District of Columbia Sample Letter for Copies of Exemptions

Description

How to fill out Sample Letter For Copies Of Exemptions?

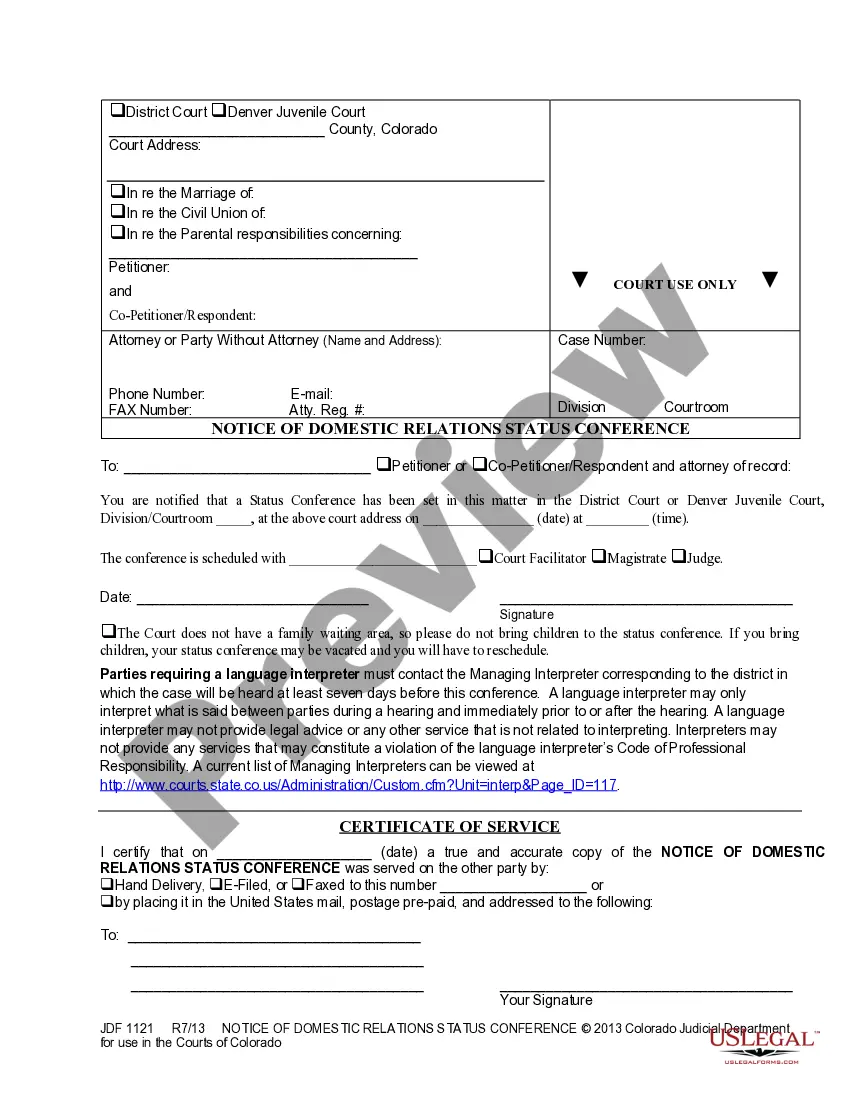

Choosing the right legal papers web template can be a struggle. Obviously, there are tons of themes available on the Internet, but how will you get the legal kind you will need? Use the US Legal Forms site. The service delivers a large number of themes, such as the District of Columbia Sample Letter for Copies of Exemptions, that you can use for organization and personal requires. Every one of the forms are checked out by professionals and meet up with federal and state demands.

Should you be presently signed up, log in to your account and click on the Download switch to obtain the District of Columbia Sample Letter for Copies of Exemptions. Use your account to look with the legal forms you might have purchased formerly. Proceed to the My Forms tab of the account and get yet another copy in the papers you will need.

Should you be a brand new user of US Legal Forms, listed below are basic recommendations for you to stick to:

- Initial, be sure you have selected the correct kind to your area/region. You are able to check out the shape utilizing the Review switch and study the shape explanation to make certain this is basically the best for you.

- If the kind does not meet up with your needs, take advantage of the Seach field to obtain the proper kind.

- When you are certain the shape is suitable, go through the Acquire now switch to obtain the kind.

- Choose the rates plan you desire and type in the necessary information and facts. Make your account and pay for your order with your PayPal account or charge card.

- Select the submit formatting and obtain the legal papers web template to your system.

- Comprehensive, edit and print out and sign the obtained District of Columbia Sample Letter for Copies of Exemptions.

US Legal Forms is the greatest catalogue of legal forms in which you will find numerous papers themes. Use the company to obtain skillfully-produced paperwork that stick to state demands.

Form popularity

FAQ

If you have an out-of-state resale certificate but try to buy an item tax-free in Washington DC, your DC vendor will be unable to accept your out-of-state resale certificate. To receive a sales tax exemption on an item in DC, you must register for a sales tax permit there.

To apply for recognition of exemption from District of Columbia taxation, please visit MyTax.DC.gov. For questions, please contact OTR's Customer Service Administration at (202) 727-4TAX (4829).

An official document that gives someone special permission not to do or pay something: a medical/tax exemption certificate.

An exemption reduces the amount of income that is subject to income tax. There are a variety of exemptions allowed by the Internal Revenue Service (IRS). Previously, the two most common types were personal and dependent exemptions.

LETTER OF EXEMPTION. This Letter of Exemption certifies that federal credit unions are exempt from all taxes imposed by the United States or by any state, territorial, or local taxing authority, except for local real or personal property tax.

Each exemption reduces the income subject to tax. The amount by which the income subject to tax is reduced for the taxpayer, spouse, and each dependent.

An exemption certificate is the form presented by an exempt organization or individual to the seller when making a tax-exempt purchase. Exemptions are based on the customer making the purchase and always require documentation. Different purchasers may be granted exemptions under a state's statutes.

Organizations applying for exemption from D.C. real property tax must own the real property for which the request is made and qualify under D.C. Official Code § 47-1002. The applicant must specify the subsection of § 47-1002, detailing the major categories of exempt property, pursuant to which the exemption is sought.