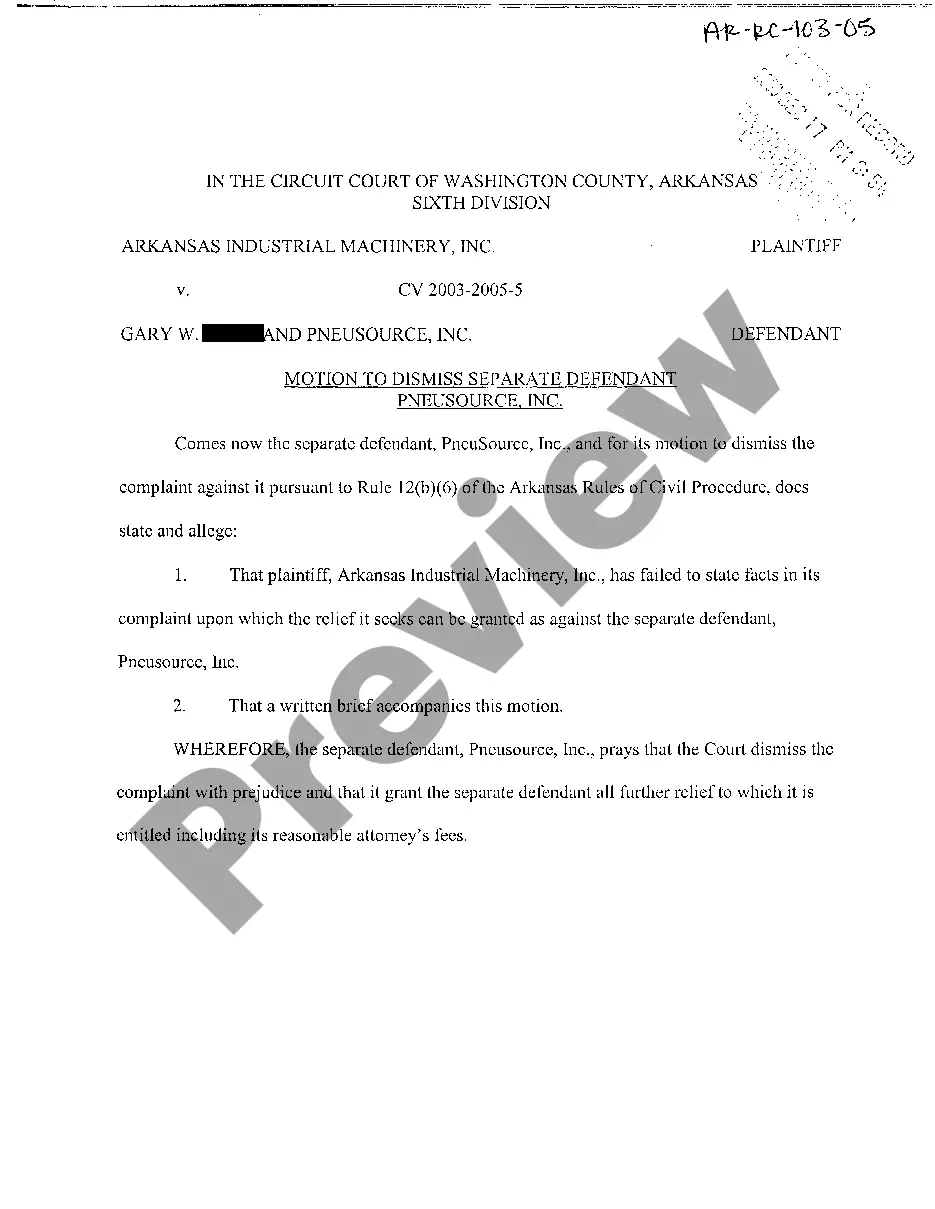

This is the accounting form used in an accounting of a law firm on the complaint of a former partner. It includes assets, liabilities, total liabilities, net assets, and a computation of the former partner's share.

District of Columbia Form of Accounting Index

Description

How to fill out Form Of Accounting Index?

