An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

District of Columbia Petition to Require Accounting from Testamentary Trustee

Description

How to fill out Petition To Require Accounting From Testamentary Trustee?

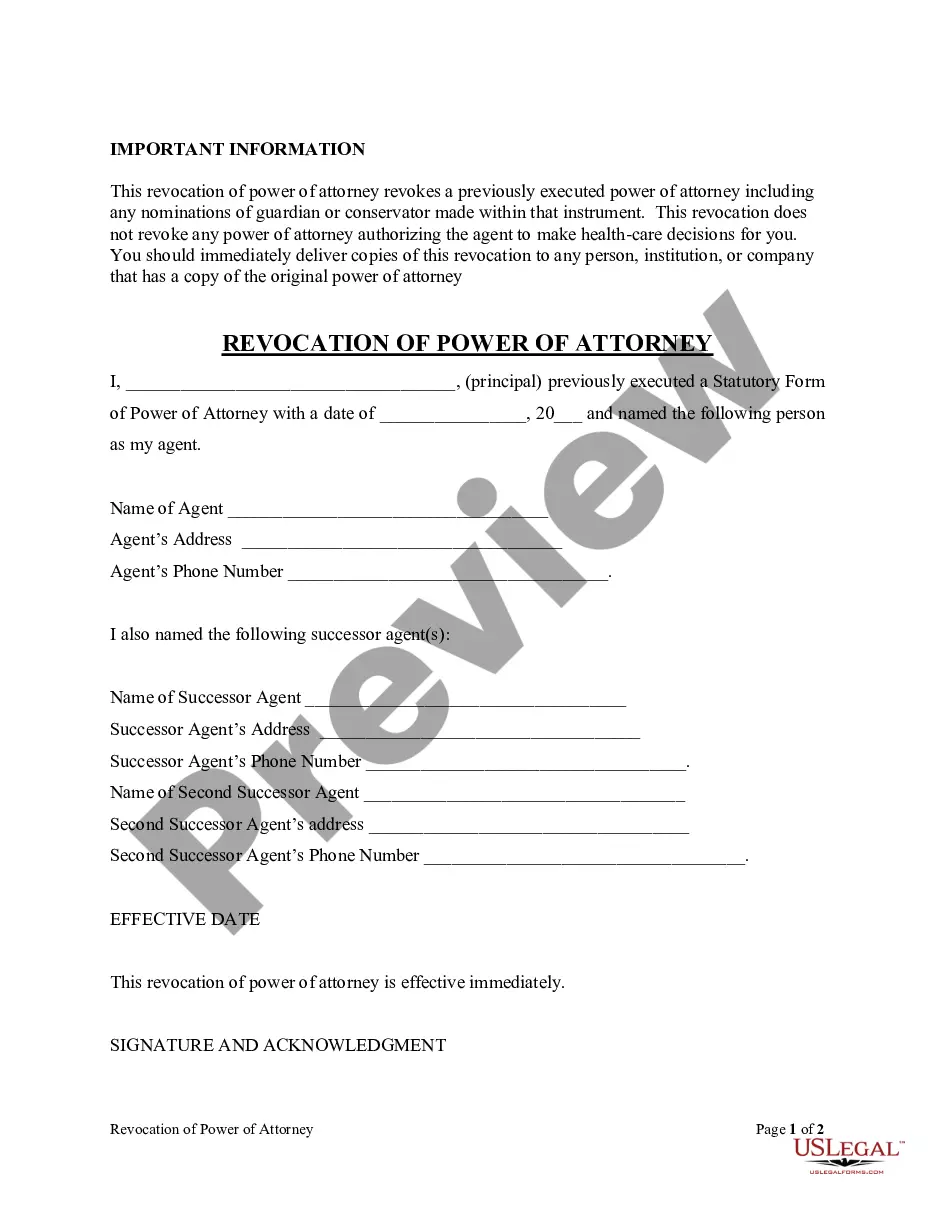

It is possible to devote hrs on the Internet attempting to find the authorized papers template that fits the state and federal demands you will need. US Legal Forms provides 1000s of authorized kinds which can be evaluated by professionals. It is possible to down load or print out the District of Columbia Petition to Require Accounting from Testamentary Trustee from your services.

If you already possess a US Legal Forms account, you are able to log in and click on the Obtain button. After that, you are able to total, revise, print out, or indication the District of Columbia Petition to Require Accounting from Testamentary Trustee. Each and every authorized papers template you purchase is your own property for a long time. To have yet another duplicate of the purchased form, go to the My Forms tab and click on the related button.

If you work with the US Legal Forms website the very first time, keep to the simple directions below:

- Initially, make certain you have chosen the correct papers template for your region/city of your choice. Browse the form information to ensure you have picked out the right form. If readily available, make use of the Preview button to appear with the papers template too.

- If you want to find yet another version of the form, make use of the Research area to obtain the template that fits your needs and demands.

- Once you have found the template you desire, click Purchase now to continue.

- Pick the prices program you desire, type in your accreditations, and register for an account on US Legal Forms.

- Comprehensive the financial transaction. You may use your bank card or PayPal account to pay for the authorized form.

- Pick the structure of the papers and down load it to your gadget.

- Make modifications to your papers if possible. It is possible to total, revise and indication and print out District of Columbia Petition to Require Accounting from Testamentary Trustee.

Obtain and print out 1000s of papers layouts using the US Legal Forms website, that offers the greatest selection of authorized kinds. Use professional and condition-specific layouts to handle your organization or personal requires.

Form popularity

FAQ

Under the law in the District of Columbia, the will must be in writing, signed by the testator, and attested and signed by at least 2 credible witnesses in the presence of the testator.

Is Probate Required in Washington, DC? Probate is required in many cases in the District of Columbia. If the property value is under $40,000, you can settle under small estate administration.

Probating an estate through the supervised or formal administration procedures in the District of Columbia generally takes about 12 to 18 months to complete.

DC law requires that all original wills must be filed with the Register of Wills Office. Regardless of whether there are assets that are passing through the probate administration, the law does require that original wills must be filed.

You can avoid going to DC probate court by creating a living trust and making a trust document that transfers property ownership to yourself as a trustee. Upon your death, your successor trustee gains control of the transfer and can avoid probate.

Avoid probate with a trust With a living trust, the creator of such trust no longer ?owns? the assets in it, but a trustee does and therefore, at the moment of death this partial or full estate does not apply for probate, since ownership is no longer with the decedent.

Letters of administration are evidence that the Court has appointed a personal representative. They are needed to support the authority of the personal representative to collect the decedent's assets and transact any business on behalf of the estate.

Probate is a legal process that takes place after someone's death. It usually involves proving that the deceased's will is valid, identifying the deceased person's property and having it appraised, paying outstanding debts and taxes, and distributing the property per the will or state law.