District of Columbia Purchase Agreement by a Corporation of Assets of a Partnership

Description

How to fill out Purchase Agreement By A Corporation Of Assets Of A Partnership?

Are you located in an area where you frequently require documents for either organizations or particular tasks nearly every day.

There are numerous legitimate document templates available online, but locating reliable ones can be challenging.

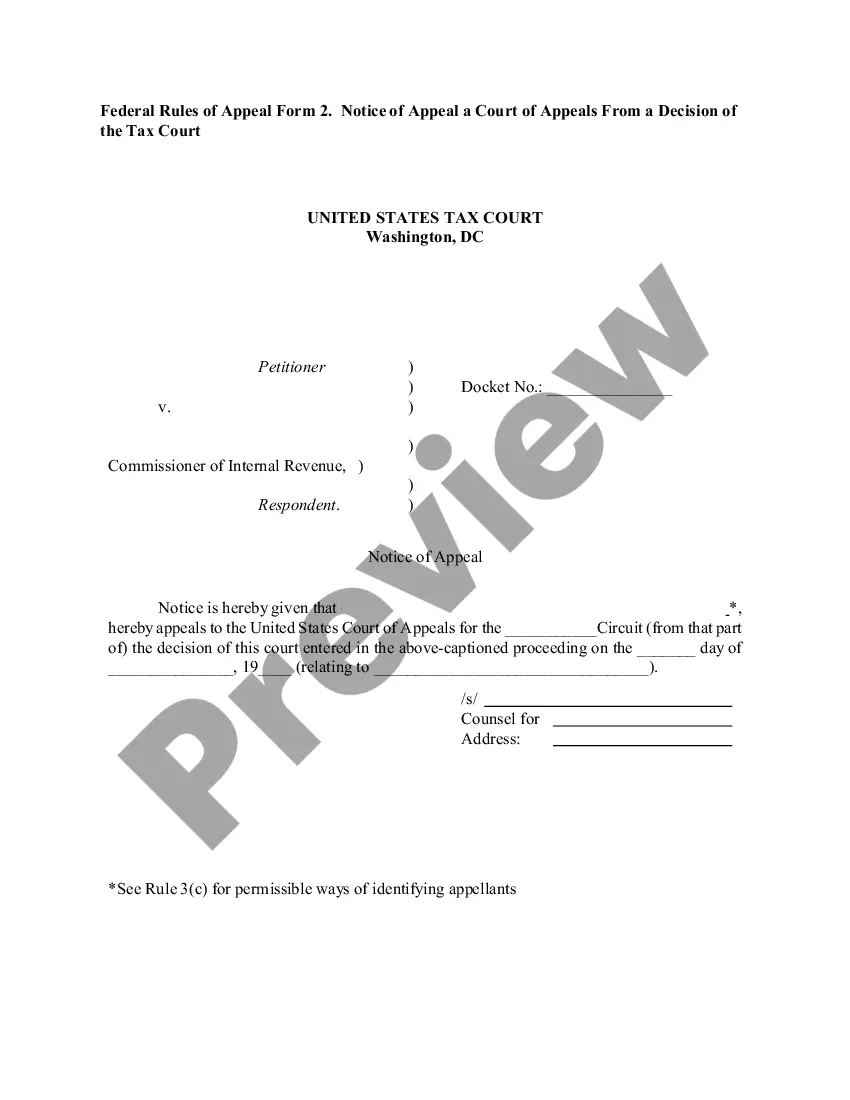

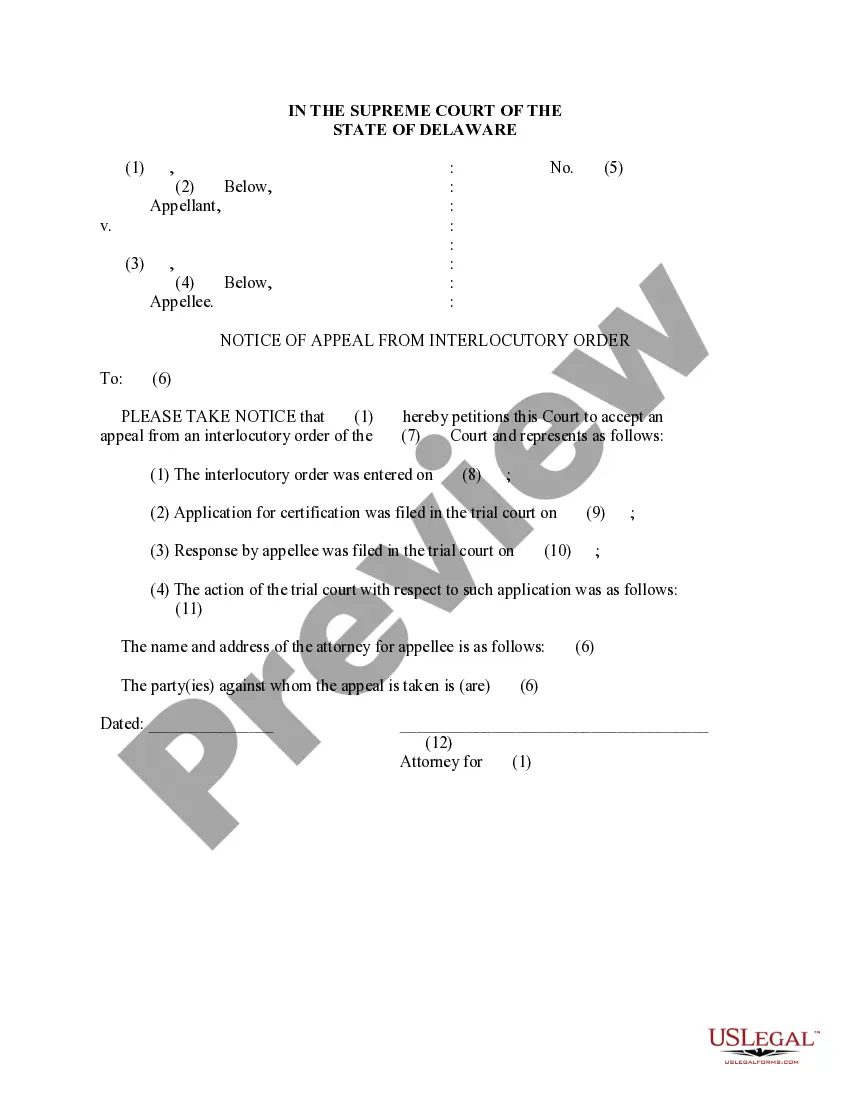

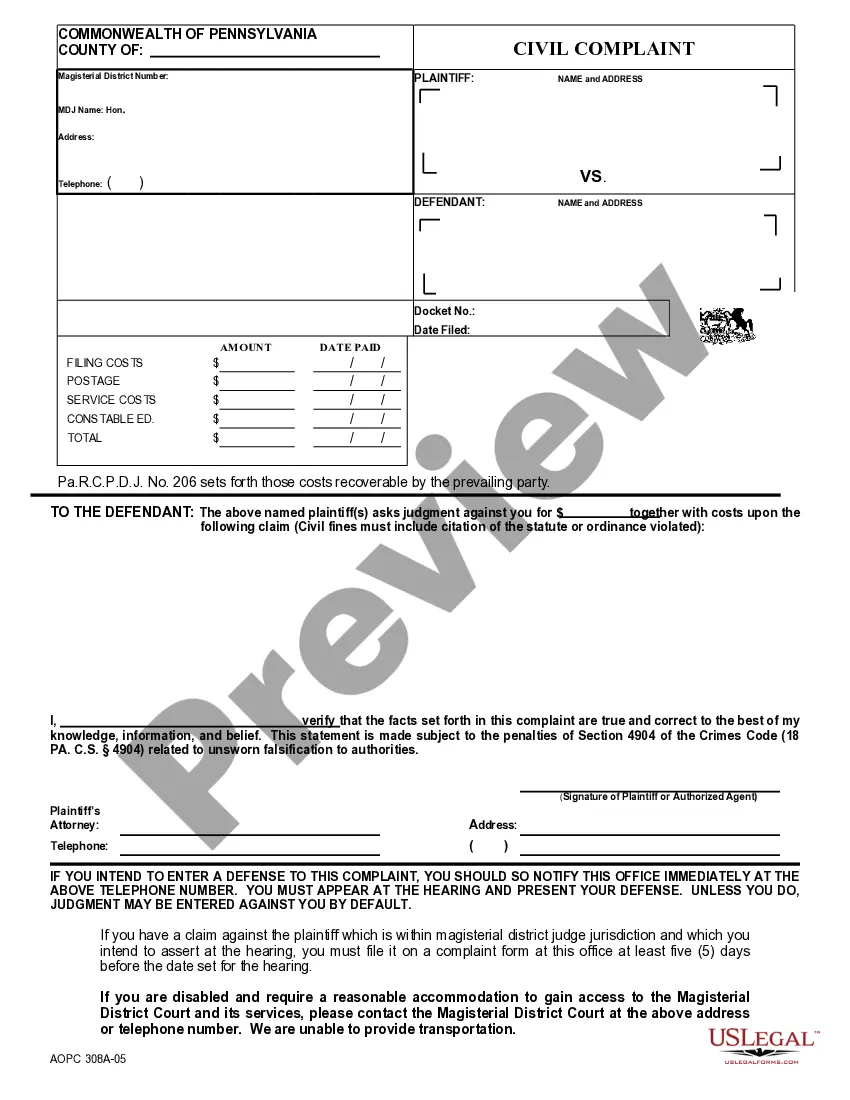

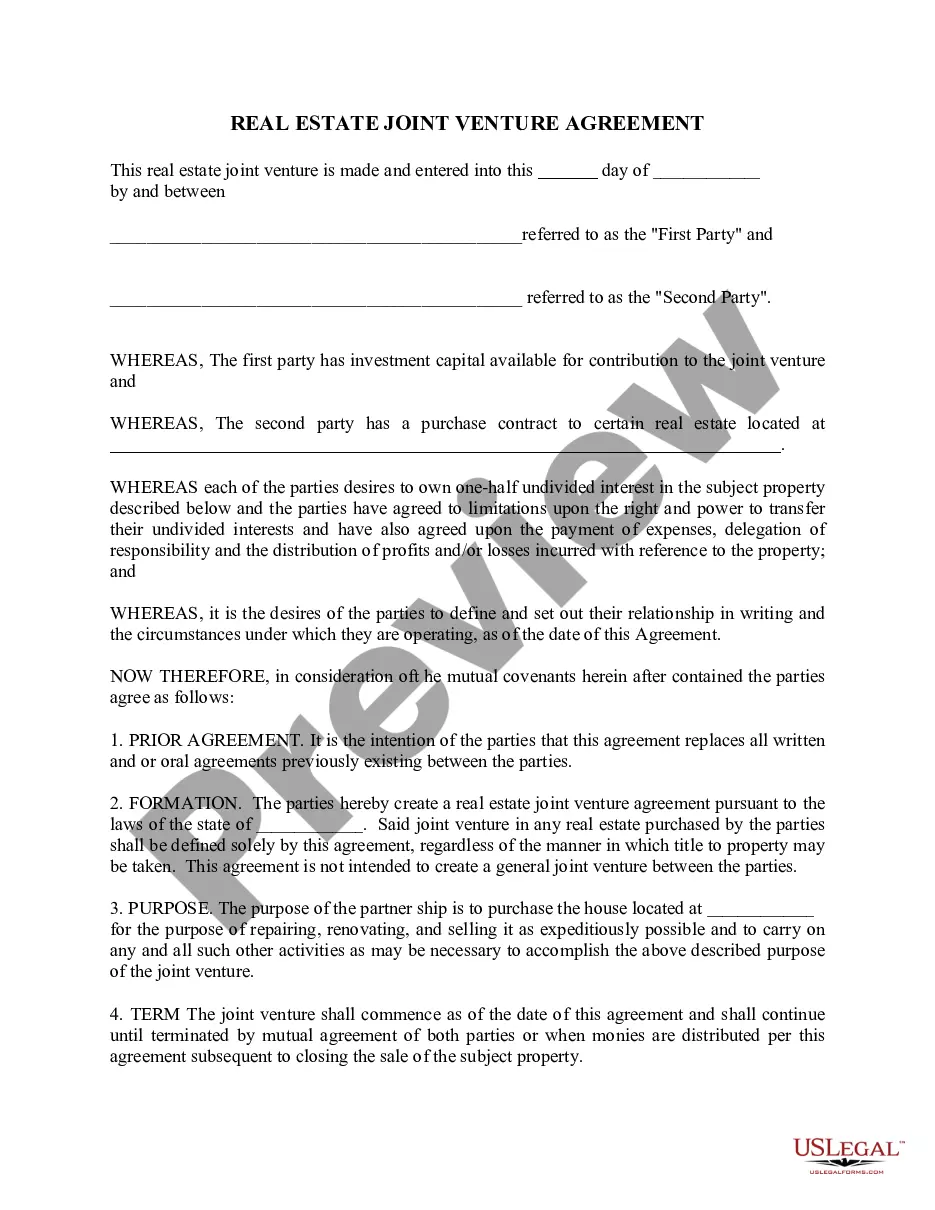

US Legal Forms provides thousands of form templates, including the District of Columbia Purchase Agreement by a Corporation for Assets of a Partnership, designed to comply with state and federal requirements.

Choose a convenient file format and download your copy.

Access all the document templates you have acquired in the My documents menu. You can obtain another copy of the District of Columbia Purchase Agreement by a Corporation for Assets of a Partnership at any time if needed. Just select