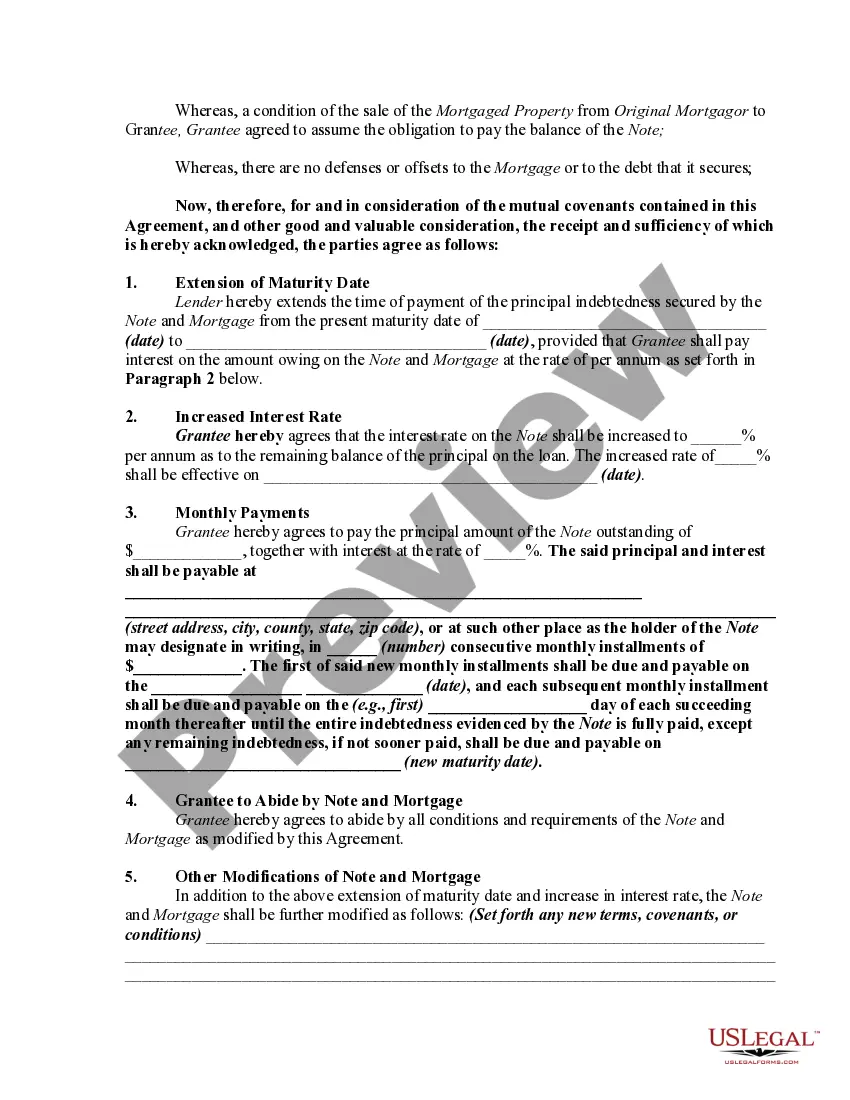

An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. Such a modification or extension is contractual in nature and must be supported by consideration. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

District of Columbia Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest

Description

How to fill out Mortgage Extension Agreement With Assumption Of Debt By New Owner Of Real Property Covered By The Mortgage And Increase Of Interest?

Choosing the right legitimate document format can be quite a battle. Needless to say, there are plenty of themes accessible on the Internet, but how will you get the legitimate kind you require? Make use of the US Legal Forms site. The assistance offers thousands of themes, including the District of Columbia Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest, that can be used for company and personal demands. All of the types are examined by specialists and fulfill federal and state needs.

Should you be currently signed up, log in to the profile and then click the Obtain switch to have the District of Columbia Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest. Utilize your profile to appear from the legitimate types you possess purchased formerly. Visit the My Forms tab of your profile and obtain yet another copy of the document you require.

Should you be a brand new user of US Legal Forms, allow me to share basic guidelines that you should comply with:

- First, be sure you have chosen the right kind for your town/region. You can examine the shape while using Review switch and look at the shape information to make certain this is the right one for you.

- In the event the kind is not going to fulfill your requirements, make use of the Seach industry to obtain the correct kind.

- Once you are sure that the shape would work, go through the Purchase now switch to have the kind.

- Opt for the prices plan you need and enter in the essential information and facts. Build your profile and buy the order utilizing your PayPal profile or credit card.

- Choose the document file format and download the legitimate document format to the system.

- Complete, revise and produce and indication the attained District of Columbia Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest.

US Legal Forms will be the largest catalogue of legitimate types for which you can see various document themes. Make use of the company to download appropriately-created papers that comply with condition needs.