Selecting the optimal legal document format could be a challenge. Naturally, there are numerous templates accessible online, but how can you acquire the legal version you require? Utilize the US Legal Forms platform.

This service offers a plethora of templates, including the District of Columbia Form of Accounting Index, suitable for both business and personal needs. All documents are verified by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to access the District of Columbia Form of Accounting Index. Use your account to review the legal documents you have previously purchased. Navigate to the My documents section of your account to obtain another copy of the document you require.

In conclusion, revise, print, and sign the acquired District of Columbia Form of Accounting Index. US Legal Forms is the largest collection of legal forms available, where you can find numerous document templates. Utilize this service to download professionally crafted documents that comply with state regulations.

- If you are a new user of US Legal Forms, here are straightforward steps for you to follow.

- First, ensure you have selected the correct form for your specific region/state. You can preview the form using the Preview button and read the form description to confirm it is the right one for you.

- If the form doesn't meet your needs, utilize the Search field to find the appropriate form.

- Once you are certain that the form is suitable, click the Purchase now button to acquire the form.

- Select the pricing plan you prefer and fill in the required information. Create your account and place an order using your PayPal account or credit card.

- Choose the document format and download the legal document format to your device.

Form popularity

FAQ

In finance, DC typically refers to direct current; however, in a legal and taxation context, it can denote the District of Columbia, where specific financial regulations apply. In this context, understanding financial regulations, including the District of Columbia Form of Accounting Index, is vital for compliance. Resources like uslegalforms can guide you through various financial forms and ensure you remain informed in your financial dealings.

The DC out of state tax form is designed for individuals and businesses that earn income from sources outside of the District of Columbia while maintaining residency in the area. This form helps taxpayers report their non-DC income and claim any necessary credits or deductions. Using tools like the District of Columbia Form of Accounting Index can simplify this process, ensuring that you meet all tax obligations efficiently.

DC residency for tax purposes refers to an individual's status as a resident of the District of Columbia. Residents are subject to DC income tax on all income earned, regardless of where it comes from. Understanding your residency status is crucial, especially when referencing the District of Columbia Form of Accounting Index, which provides guidelines for reporting income accurately.

Yes, you can file the DC D-30 form electronically, which provides a convenient option for businesses. E-filing simplifies the process, allowing you to submit your forms securely and receive confirmation quicker. Moreover, using the District of Columbia Form of Accounting Index facilitates smoother navigation through the electronic filing process. Embracing e-filing can save you time and streamline your compliance efforts.

Yes, if you have income from a business operating in the District of Columbia, you must file a DC tax return. This includes personal income derived from your business, as well as corporate income. The District of Columbia Form of Accounting Index helps you identify the appropriate forms and methods to efficiently complete your tax return. Proper filing ensures that you meet the legal obligations and stay clear of unnecessary fines.

Yes, the District of Columbia requires most businesses to file an annual report. The annual report is important for maintaining active status with the District's regulatory bodies. Typically, businesses need to submit this report along with their DC D-30 filing. The District of Columbia Form of Accounting Index provides useful guidance on how to properly complete your annual report.

If you operate a business in the District of Columbia and earn income, you may need to file the DC D-30 form. This form is required for corporations, including those that are formed in DC or outside of DC but are conducting business within the district. Using the District of Columbia Form of Accounting Index can help you determine if your business meets the filing requirements. It's important to ensure compliance to avoid penalties.

In business contexts, DC often stands for Distribution Center. These facilities play a critical role in the logistics and supply chain processes of many organizations. Understanding the frameworks within which the District of Columbia Form of Accounting Index operates can significantly benefit businesses in optimizing their distribution strategies.

Washington, D.C. is an excellent location for accountants due to its diverse economy and numerous governmental and private sector organizations. The city offers various opportunities for accountants to grow their careers, thanks to ongoing demand in financial services. Moreover, resources like the District of Columbia Form of Accounting Index can further enhance your understanding of compliance requirements in this vibrant market.

In accounting, DC stands for Debit Credit. This term is fundamental as it outlines how financial transactions are recorded. The District of Columbia Form of Accounting Index employs this concept to help ensure accurate financial reporting and compliance for businesses operating in the area.