Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

District of Columbia Demand for Accounting from a Fiduciary

Description

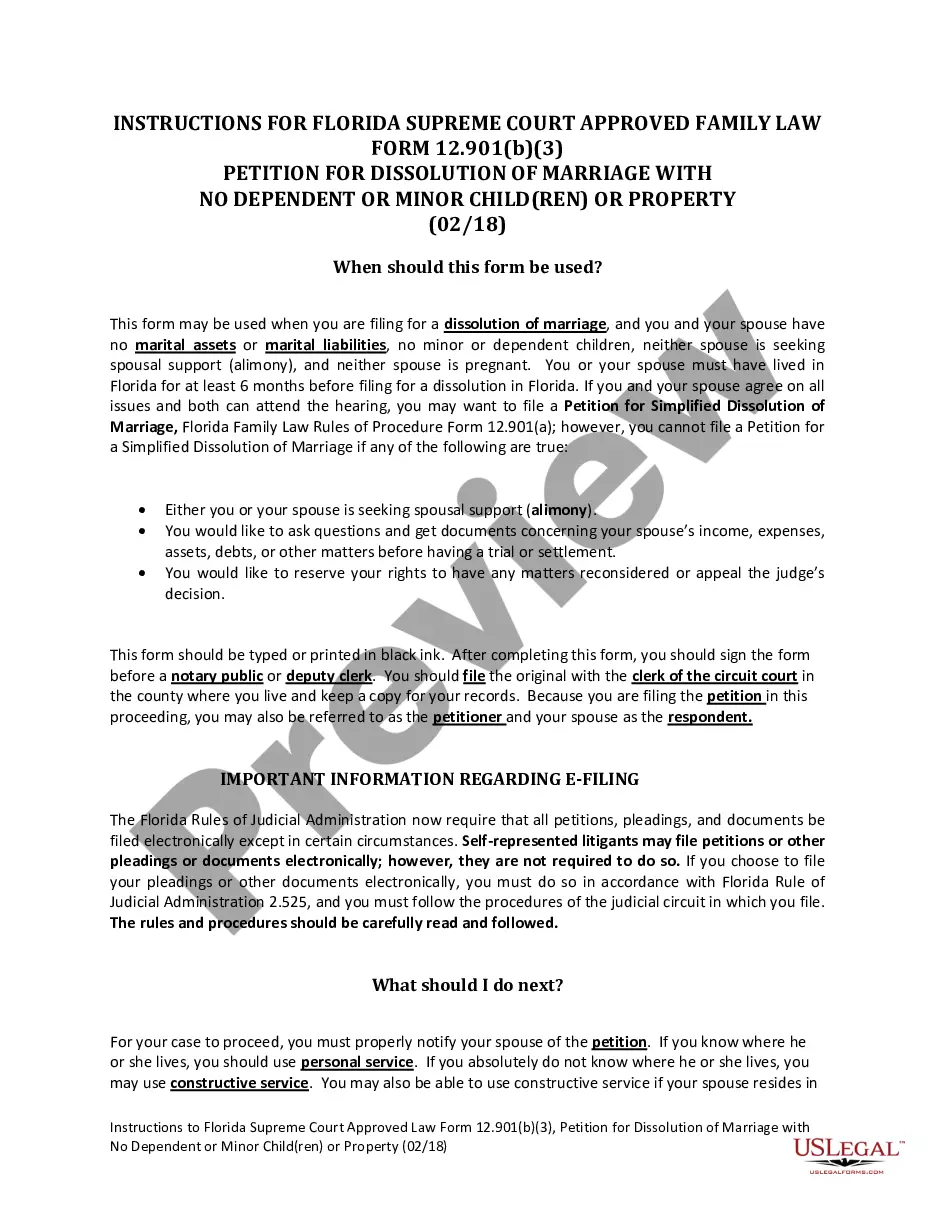

How to fill out Demand For Accounting From A Fiduciary?

