This form is a general form of a bill of sale for personal property (i.e. goods). It should not be used to convey title to real property or title to a motor vehicle.

District of Columbia General Form for Bill of Sale of Personal Property from One Individual to another Individual

Description

How to fill out General Form For Bill Of Sale Of Personal Property From One Individual To Another Individual?

Are you in a situation where you need documents for either business or personal purposes on a daily basis.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms provides thousands of form templates, such as the District of Columbia General Form for Bill of Sale of Personal Property from One Person to Another Person, which are crafted to comply with federal and state regulations.

Access all the document templates you have purchased in the My documents section. You can retrieve an additional copy of the District of Columbia General Form for Bill of Sale of Personal Property from One Person to Another Person at any time if needed. Just click on the required document to download or print the template.

Utilize US Legal Forms, which offers one of the largest collections of legal documents, to save time and avoid errors. The service provides well-crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the District of Columbia General Form for Bill of Sale of Personal Property from One Person to Another Person template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct city/state.

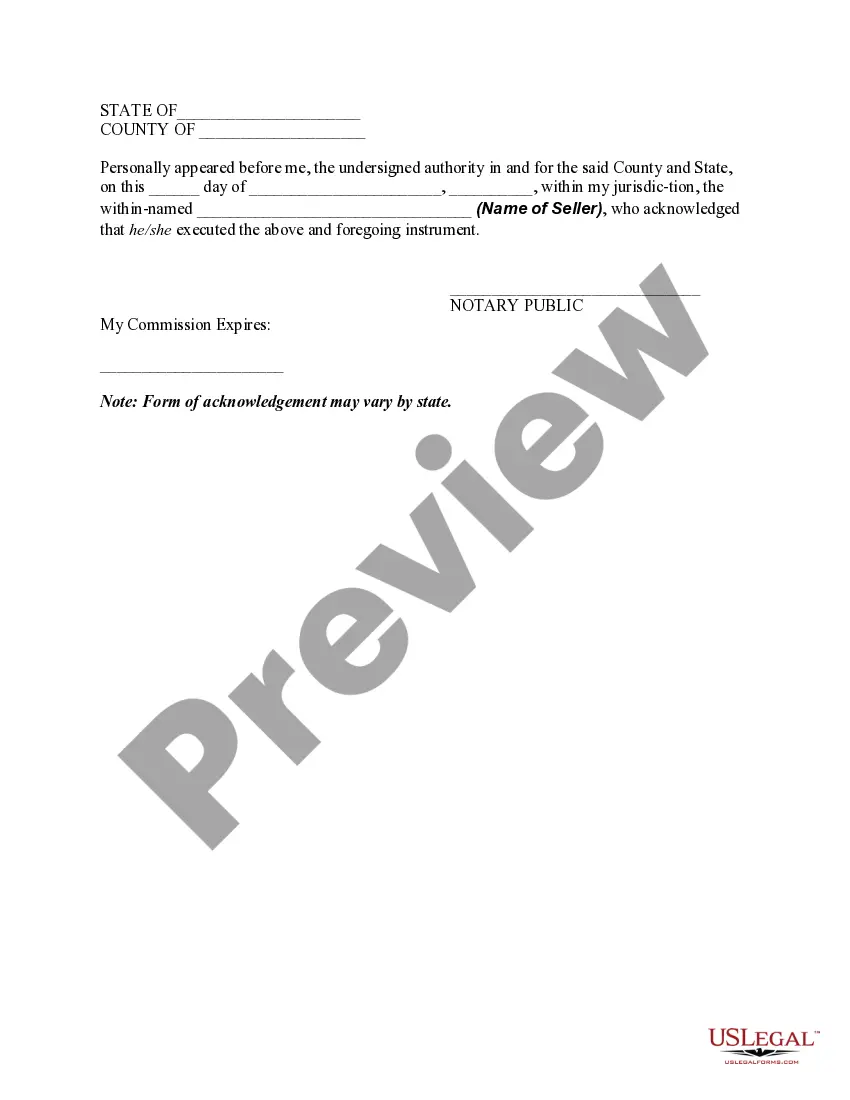

- Use the Review button to examine the form.

