District of Columbia Notice of the Findings of the Lost Property to Apparent Owner of Property

Description

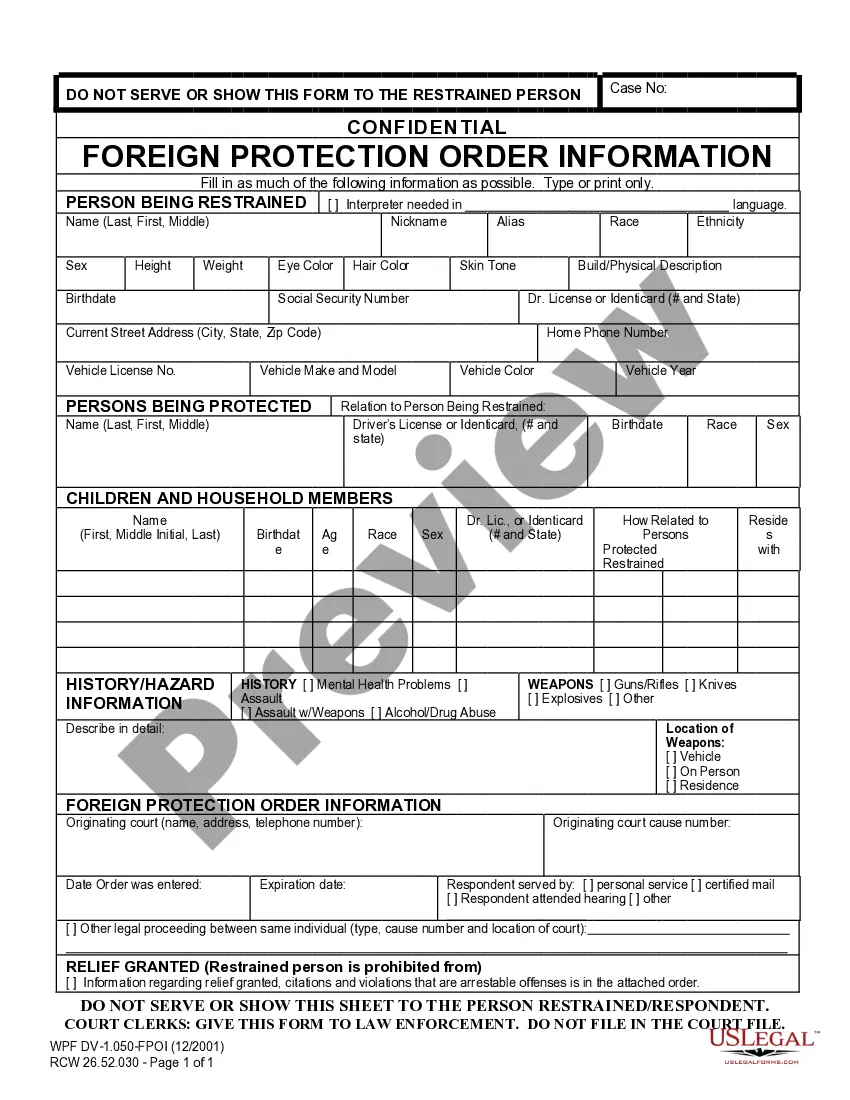

How to fill out Notice Of The Findings Of The Lost Property To Apparent Owner Of Property?

If you wish to aggregate, download, or print legitimate document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to locate the documents you require.

Various templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Step 4. Once you have located the form you want, click the Get now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment.

- Utilize US Legal Forms to retrieve the District of Columbia Notice of the Findings of the Lost Property to Apparent Owner of Property with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Obtain button to find the District of Columbia Notice of the Findings of the Lost Property to Apparent Owner of Property.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct jurisdiction/area.

- Step 2. Use the Review option to examine the contents of the form. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Lookup field at the top of the screen to find other forms in the legal category.

Form popularity

FAQ

A property that is intentionally placed but then forgotten is generally referred to as 'mislaid property.' In various legal contexts, including the District of Columbia Notice of the Findings of the Lost Property to Apparent Owner of Property, it's important to understand this classification. Recognizing the difference aids in appropriate handling and potential recovery of such items by their true owners.

The DC unclaimed property Act is legislation that governs how unclaimed and abandoned properties are managed within the District of Columbia. This Act establishes procedures for identifying, reporting, and distributing unclaimed property to entitled owners. It is closely related to the District of Columbia Notice of the Findings of the Lost Property to Apparent Owner of Property, offering a framework for reclaiming lost items effectively.

If a finder of property is aware of the owner's identity, they cannot rightfully claim the property as their own. Instead, they should return it to the owner or notify the appropriate authorities. The District of Columbia Notice of the Findings of the Lost Property to Apparent Owner of Property process aims to facilitate such returns in an organized manner, ensuring rightful ownership is respected.

In the District of Columbia, property is often considered abandoned after a specific period has lapsed, typically around a few months. The exact time frame can vary depending on the type of property and local regulations. It’s essential for those dealing with lost property to consult the District of Columbia Notice of the Findings of the Lost Property to Apparent Owner of Property guidelines to understand the process thoroughly.

The primary difference between lost and mislaid property lies in the owner's intent. Lost property refers to items that have been unintentionally left behind, while mislaid property occurs when an owner intentionally places the item in a location but forgets it. Understanding these distinctions is crucial, especially when filing a District of Columbia Notice of the Findings of the Lost Property to Apparent Owner of Property.

When an owner deliberately leaves property somewhere but forgets about it, this property is termed as 'mislaid property.' The District of Columbia Notice of the Findings of the Lost Property to Apparent Owner of Property outlines that mislaid property differs from lost property in terms of owner intent. It's essential for finders to follow legal procedures to return mislaid items to their rightful owners.

A property that an owner has knowingly discarded is often referred to as 'abandoned property.' In the context of the District of Columbia Notice of the Findings of the Lost Property to Apparent Owner of Property, it's vital to differentiate between abandonment and other statuses. Abandoned property typically means the owner no longer wishes to claim it, and local laws determine the handling of such assets.

In Missouri, unclaimed property laws protect the rights of owners to recover their property. The law mandates that businesses report unclaimed property after a specified period, allowing rightful owners to reclaim their belongings. The District of Columbia Notice of the Findings of the Lost Property to Apparent Owner of Property serves similar functions, helping owners find lost property. For more insights on these laws, consider visiting US Legal Forms for comprehensive legal resources.

Claiming someone else's unclaimed funds is not allowed, as these funds belong to the rightful owner. Each state, including the District of Columbia, has specific regulations governing who can claim unclaimed property. The District of Columbia Notice of the Findings of the Lost Property to Apparent Owner of Property protects the rights of owners. For assistance, US Legal Forms provides valuable resources to help you understand the claiming process.

You can often claim unclaimed property, provided you can prove ownership. However, claiming random unclaimed property that belongs to someone else is not permitted. The District of Columbia Notice of the Findings of the Lost Property to Apparent Owner of Property ensures that rightful owners have the opportunity to reclaim their property. Consider using platforms like US Legal Forms to help navigate this process effectively.