Many different types of contracts provide for automatic extension unless timely notice is given that a party declines such an extension. This is a generic form declining such an extension.

District of Columbia Notice of Decline of Extension of Agreement

Description

How to fill out Notice Of Decline Of Extension Of Agreement?

Have you ever found yourself in a situation where you constantly require documents for various enterprise or specific applications almost daily? There are numerous legal document templates accessible online, yet finding trustworthy ones can be challenging.

US Legal Forms offers a vast array of form templates, including the District of Columbia Notice of Decline of Extension of Agreement, designed to meet federal and state regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the District of Columbia Notice of Decline of Extension of Agreement template.

Select a convenient file format and download your version.

You can find all the document templates you have purchased in the My documents section. You can download an additional copy of the District of Columbia Notice of Decline of Extension of Agreement at any time if needed. Simply click on the desired form to download or print the document template. Use US Legal Forms, the most extensive collection of legal documents, to save time and prevent mistakes. The service provides professionally crafted legal document templates suitable for various applications. Create an account on US Legal Forms and start simplifying your life.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Search for the form you need and ensure it corresponds to the correct city or county.

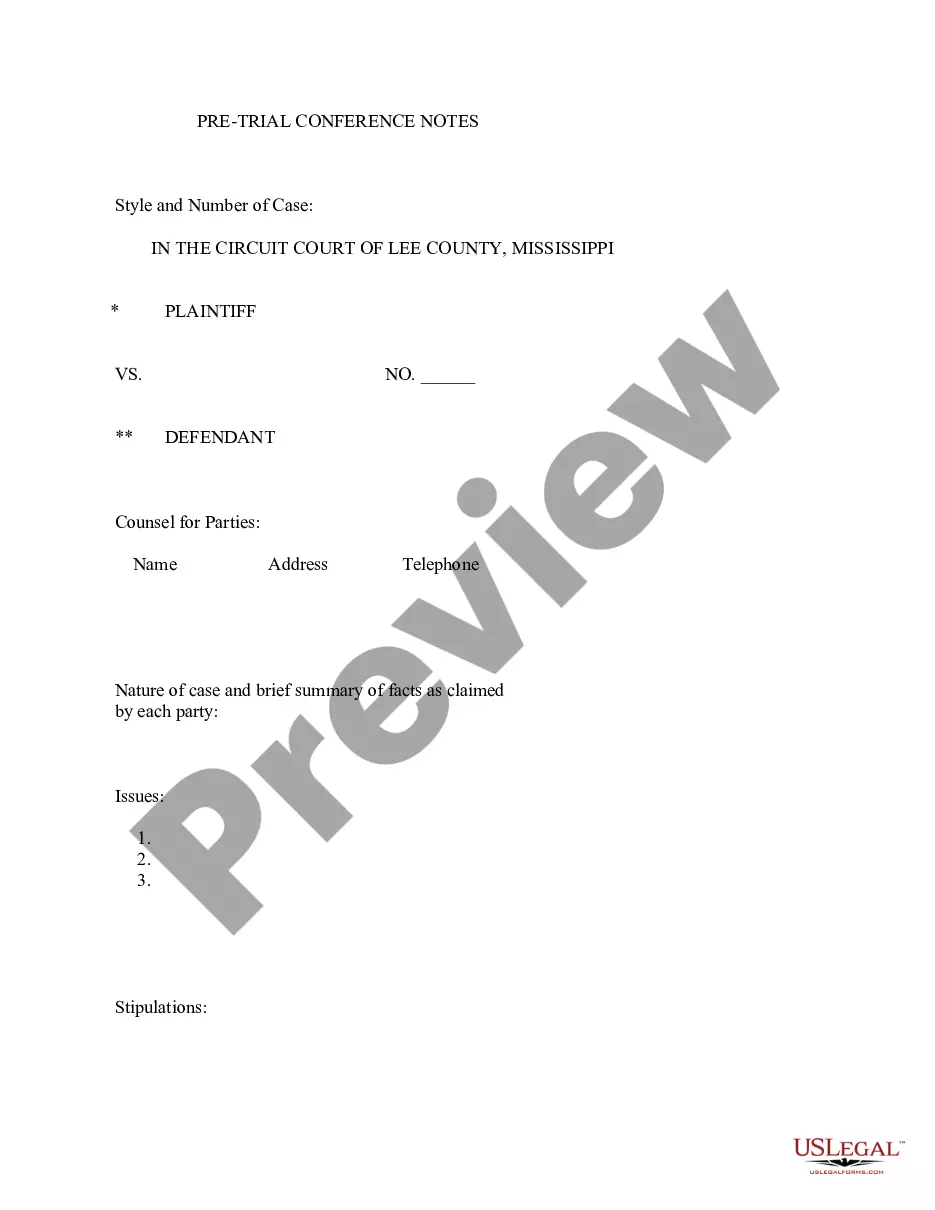

- Use the Review button to examine the form closely.

- Check the description to confirm you have selected the appropriate form.

- If the form does not meet your requirements, utilize the Research field to find a form that suits your needs and specifications.

- Once you locate the correct form, click Purchase now.

- Choose your preferred pricing plan, fill out the necessary information to create your account, and complete your order using PayPal or credit card.

Form popularity

FAQ

To close your DC sales tax account, you should submit a formal request to the Office of Tax and Revenue. Be sure to settle any outstanding taxes and keep accurate records of your sales. Utilizing the uslegalforms platform can help you generate the required forms and ensure your documentation aligns with the District of Columbia Notice of Decline of Extension of Agreement standards.

In the District of Columbia, the auto renewal law requires businesses to inform customers about auto-renewal terms clearly and conspicuously before the renewal. Customers must also be made aware of their right to cancel. If you're dealing with agreements that may lead to situations covered by a District of Columbia Notice of Decline of Extension of Agreement, it's crucial to understand these terms to avoid unexpected extensions.