Form popularity

FAQ

As one of the final forms you receive before you close on your new loan, the Closing Disclosure allows you to compare your loan terms and costs to the terms listed in the Loan Estimate form you were given at the beginning of the process.

§ 28?3302. (b) Interest, when authorized by law, on judgments or decrees against the District of Columbia, or its officers, or its employees acting within the scope of their employment, is at the rate of not exceeding 4% per annum.

If a mortgage loan application is approved and executed without the information in sections 1116.1 and 1116.2, the mortgage loan application shall be voidable by the borrower(s) prior to the loan closing and any fees submitted by the borrower(s) in connection with the application shall be returned to the borrower(s) in ...

Usury laws set a limit on the amount of interest that can be charged on different kinds of loans. While most states have usury laws, national banks can charge the highest interest rate allowed in the bank's home state ? not the cardholder's.

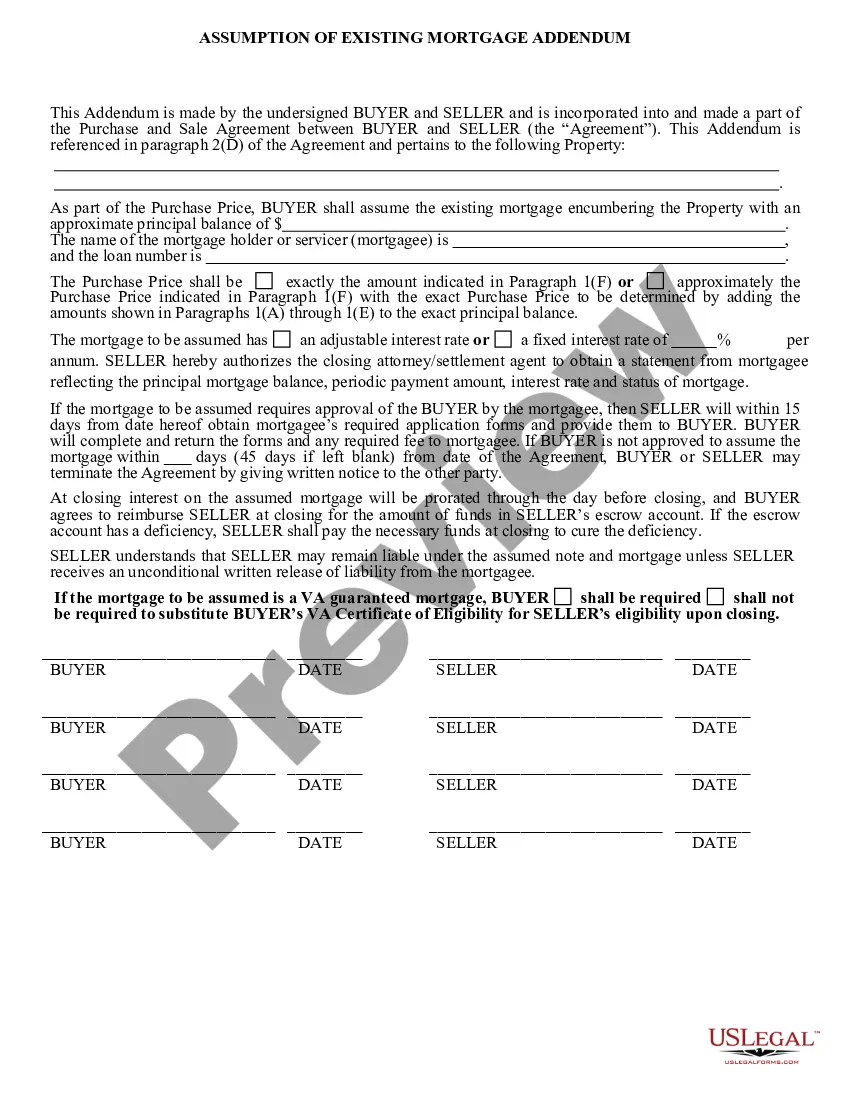

Unfortunately, most conventional mortgages are not assumable. One of the exceptions is if someone is a successor in interest based on having the property transferred to them during someone's lifetime or after their passing. You can also assume an adjustable-rate mortgage that's outside its initial fixed period.

Required loan disclosures. (a)(1) A licensee who offers to make or procure a loan secured by a first or subordinate mortgage or deed of trust on a single to 4-family home shall provide the borrower with a financing agreement executed by the lender.

Does a closing disclosure mean your loan is approved? No, a closing disclosure does not always mean your loan is approved. You may find incorrect information or something you want to change. Your lender also has the opportunity to back out if they find something new that makes them change their mind.

A Closing Disclosure is a five-page form that provides final details about the mortgage loan you have selected. It includes the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage (closing costs).