District of Columbia Consumer Loan Application - Personal Loan Agreement

Description

How to fill out Consumer Loan Application - Personal Loan Agreement?

Are you currently in a situation where you need documents for either business or personal reasons almost every day.

There are numerous legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of form templates, such as the District of Columbia Consumer Loan Application - Personal Loan Agreement, which can be tailored to meet federal and state requirements.

Once you find the appropriate form, click on Buy now.

Select the pricing plan you prefer, fill out the required information to create your account, and purchase your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the District of Columbia Consumer Loan Application - Personal Loan Agreement template.

- If you don’t have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

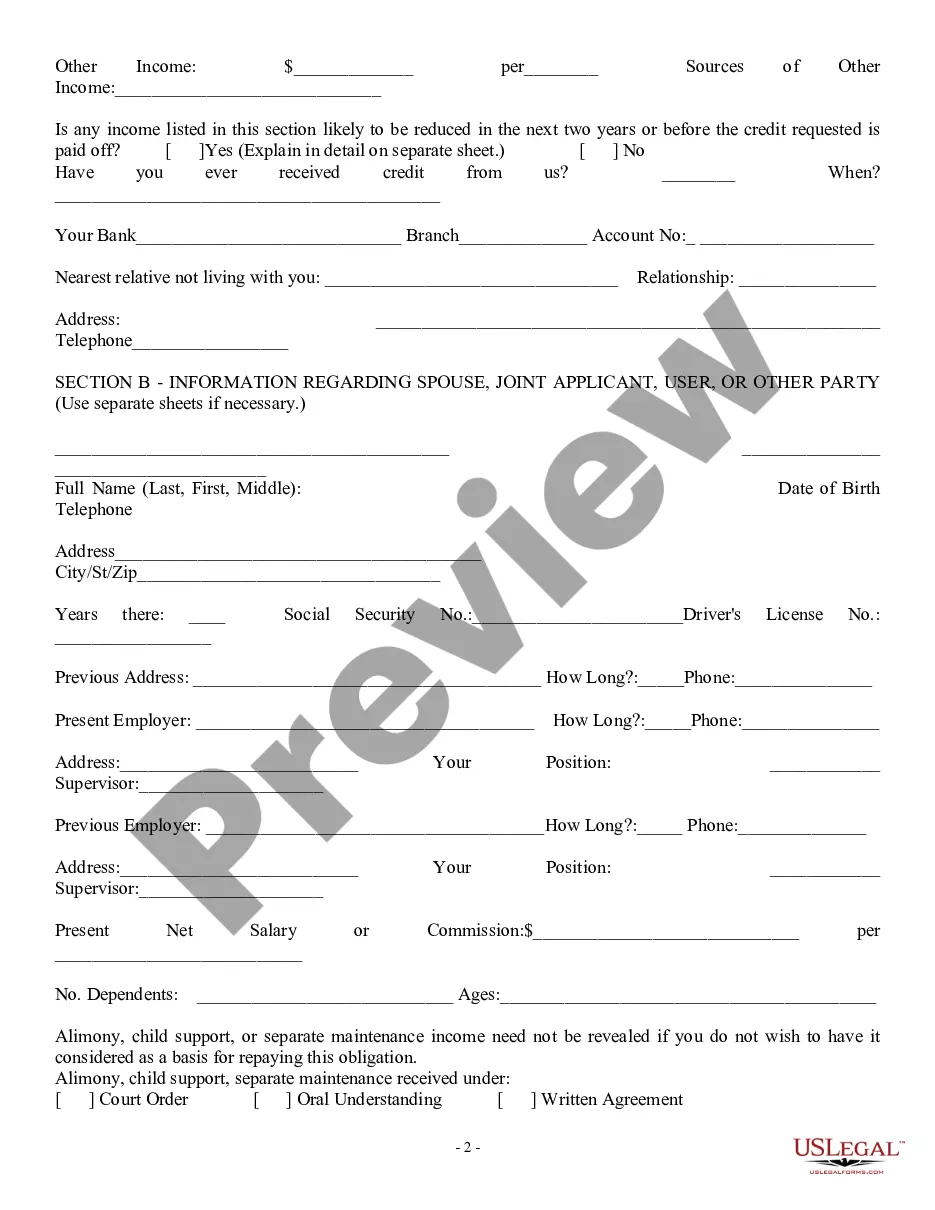

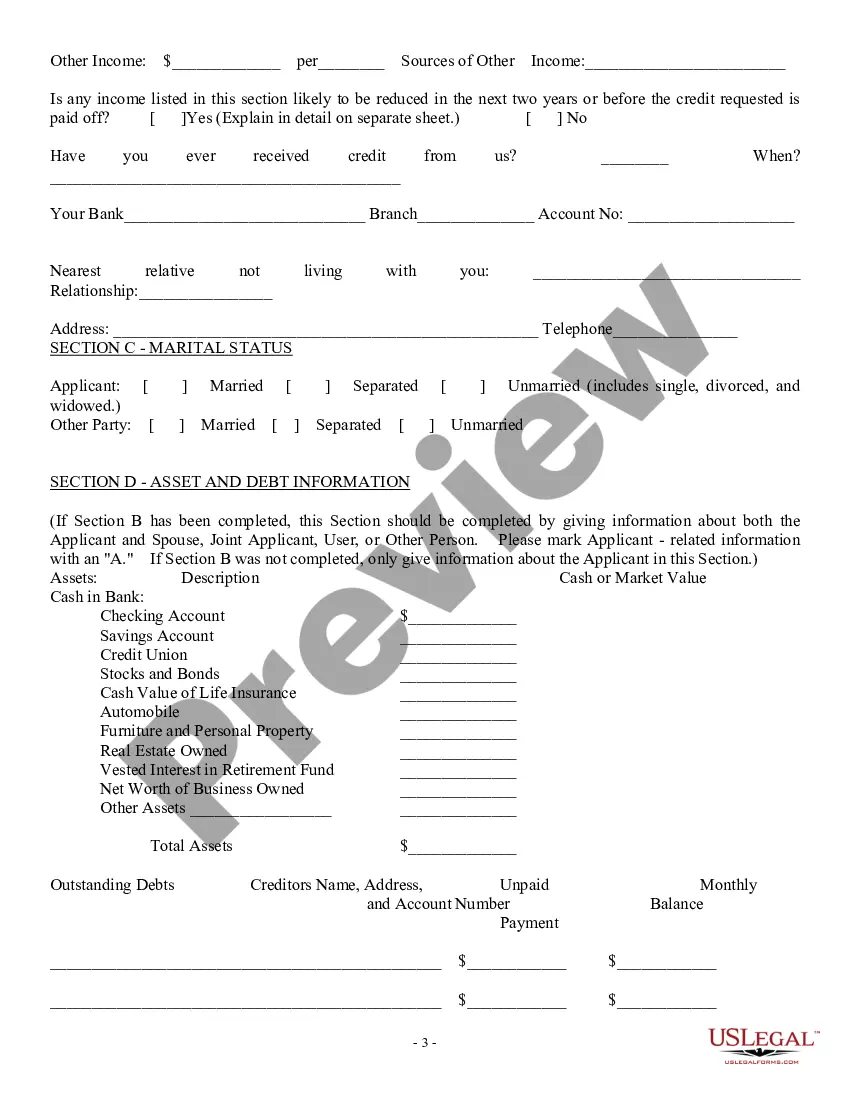

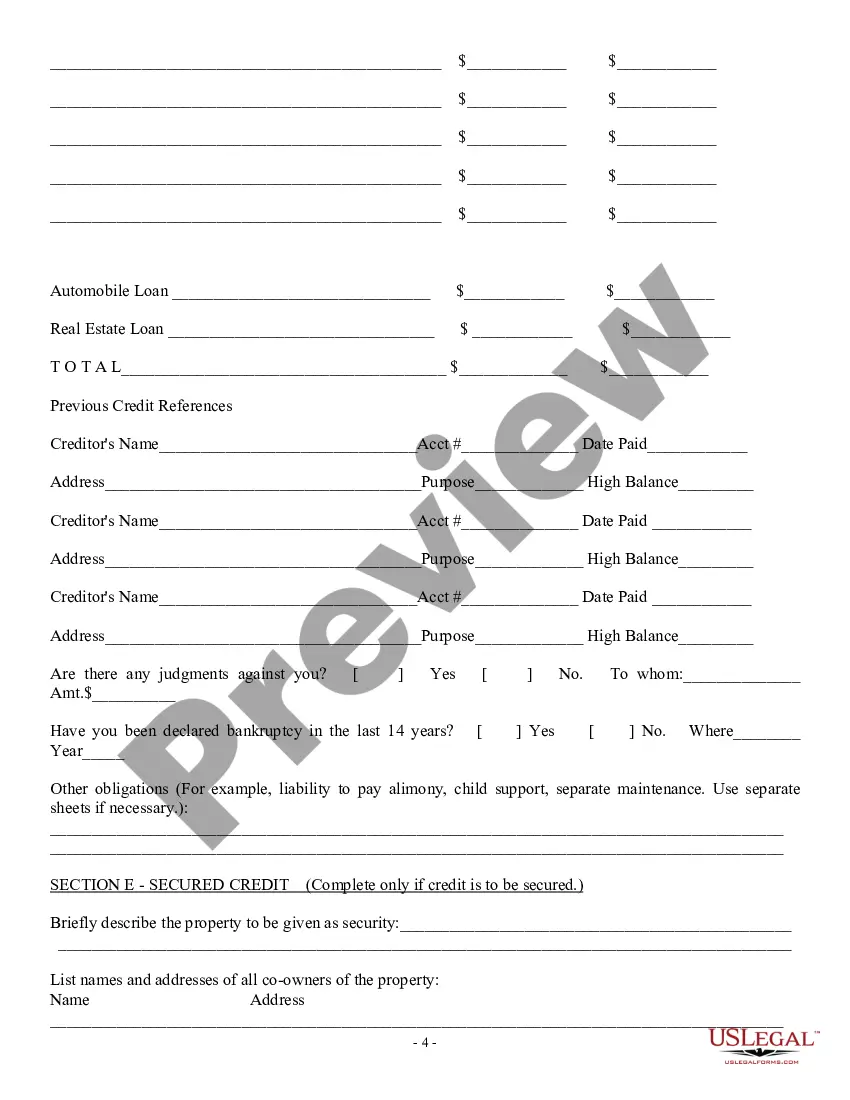

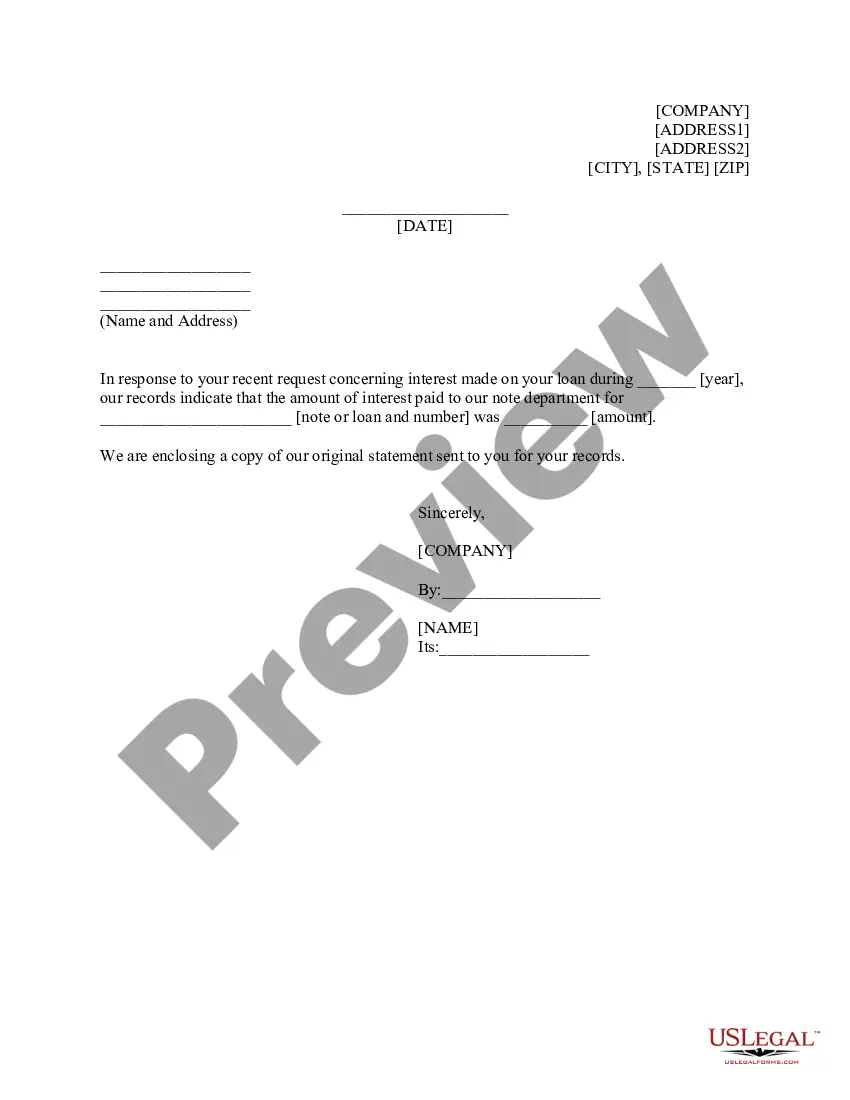

- Use the Review button to examine the form.

- Check the summary to confirm that you have selected the right form.

- If the form is not what you’re looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

(c) It shall be lawful to contract for a rate of interest not exceeding 24% per annum on a loan or financial transaction which is secured directly or indirectly by: (1) a mortgage or deed of trust, other than a first purchase mortgage or first purchase deed of trust, on residential real property; (2) a security ...

