District of Columbia Sample Letter regarding Articles of Incorporation - Election of Sub-S Status

Description

How to fill out Sample Letter Regarding Articles Of Incorporation - Election Of Sub-S Status?

Are you within a situation the place you require paperwork for both company or individual uses virtually every day? There are plenty of legitimate document templates available on the Internet, but locating kinds you can rely on isn`t simple. US Legal Forms gives 1000s of kind templates, much like the District of Columbia Sample Letter regarding Articles of Incorporation - Election of Sub-S Status, that happen to be written to meet state and federal needs.

If you are currently knowledgeable about US Legal Forms internet site and have an account, merely log in. Following that, you can down load the District of Columbia Sample Letter regarding Articles of Incorporation - Election of Sub-S Status template.

Should you not offer an profile and wish to begin using US Legal Forms, adopt these measures:

- Discover the kind you need and ensure it is to the right town/area.

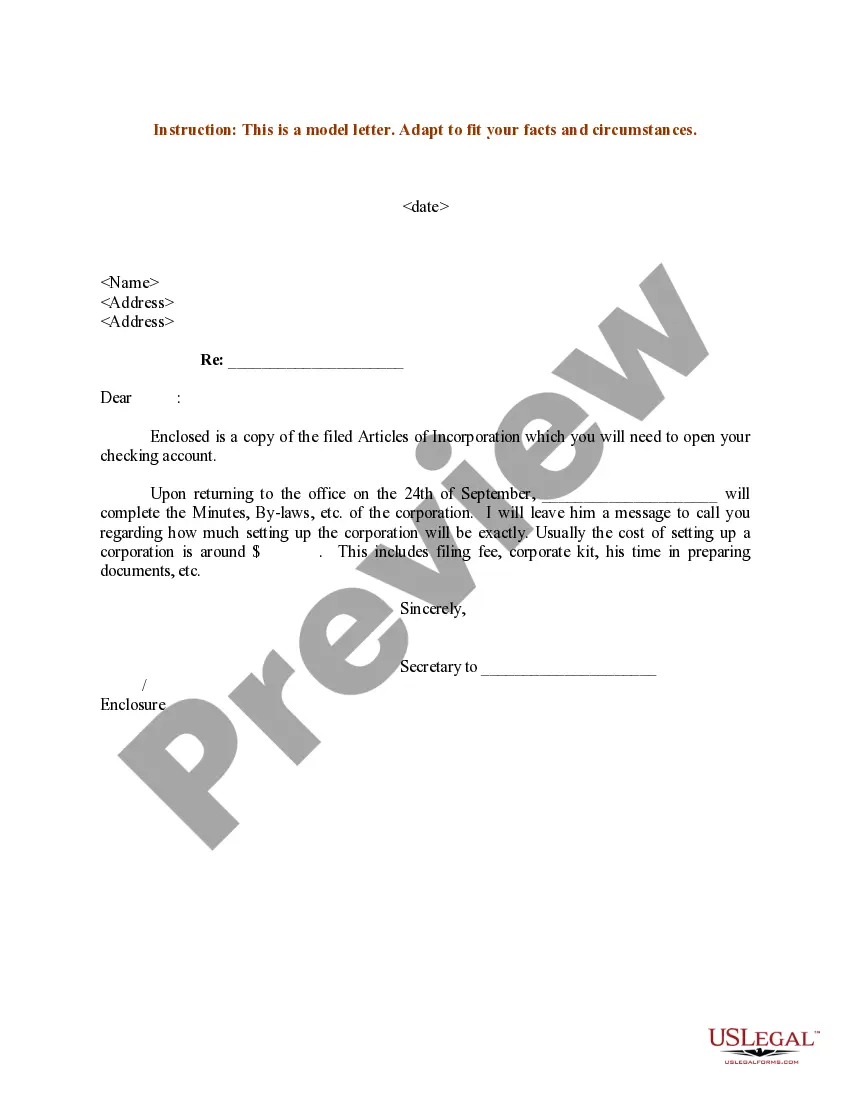

