District of Columbia Demand for Payment of an Open Account by Creditor

Description

How to fill out Demand For Payment Of An Open Account By Creditor?

Have you been in a place that you require paperwork for sometimes business or specific functions almost every time? There are a variety of legal papers templates available online, but locating versions you can depend on isn`t effortless. US Legal Forms provides a huge number of develop templates, much like the District of Columbia Demand for Payment of an Open Account by Creditor, which are composed in order to meet state and federal specifications.

Should you be presently familiar with US Legal Forms web site and get your account, simply log in. After that, it is possible to acquire the District of Columbia Demand for Payment of an Open Account by Creditor design.

Should you not have an account and would like to begin using US Legal Forms, adopt these measures:

- Find the develop you want and make sure it is for the right area/region.

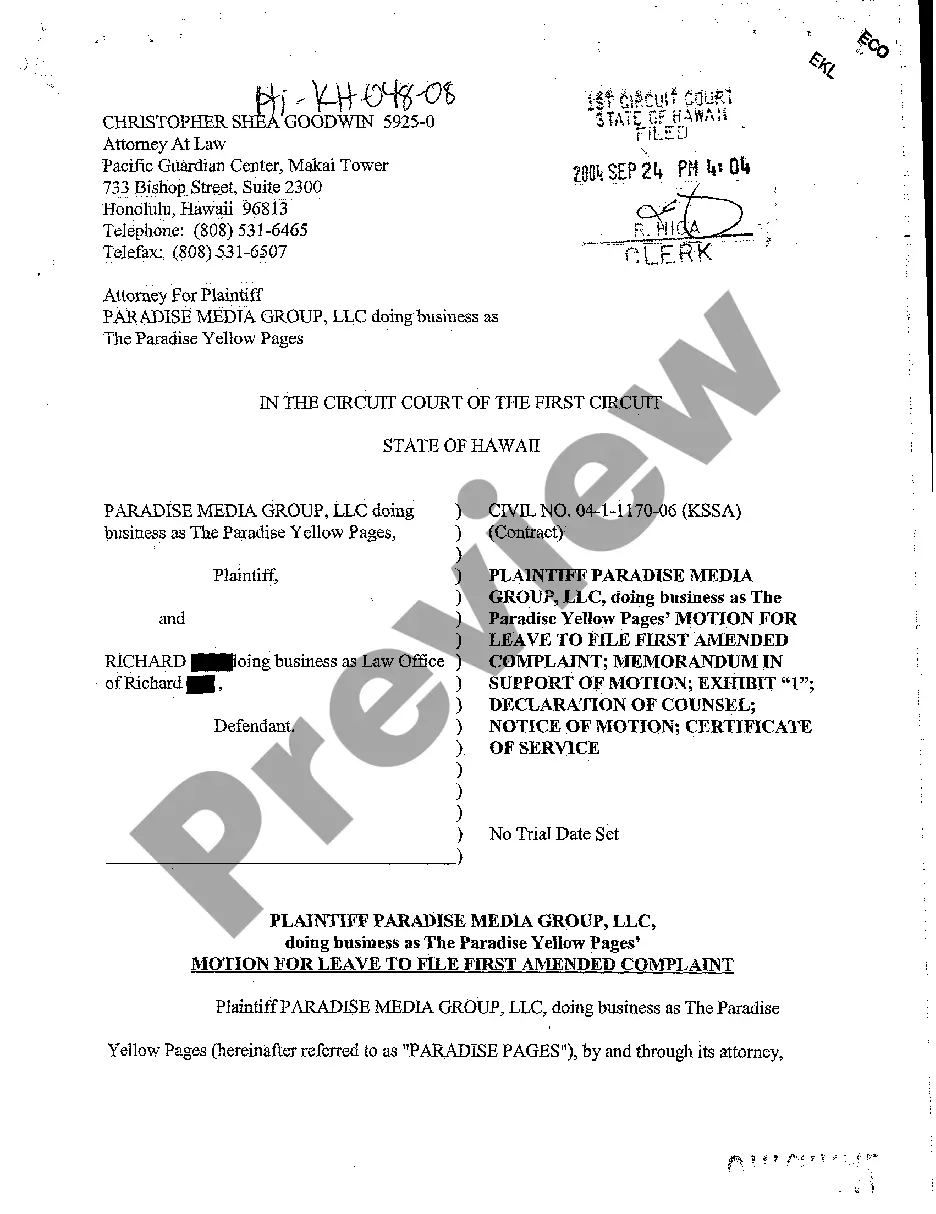

- Utilize the Review key to check the shape.

- Browse the explanation to ensure that you have selected the correct develop.

- In the event the develop isn`t what you`re seeking, make use of the Lookup discipline to find the develop that meets your requirements and specifications.

- When you get the right develop, click Get now.

- Pick the pricing program you would like, fill in the desired information to make your account, and pay money for your order making use of your PayPal or bank card.

- Decide on a convenient document file format and acquire your copy.

Find all of the papers templates you have bought in the My Forms food selection. You can get a extra copy of District of Columbia Demand for Payment of an Open Account by Creditor at any time, if possible. Just select the required develop to acquire or produce the papers design.

Use US Legal Forms, the most substantial collection of legal types, in order to save some time and stay away from faults. The services provides professionally manufactured legal papers templates that you can use for a selection of functions. Produce your account on US Legal Forms and begin creating your daily life a little easier.

Form popularity

FAQ

Here, then, are ten of the best-kept collection secrets. The More You Pay, the More They Earn. ... Payment Deadlines Are Phony. ... They Don't Need a 'Financial Statement' ... The Threats Are Inflated. ... You Can Stop Their Calls. ... They Can Find Out How Much You Have in the Bank. ... If You're Out of State, They're Out of Luck.

Statute of Limitations The Statute of limitations in the District of Columbia for open accounts and writings, such as contracts and promissory notes, is three (3) years from the date of breach. Generally, a renewed promise that can be proved to pay an old debt renews the limitations period.

Debt collection. (a)(1) This section applies to conduct and practices in connection with the collection of obligations arising from any consumer debt (other than a loan directly secured on real estate or a direct motor vehicle installment loan covered by Chapter 36 of this title).

Don't provide personal or sensitive financial information Never give out or confirm personal or sensitive financial information ? such as your bank account, credit card, or full Social Security number ? unless you know the company or person you are talking with is a real debt collector.

Using text messages in debt collection The ruling was effective starting November 2021 and confirmed that debt collectors could use emails, text messages and other digital communication channels. Businesses in many other industries have been communicating with customers by text for years.

Among other things, the bill: (i) prohibits deceptive behavior from debt collectors, such as making threats; (ii) clarifies that no one can be jailed for failing to pay a debt; (iii) prohibits debt collectors from communicating any information regarding a person's debt to employers or family members; and (vi) clarifies ...