Closing your DC account involves notifying the Office of Tax and Revenue. You can submit a Request for Closure form, ensuring that all tax obligations are satisfied beforehand. If you need guidance through this process, consider using the resources on the uslegalforms platform. They can help you prepare any necessary documents related to your District of Columbia Notice of Decline of Extension of Agreement.

To inquire about withholding tax in the District of Columbia, you can contact the Office of Tax and Revenue at 202-727-4829. This line provides assistance for various tax-related issues, including questions about your District of Columbia Notice of Decline of Extension of Agreement. It's advisable to have your tax information handy to facilitate the conversation and ensure you receive the information you need.

Yes, you can file a DC tax extension online through the Office of Tax and Revenue. The online portal provides a straightforward process for submitting your extension request. It is essential to consider how the District of Columbia Notice of Decline of Extension of Agreement might affect your situation before proceeding.

To file DC sales tax online, access the Office of Tax and Revenue’s e-services portal. You will need to provide relevant sales data and confirm your calculations. Always keep in mind the guidelines associated with the District of Columbia Notice of Decline of Extension of Agreement to avoid unexpected issues.

Filing a DC personal property tax return online is simple through the Office of Tax and Revenue’s website. You will need to create an account if you don't have one already. Throughout this process, be mindful of the requirements outlined in the District of Columbia Notice of Decline of Extension of Agreement.

To close a DC withholding account, you need to submit the appropriate request form to the Office of Tax and Revenue. It is important to ensure that all outstanding liabilities are settled before closing your account. Proper adherence to the guidelines related to the District of Columbia Notice of Decline of Extension of Agreement can facilitate a smoother closing process.

Yes, you can electronically file a DC tax return using the Office of Tax and Revenue’s online portal. This method is efficient and allows for faster processing of your return. As you prepare to file, ensure you are aware of the implications of the District of Columbia Notice of Decline of Extension of Agreement.

To file DC FP 31 online, visit the Office of Tax and Revenue's website. You'll find the necessary forms and instructions to complete your filing electronically. Remember to review the process associated with the District of Columbia Notice of Decline of Extension of Agreement to avoid any penalties.