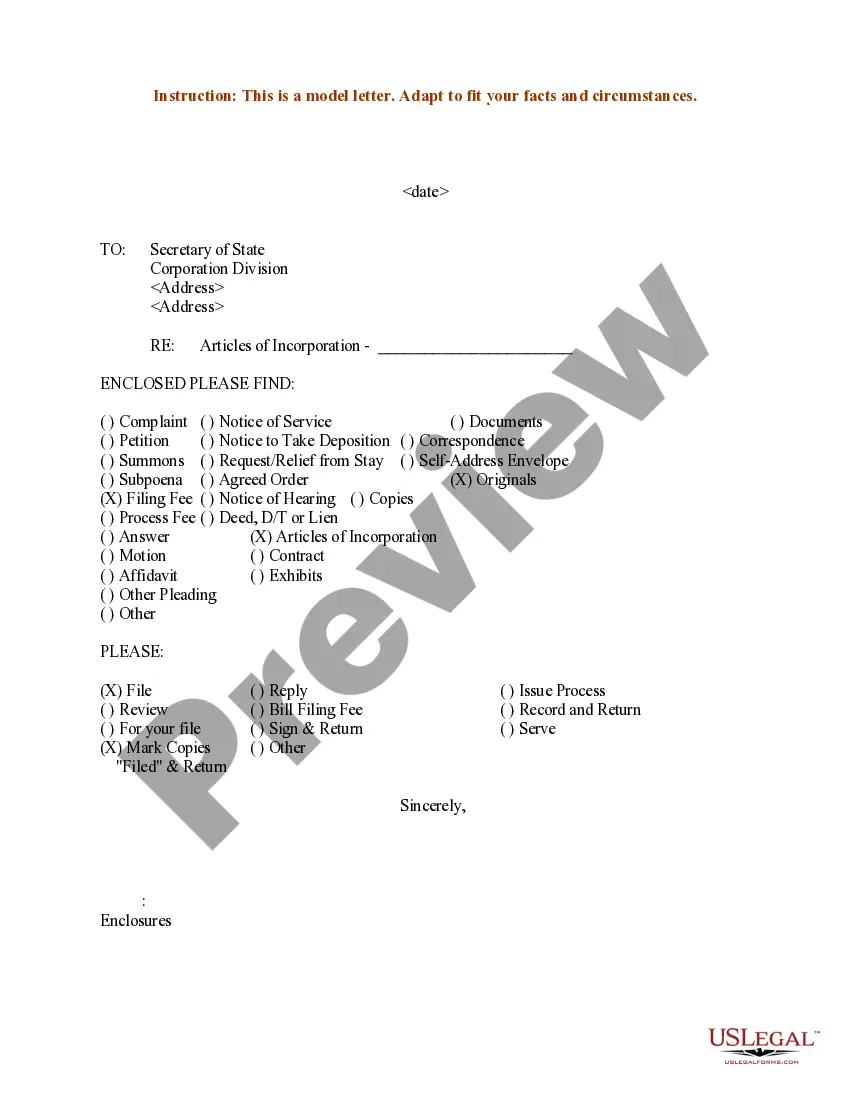

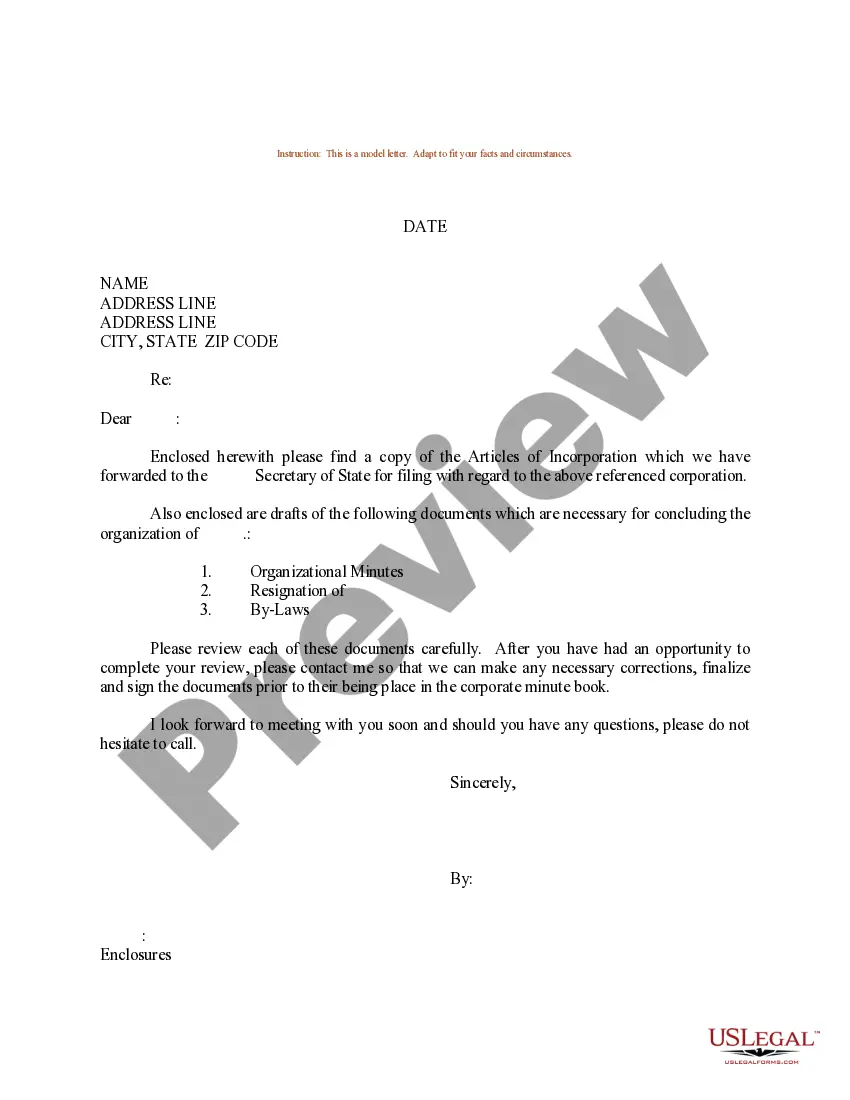

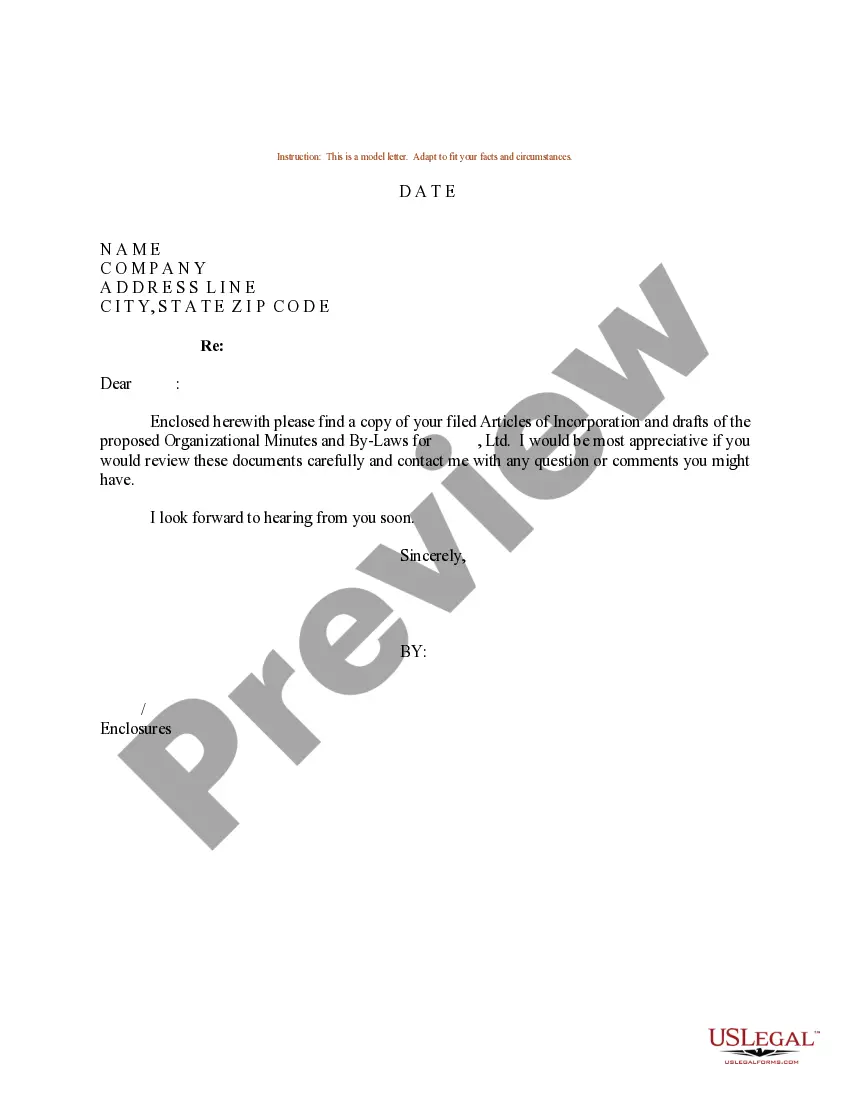

- Utilize the Preview button to check the form.

- Browse the information to ensure that you have chosen the right kind.

- In case the kind isn`t what you are seeking, utilize the Search discipline to get the kind that meets your requirements and needs.

- When you discover the right kind, click on Get now.

- Opt for the prices program you want, complete the desired details to produce your bank account, and pay for the order making use of your PayPal or Visa or Mastercard.

- Choose a hassle-free data file file format and down load your duplicate.

Locate all of the document templates you have bought in the My Forms food selection. You can aquire a further duplicate of District of Columbia Sample Letter regarding Articles of Incorporation - Election of Sub-S Status anytime, if needed. Just click on the essential kind to down load or printing the document template.