the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the District of Columbia Purchase Agreement by a Corporation for Assets of a Partnership template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Utilize the Review function to examine the form.

- Check the description to confirm you have selected the correct form.

- If the form is not what you are searching for, use the Search field to discover a form that suits your needs and criteria.

- Once you identify the correct form, click Purchase now.

- Select the pricing plan you prefer, complete the required information to create your account, and finalize the purchase with your PayPal or credit card.

Form popularity

FAQ

Yes, a corporation can be a partner in a limited partnership as well as in a general partnership. However, when it is a limited liability partnership, things can get a bit complicated owing to the legal requirements involved.

A partnership does not own assets for capital gains tax (CGT) purposes. A partnership asset is owned by the partners in the proportion to which they have agreed.

What Constitutes a Legally Binding Business Partnership?All partners must hold up their side of the business responsibilities, financial payments, and guidelines set when the partnership was created.Both partners are responsible for their share fair of the investment.More items...

A partnership agreement is a legally binding document between the partners of a business to establish roles and responsibilities. All partners within a business are expected to sign this legally binding contract.

Any property acquired by a firm for the purpose of carrying on its business is a partnership property. Any property acquired by a firm for the purpose of carrying on its business shall be solely used for the purpose of such business and nothing else.

A general partnership is a company owned by two or more individuals who agree to run the business as partners or co-owners. Unless otherwise agreed, each partner has an equal share of profits and losses. Partnership agreements play a major role in general partnerships that don't evenly split duties and shares.

A partnership has no separate legal personality and it cannot therefore own property and it will be owned by the individual property owning partners. The Land Registry will allow up to four property owning partners to be named at the Land Registry as legal owners.

Can hold the property in its own name. According to Section 14 of the Partnership Act, 1932 specifies any property and rights and interest in property acquired with money belonging to the firm are deemed to have been acquired for the firm. A Partnership is not a juristic person; the legal entity is the partner himself.

A Partnership is defined by the Indian Partnership Act, 1932, as 'the relation between persons who have agreed to share profits of the business carried on by all or any of them acting for all'. Agreement is the essential part of partnership business. It secure the right of both party.

Helping business owners for over 15 years. Property of a partnership is owned by its tenants, generally referred to as tenants in common or tenants in partnership. As such, the partnership property is considered the property of each of its partners and they each have equal rights to use it.