The District of Columbia will soon have in place what may be the most progressive law in the nation protecting consumers from unfair and abusive debt collection practices. On June 7, 2022, the DC Council passed the Protecting Consumers from Unjust Debt Collection Practices Amendment Act of 2021 (B24-0357).

§ 28?3801. This subchapter applies to actions to enforce rights arising from a consumer credit sale or a direct installment loan.

Debt collection. (a)(1) This section applies to conduct and practices in connection with the collection of obligations arising from any consumer debt (other than a loan directly secured on real estate or a direct motor vehicle installment loan covered by Chapter 36 of this title).

§ 28?3302. (b) Interest, when authorized by law, on judgments or decrees against the District of Columbia, or its officers, or its employees acting within the scope of their employment, is at the rate of not exceeding 4% per annum.

Usury laws set a limit on the amount of interest that can be charged on different kinds of loans. While most states have usury laws, national banks can charge the highest interest rate allowed in the bank's home state ? not the cardholder's.

The interest rate on judgments is six percent (6%) for the calendar quarter beginning October 1, 2023 (DC Code §28-3302(c)). Pursuant to DC Code §28-3302(b), this rate does not apply to judgments against the District of Columbia or its employees acting within the scope of their employment.

Generally, any unpaid principal balance collects interest at 10%, or 7% if the debtor is a government agency. This general rule applies to any judgment against a business or government agency, or when the debtor owes $200,000 or more.