District of Columbia Consumer Credit Application

Description

How to fill out Consumer Credit Application?

Are you presently in the situation where you need to have papers for both company or individual uses nearly every day? There are a lot of authorized document layouts available on the net, but locating types you can trust isn`t straightforward. US Legal Forms provides 1000s of kind layouts, just like the District of Columbia Consumer Credit Application, that are published in order to meet state and federal needs.

In case you are already acquainted with US Legal Forms internet site and get a free account, basically log in. Afterward, you can down load the District of Columbia Consumer Credit Application format.

If you do not offer an accounts and want to begin using US Legal Forms, follow these steps:

- Find the kind you require and ensure it is for your right town/area.

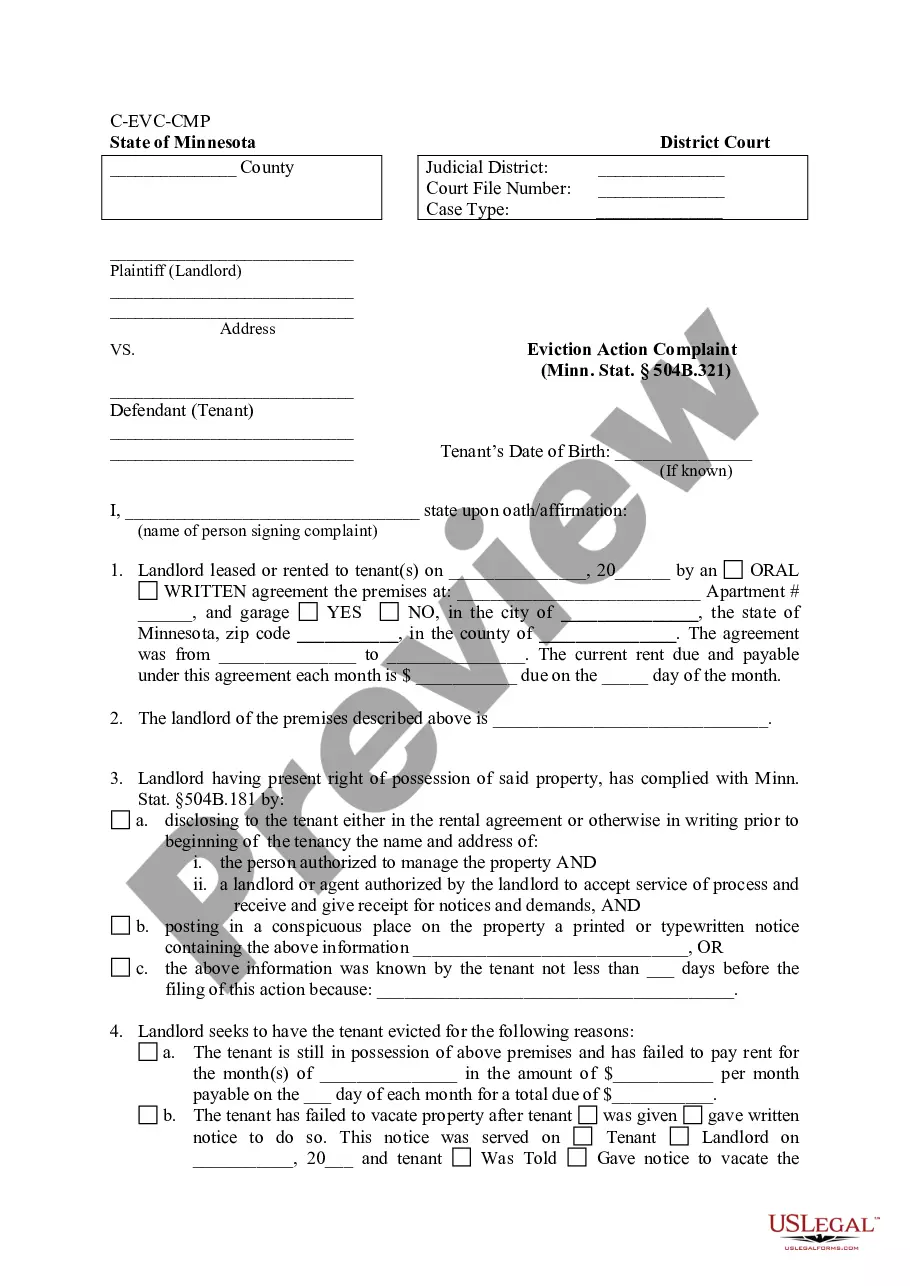

- Utilize the Preview switch to examine the form.

- Look at the outline to actually have chosen the right kind.

- In case the kind isn`t what you are trying to find, make use of the Research industry to find the kind that suits you and needs.

- When you find the right kind, just click Buy now.

- Choose the pricing program you desire, fill out the necessary details to create your bank account, and pay money for an order using your PayPal or bank card.

- Choose a practical file formatting and down load your duplicate.

Get all the document layouts you may have bought in the My Forms food selection. You can aquire a further duplicate of District of Columbia Consumer Credit Application anytime, if required. Just click on the needed kind to down load or printing the document format.

Use US Legal Forms, one of the most extensive selection of authorized kinds, to conserve some time and prevent blunders. The service provides appropriately produced authorized document layouts which can be used for an array of uses. Create a free account on US Legal Forms and start producing your daily life easier.

Form popularity

FAQ

There are three big nationwide providers of consumer reports: Equifax, TransUnion, and Experian. Their reports contain information about your payment history, how much credit you have and use, and other inquiries and information.

A. Any individual action pursuant to § 59.1-204 for which the right to bring such action first accrues on or after July 1, 1995, shall be commenced within two years after such accrual.

How to get a copy of your credit report Online by visiting AnnualCreditReport.com. By calling 1-877-322-8228 (TTY: 1-800-821-7232) By filling out the Annual Credit Report request form and mailing it to: Annual Credit Report Request Service. PO Box 105281. Atlanta, GA 30348-5281.

The CPPA also provides for a private right of action: a consumer who is harmed by an unlawful trade practice may sue for treble damages (or $1500 per violation, if greater), punitive damages, and attorney's fees, as well as an injunction against the unlawful trade practice.

It means a lender wants to check your credit file to assess whether they can responsibly lend to you.

The Act proscribes a variety of misrepresentations by suppliers to consumers. A violation of the Act subjects the supplier to liability for actual damages for his misrepresentation or a fine of $500, whichever is greater. A willful violation of the Act may subject the supplier to treble damages and attorney's fees.

Prohibited Acts Under the DC Consumer Protection Procedures Act. The CPPA enumerates specific ?unlawful trade practices? that are violations of the statute. Most of the unlawful trade practices identified relate to fraud or misrepresentation.

Washington, D.C. Deceptive Trade Practice Laws at a Glance These include false advertising, bait-and-switch tactics, selling used or damaged goods as new, and other schemes. Contact Washington, D.C.'s Office of the Attorney General if you would like to file a formal consumer complaint.