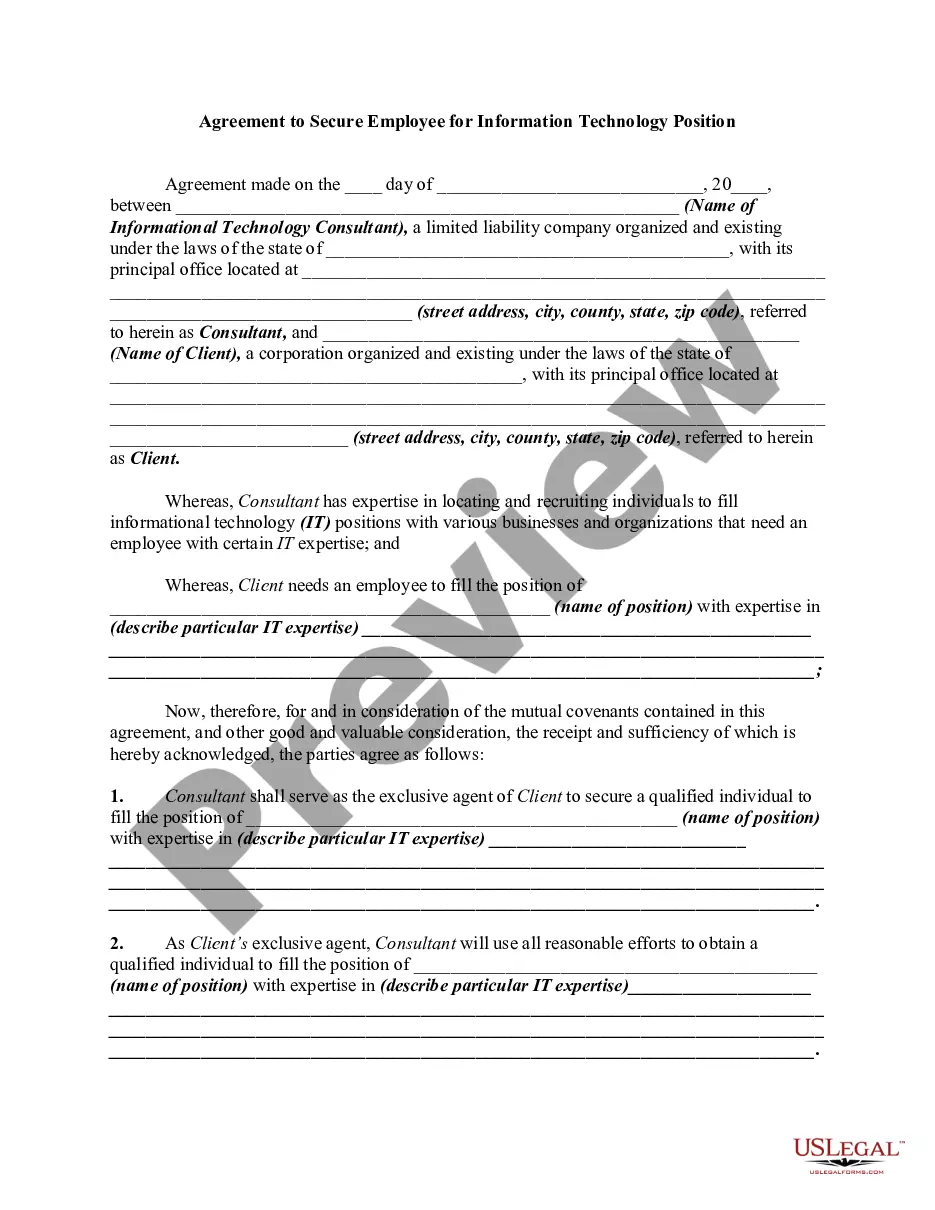

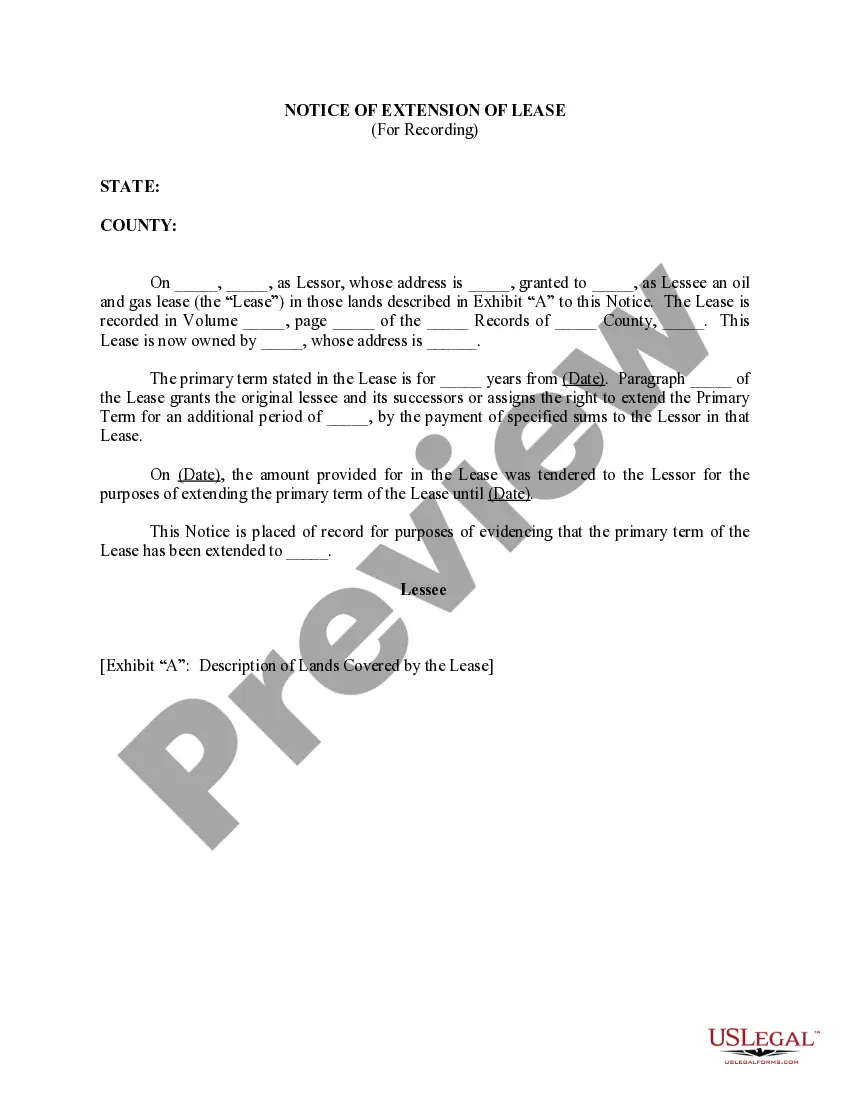

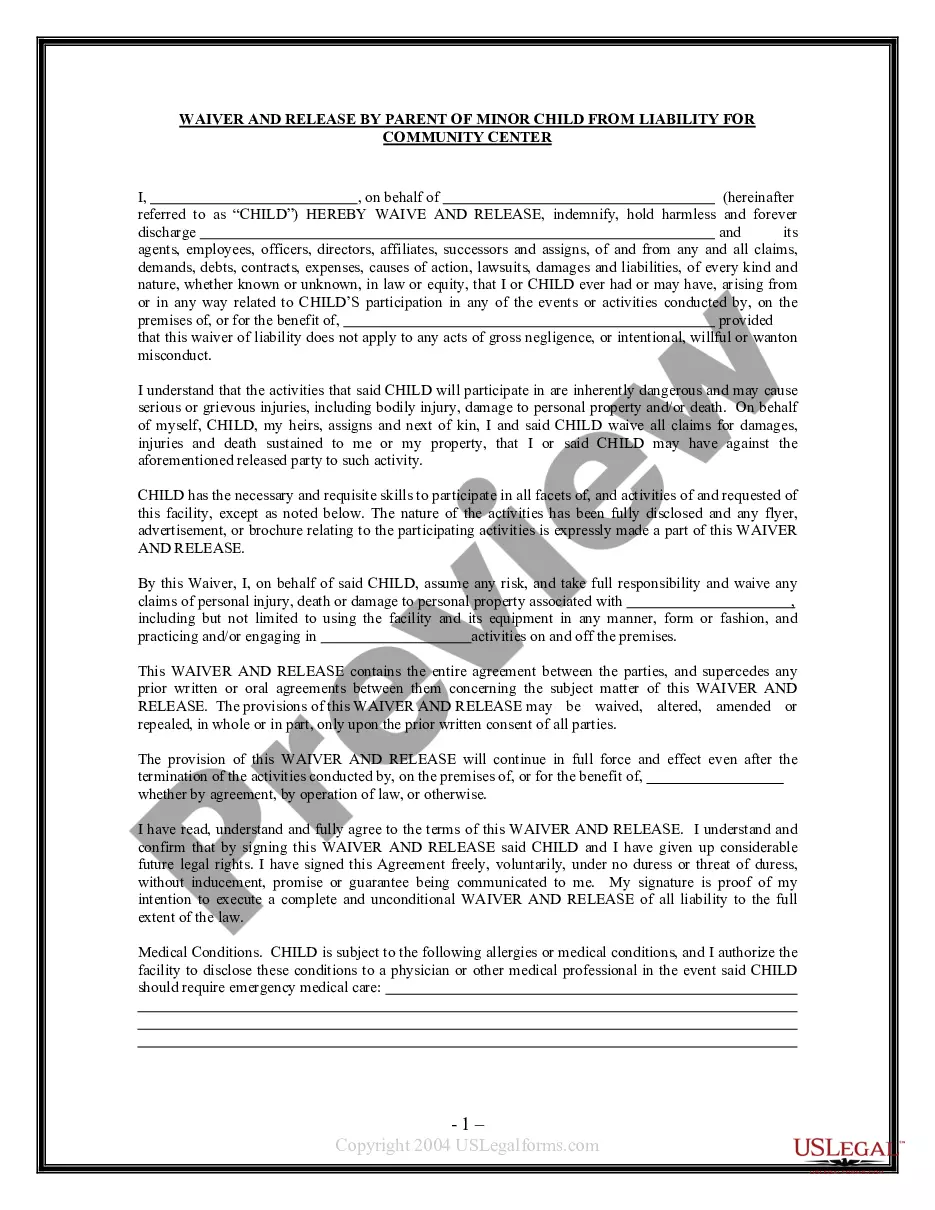

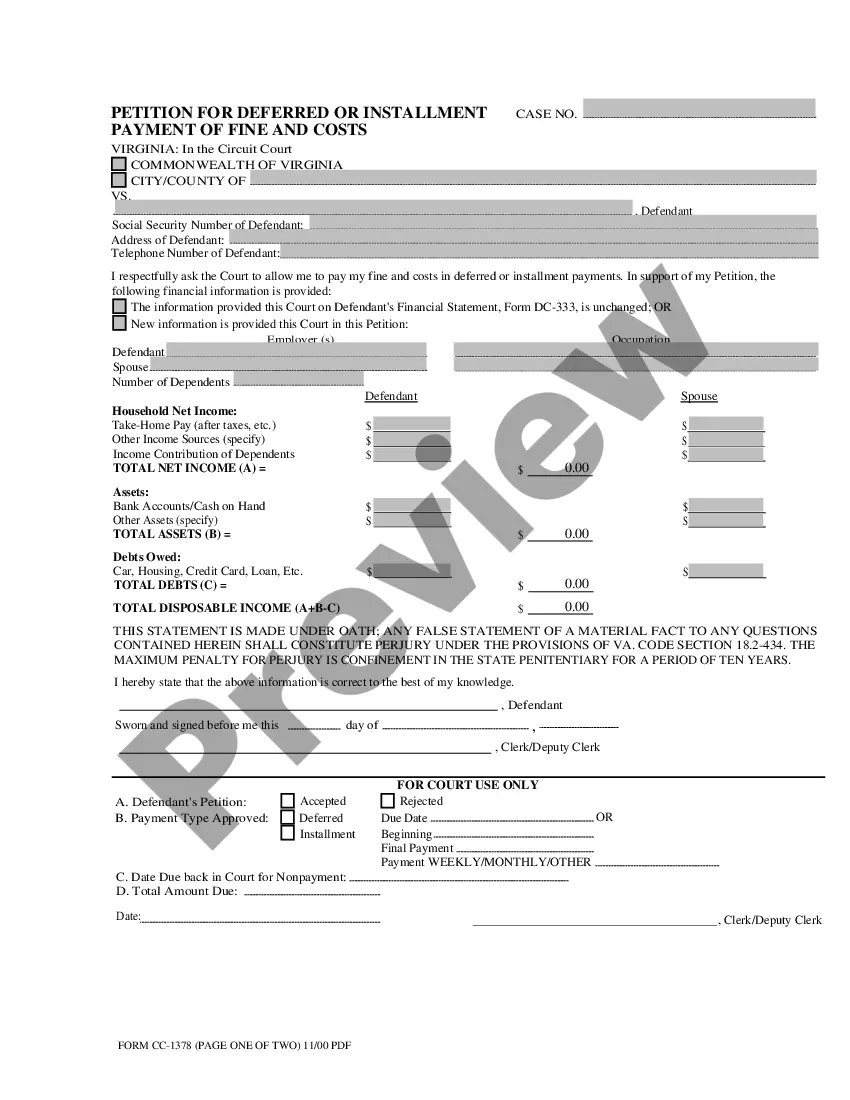

You might spend hours online searching for the legal document template that satisfies the state and federal criteria you require.

US Legal Forms provides thousands of legal templates that can be reviewed by experts.

You can easily obtain or create the District of Columbia Irrevocable Trust for the Future Benefit of Trustor with Income Payable to Trustor after a Designated Period through our service.

- If you already possess a US Legal Forms account, you can Log In and select the Download option.

- After that, you can fill out, modify, print, or sign the District of Columbia Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after a Designated Period.

- Every legal document template you purchase is yours permanently.

- To acquire another version of any purchased form, visit the My documents section and click on the relevant option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions provided below.

- First, ensure you have selected the right document template for your selected county/city.