- Read the description to confirm you have selected the correct document.

- If the form isn't what you are looking for, use the Search field to locate the form that meets your needs.

- Once you find the right form, click on Get now.

- Choose the payment plan you want, fill in the necessary information to create your account, and pay for your order using PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

Filing the DC personal property tax (ppt) involves completing the FP-31 form and submitting it to the appropriate tax authority. The process requires you to detail all owned personal property and its assessed values. Ensuring accuracy in your submission can prevent complications later on. Using the District of Columbia General Form for Bill of Sale of Personal Property from One Individual to another Individual can help you gather the necessary details for your filing, making it easier to comply with tax regulations.

The property tax rate on personal property in the District of Columbia is typically a specific percentage of the assessed value of the property. This rate can differ for various categories of personal property, so it is important to check the current rates when assessing your tax liability. Understanding this percentage helps you budget for potential tax payments. The District of Columbia General Form for Bill of Sale of Personal Property from One Individual to another Individual can play a crucial role in accurately determining your property’s value.

The FP-31 is a form used to report personal property for taxation purposes in Washington, D.C. Individuals and businesses must complete this form annually to disclose the value of their personal property. This reporting is crucial for determining the amount of personal property tax owed. To streamline the process, you can utilize the District of Columbia General Form for Bill of Sale of Personal Property from One Individual to another Individual to properly categorize your assets.

In Washington, D.C., the depreciation rate for personal property varies depending on the type of asset. Commonly, tangible personal property depreciates over a useful life of five to ten years, impacting how owners calculate taxes owed. Understanding these rates can aid in financial planning and tax preparation. You can find valuable resources on the District of Columbia General Form for Bill of Sale of Personal Property from One Individual to another Individual that assist with proper valuation.

DC FP 31 personal property tax refers to taxes levied on tangible and intangible personal property in Washington, D.C. This tax applies to businesses and individuals who own personal property within the district. Generally, the tax is based on the assessed value of the personal property, and it is essential for owners to stay compliant. Using the District of Columbia General Form for Bill of Sale of Personal Property from One Individual to another Individual can help document personal property accurately.

The tax form for rental property in DC is the DC Schedule H or the DC Rental Property Schedule. These forms allow property owners to report rental income and deduct eligible expenses. If you're transferring ownership of rental property using the District of Columbia General Form for Bill of Sale of Personal Property from One Individual to another Individual, consider how these tax forms may impact your overall financial situation.

Individuals and businesses that own personal property valued at over $1,000 in the District of Columbia must file the DC FP-31. This includes assets such as vehicles, equipment, and machinery. If you're participating in transactions that include the District of Columbia General Form for Bill of Sale of Personal Property from One Individual to another Individual, ensure that you are aware of your filing responsibilities to avoid potential penalties.

DC personal income tax is a tax imposed on the income earned by residents of Washington, D.C. The tax rate is progressive, meaning it increases with higher income levels. For individuals engaged in buying or selling personal property, including transactions documented by the District of Columbia General Form for Bill of Sale of Personal Property from One Individual to another Individual, understanding this tax is crucial for financial planning.

Filing the DC FP-31 online is straightforward and can be done through the Office of Tax and Revenue's website. Simply create an account, enter your personal information, and follow the prompts for submitting your return electronically. For transactions that involve the District of Columbia General Form for Bill of Sale of Personal Property from One Individual to another Individual, ensure that you have all necessary documentation ready for a smooth filing.

The form 8829 is used by taxpayers to deduct expenses related to the business use of their home. This includes costs for mortgage interest, utilities, and repairs. If you engage in activities that require the District of Columbia General Form for Bill of Sale of Personal Property from One Individual to another Individual, it's essential to understand how these deductions can affect your overall tax liability.