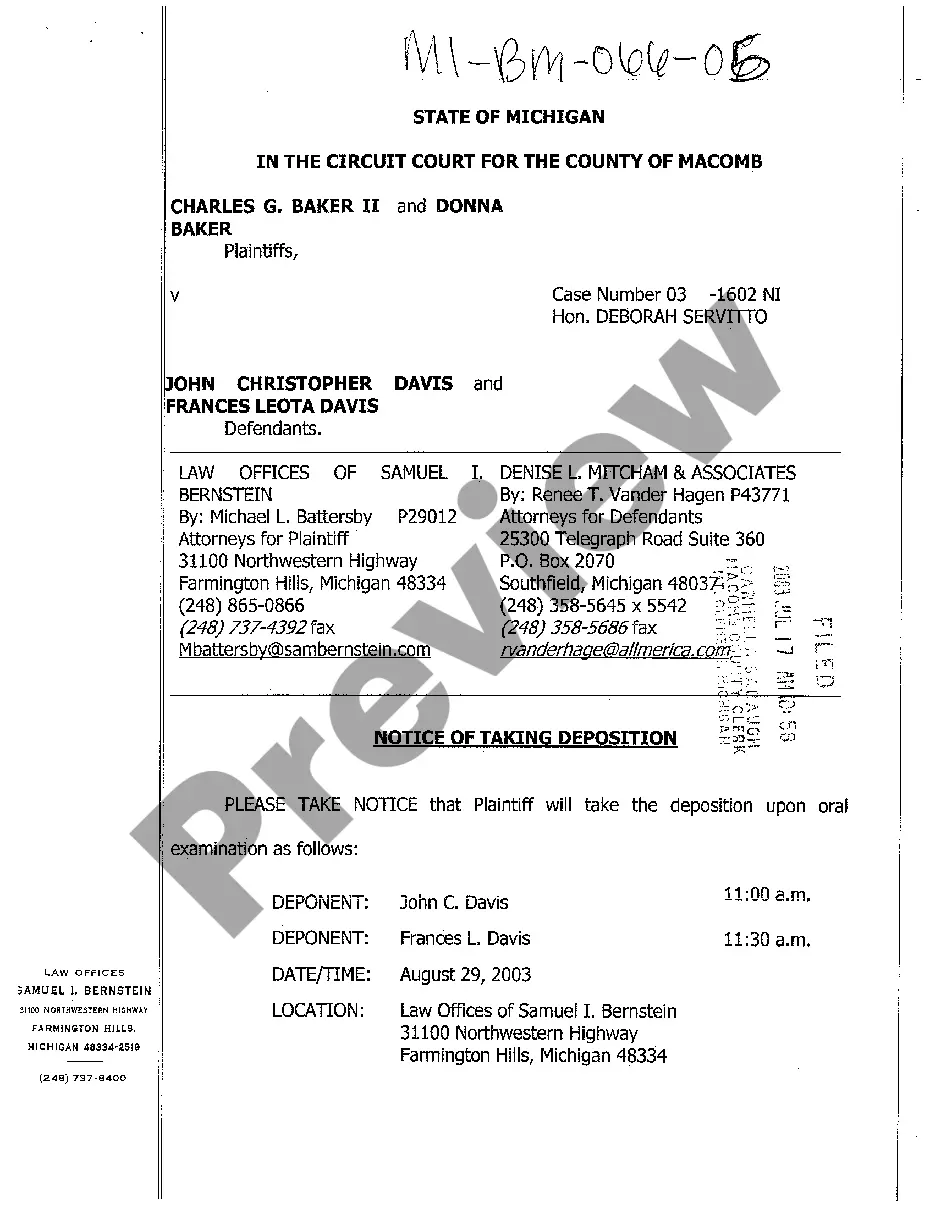

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides a range of legal form templates that you can purchase or print.

By utilizing the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can quickly find the latest versions of forms like the District of Columbia Demand for Accounting from a Fiduciary.

If you have a monthly subscription, Log In to obtain the District of Columbia Demand for Accounting from a Fiduciary in the US Legal Forms repository. The Download button will appear on each form you view. You have access to all previously acquired forms in the My documents section of your account.

Each form you add to your account has no expiration date and remains your property indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

Gain access to the District of Columbia Demand for Accounting from a Fiduciary through US Legal Forms, the largest collection of legal document templates. Utilize a plethora of professional and state-specific templates that cater to your business or personal needs and requirements.