Use US Legal Forms, probably the most extensive variety of legitimate types, to save efforts and prevent errors. The service gives appropriately created legitimate document templates which you can use for a range of uses. Create an account on US Legal Forms and commence producing your life a little easier.

Form popularity

FAQ

To qualify: Shareholders may only be individuals, certain trusts, estates, and certain exempt organizations (such as a 501(c)(3) nonprofit). Shareholders may not be partnerships or corporations. Shareholders must be US citizens or residents.

S Corporation Elections A small business corporation elects federal S corporation status by filing federal Form 2553 (Election By a Small Business Corporation) with the Internal Revenue Service. When a corporation elects federal S corporation status it automatically becomes an S corporation for California.

For federal tax purposes, a corporation must file Form 2553, Election by a Small Business Corporation, to gain S corporation status. Most states follow the federal government in recognizing the S election. However, Arkansas, New Jersey and New York require a separate state S election.

Once you confirm you meet the requirements, you may apply for S Corporation status with the IRS by filing Form 2553. The State of Texas recognizes the federal S Corp election. Your business will still be subject to franchise taxes with the State of Texas.

How do I form an S-Corp? DC requires S-Corps to register with the Department of Consumer and Regulatory Affairs (DCRA), which is done by filing an "Articles of Incorporation." Registration costs a minimum of $220 and can increase depending on the amount of stock to be issued by the corporation.

Some jurisdictions?the District of Columbia, Louisiana, New Hampshire, New York City, Tennessee, and Texas?do not recognize the federal S corporation election and, for the most part, tax S corporations like other business corporations.

In order to become an S corporation, the corporation must submit Form 2553, Election by a Small Business Corporation signed by all the shareholders. See the Instructions for Form 2553PDF for all required information and to determine where to file the form.

Florida recognizes the S designation. The state does not treat S corporations as traditional corporations for tax purposes, nor does it tax the income that passes through to the business owners.