- Check the form details to confirm that you have chosen the correct form.

- If available, take advantage of the Review option to examine the document template as well.

- If you wish to find another version of the form, utilize the Search field to locate the template that fits your needs and requirements.

- Once you have found the template you want, click Purchase now to proceed.

- Choose the pricing plan you desire, enter your credentials, and sign up for an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to buy the legal form.

- Select the format of the document and download it to your device.

- Make modifications to the document if possible. You may fill out, edit, sign, and print the District of Columbia Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after a Designated Period.

- Download and print thousands of document templates using the US Legal Forms website, which offers the most extensive range of legal forms.

- Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

When a trustee dies, the successor trustee of the trust takes over. If there is no named successor trustee, the involved parties can turn to the courts to appoint a successor trustee. If the deceased Trustee had co-trustees, the joint trustees take over the trust without involving the courts.

Who Pays Capital Gains Tax in a Trust? Income realized on assets inside the Trust is taxed, and if it's not distributed to beneficiaries, it's paid for by the Trust every year. Usually, beneficiaries who receive distributions on the Trust's income will be taxed individually.

Upon the death of the grantor, grantor trust status terminates, and all pre-death trust activity must be reported on the grantor's final income tax return. As mentioned earlier, the once-revocable grantor trust will now be considered a separate taxpayer, with its own income tax reporting responsibility.

Income earned by the trust can be in the form of interest, dividends, ordinary income, or capital gain. The trust document can allocate which beneficiary is to receive which type of income. Accounting income is used to determine the amount that is required to be distributed to the income beneficiary.

The grantor (as an individual or couple) transfers their assets to an irrevocable trust. However, unlike other irrevocable trusts, the grantor can be the income beneficiary. Their children or spouse would be the residual beneficiaries.

A common question that arises when preparing an estate or trust return is, can capital gains be distributed to the beneficiary? Most often, the answer is no, capital gains remain in and are taxed at the trust level.

But assets in an irrevocable trust generally don't get a step up in basis. Instead, the grantor's taxable gains are passed on to heirs when the assets are sold. Revocable trusts, like assets held outside a trust, do get a step up in basis so that any gains are based on the asset's value when the grantor dies.

After the grantor of an irrevocable trust dies, the trust continues to exist until the successor trustee distributes all the assets. The successor trustee is also responsible for managing the assets left to a minor, with the assets going into the child's sub-trust.

Who Controls an Irrevocable Trust? Under an irrevocable trust, legal ownership of the trust is held by a trustee. At the same time, the grantor gives up certain rights to the trust.

Distribute trust assets outright The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.