The right of an employee to compensation is based on either an express or implied contract. Whether the employment contract is express or implied, it need not be formalized in order for the terms of employment to begin. Once employment has begun, the employment contract represents the right of the employee to be paid the wages agreed upon for services he or she has performed and the right of an employer to receive the services for which the wages have been paid.

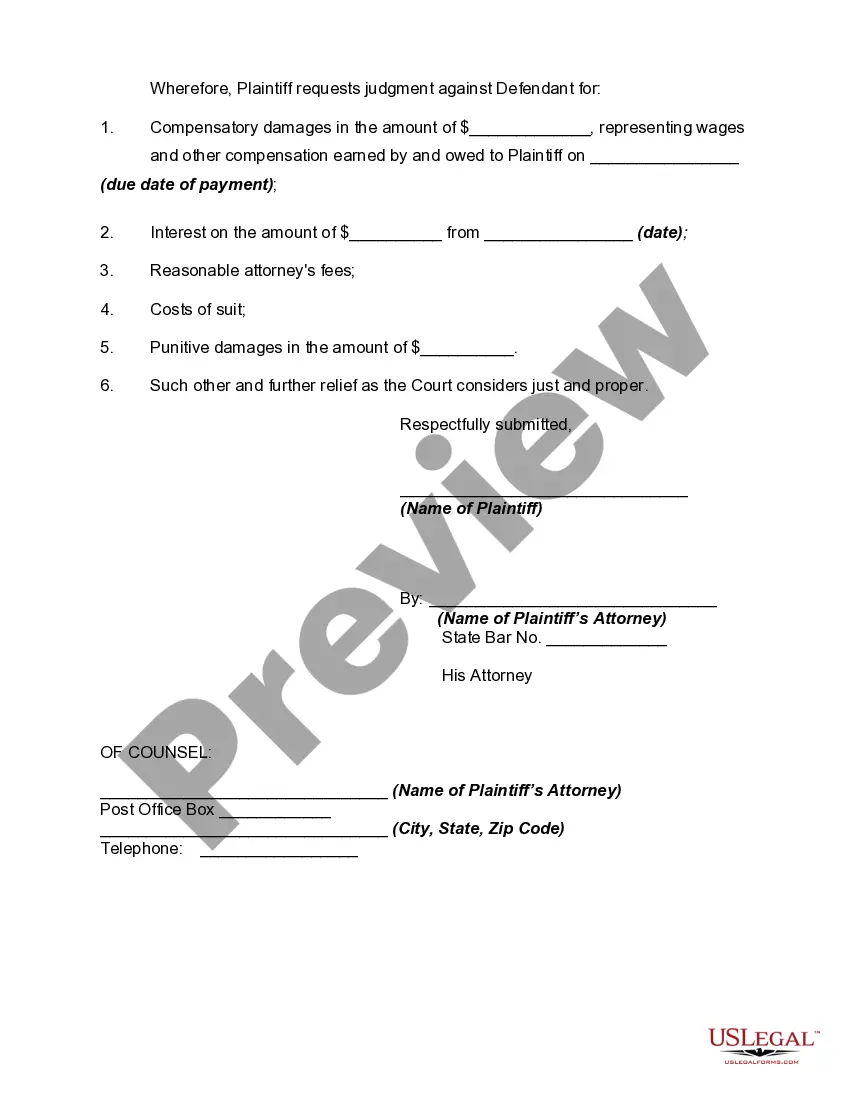

District of Columbia Complaint for Recovery of Unpaid Wages

Description

How to fill out Complaint For Recovery Of Unpaid Wages?

US Legal Forms - one of many most significant libraries of lawful types in the States - provides a wide range of lawful record themes you may acquire or produce. Using the web site, you will get a large number of types for enterprise and individual reasons, sorted by categories, says, or keywords and phrases.You will find the most recent models of types much like the District of Columbia Complaint for Recovery of Unpaid Wages within minutes.

If you have a membership, log in and acquire District of Columbia Complaint for Recovery of Unpaid Wages from the US Legal Forms local library. The Obtain switch can look on every single kind you look at. You have accessibility to all earlier acquired types inside the My Forms tab of the profile.

If you wish to use US Legal Forms for the first time, allow me to share basic recommendations to obtain started out:

- Ensure you have chosen the best kind for the metropolis/state. Click the Review switch to check the form`s content material. Look at the kind outline to actually have selected the appropriate kind.

- In case the kind doesn`t match your demands, take advantage of the Research industry on top of the screen to obtain the the one that does.

- In case you are happy with the form, affirm your choice by visiting the Purchase now switch. Then, pick the rates strategy you favor and give your references to sign up for the profile.

- Method the deal. Make use of your bank card or PayPal profile to finish the deal.

- Choose the file format and acquire the form on your system.

- Make alterations. Complete, change and produce and sign the acquired District of Columbia Complaint for Recovery of Unpaid Wages.

Each template you added to your money lacks an expiration date and is your own property for a long time. So, if you would like acquire or produce one more version, just visit the My Forms portion and click about the kind you want.

Obtain access to the District of Columbia Complaint for Recovery of Unpaid Wages with US Legal Forms, one of the most comprehensive local library of lawful record themes. Use a large number of specialist and status-certain themes that meet your organization or individual requirements and demands.

Form popularity

FAQ

Under the EPA, employers are prohibited from paying employees of one gender less than employees of the opposite gender for substantially similar work. Additionally, employers are prohibited from retaliating against employees who seek to enforce their rights under the law.

This law requires that all employers pay their employees: ? At least twice monthly ? On designated paydays, ? Pay all earned and promised wages, and ? Pay wages timely upon termination of employment.

Labor Standards/Worker Protection is managed and administered through the Labor Standards Bureau. Related Services: Employer Services. Insurance Carrier/TPA Services. Labor Standards Bureau. does@dc.gov. (202) 724-7000. 711. Monday to Friday am to 5 pm.

Effective July 1, 2023, the District's Minimum Wage and Living Wage will increase to $17.00. Employers are generally subject to both state child labor laws and the federal child labor provisions of the Fair Labor Standards Act (FLSA), 29 U.S.C. 212(c), and the FLSA regulations at 29 CFR Part 570.

D.C. has one of the most generous wage payment laws in the United States. The District of Columbia Wage Payment and Collection Law permits workers to recover 10% of their unpaid wages for each day the wages are late ? up to 4 times the amount of wages that are owed, plus attorney's fees and costs.

Wage Payment and Collection The DC Wage Payment and Wage Collection Law [PDF] requires that all employers pay their employees at least twice monthly on designated paydays, pay all earned and promised wages and pay wages timely upon the termination of employment.

Unless you regularly work a shift that is less than four hours long, your employer must pay you for at least four hours of work for each day you report to work. See DCMR 7-907. If you report to work but are sent home, your employer must pay you for four hours of work at the regular minimum wage.

Final Payments Generally, under D.C. Code § 32-1303, an employer must issue a final paycheck to a terminated employee no later than the next business day. However, an employee who quits their job is not entitled to a final paycheck until the next regularly scheduled pay date or within seven days, whichever is earlier.