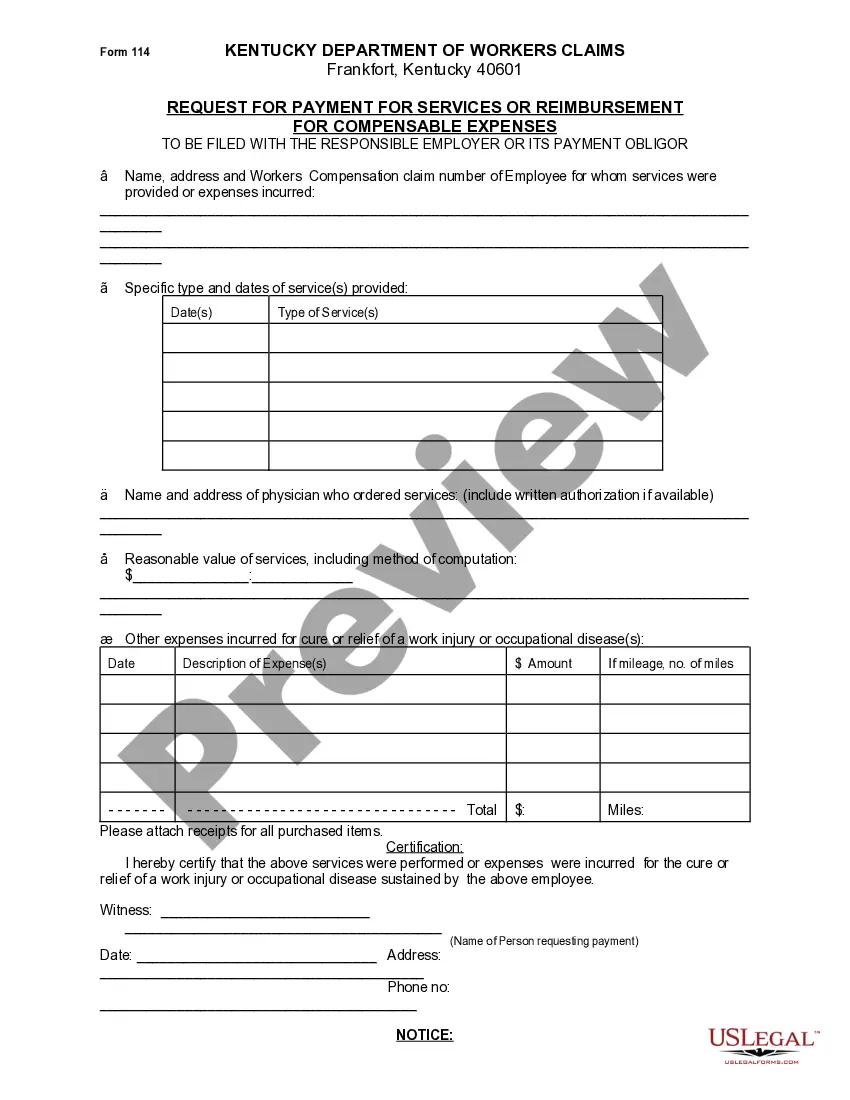

- Ensure you have selected the correct form for your location/region. Click the Preview button to review the form's details. Check the form summary to confirm you have selected the right document.

- If the form does not meet your requirements, use the Search box at the top of the page to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select the pricing plan you prefer and provide your details to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

- Choose the format and download the form to your device.

- Make modifications. Complete, edit, print, and sign the acquired District of Columbia Demand for Accounting from a Fiduciary.

Form popularity

FAQ

The best bank to open an estate account often depends on your personal needs and the specific services they offer. Look for institutions that provide clear guidelines and support related to the District of Columbia Demand for Accounting from a Fiduciary. It's advisable to compare fees, online banking features, and customer service reputation before making a decision.

A breach of fiduciary duty in DC occurs when a fiduciary fails to act in the best interest of the estate or beneficiaries. This may include mismanagement of funds, failure to provide accounting, or conflicts of interest. Understanding your rights in such circumstances is crucial, especially regarding the District of Columbia Demand for Accounting from a Fiduciary, as it protects beneficiaries and ensures transparency.

Opening an estate account requires specific documents. Generally, you need the death certificate, the will, and documentation proving your role as the executor or fiduciary. It's essential to check with your chosen bank about any additional forms they may require, especially in relation to the District of Columbia Demand for Accounting from a Fiduciary.

To open a deceased estate bank account, you must first gather necessary documents, including the death certificate and the will. Next, choose a bank or credit union that offers estate accounts, ensuring they understand the District of Columbia Demand for Accounting from a Fiduciary. Once you have selected a bank, schedule an appointment, and bring the documents mentioned to facilitate the process.

A personal representative of the estate in Washington, DC, is tasked with overseeing the administration of the deceased's estate and fulfilling legal obligations related to the estate. This includes filing necessary documents with the court and ensuring compliance with fiduciary duties. If you are managing a District of Columbia Demand for Accounting from a Fiduciary, leveraging platforms like US Legal Forms can simplify this process by providing essential documents and guidance.

Yes, in many cases, a personal representative can also be a beneficiary of the estate. This scenario is common, but it comes with complexities, especially in areas related to the District of Columbia Demand for Accounting from a Fiduciary. If you find yourself in such a situation, it may be wise to consult legal guidance to avoid conflicts of interest during the accounting process.

A personal representative possesses the authority to manage and distribute the assets of an estate according to the terms set forth in the decedent's will or by the laws of intestacy in the District of Columbia. This includes handling debts, collecting assets, and performing any necessary actions to settle the estate. If you are facing issues related to the District of Columbia Demand for Accounting from a Fiduciary, it is essential to understand these powers thoroughly.

In the context of a District of Columbia Demand for Accounting from a Fiduciary, the terms 'executor' and 'personal representative' often cause confusion. An executor is a specific type of personal representative named in a will, while a personal representative can also be appointed by the court when there is no will. Both roles aim to settle the deceased's estate, but their authority may vary based on the specific jurisdiction and circumstances.

To fill out a US tax form, start by gathering all necessary financial information, such as income statements, deduction records, and applicable tax credits. Carefully follow the instructions provided with the form, ensuring each section is completed accurately. If you encounter specific challenges related to the District of Columbia Demand for Accounting from a Fiduciary, resources on uslegalforms can help simplify your tax-related tasks.

When filling out the city and state for Washington DC, simply write 'Washington' for the city and 'D.C.' for the state. It is important to ensure that this information is accurate to prevent any delays in processing your documents or forms. If you're still unsure about how the District of Columbia Demand for Accounting from a Fiduciary influences this process, uslegalforms provides clarity on completing legal documents effectively.