District of Columbia Sample Letter for Withheld Delivery

Description

How to fill out Sample Letter For Withheld Delivery?

Are you presently in a situation where you require documentation for various business or personal reasons on a daily basis.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

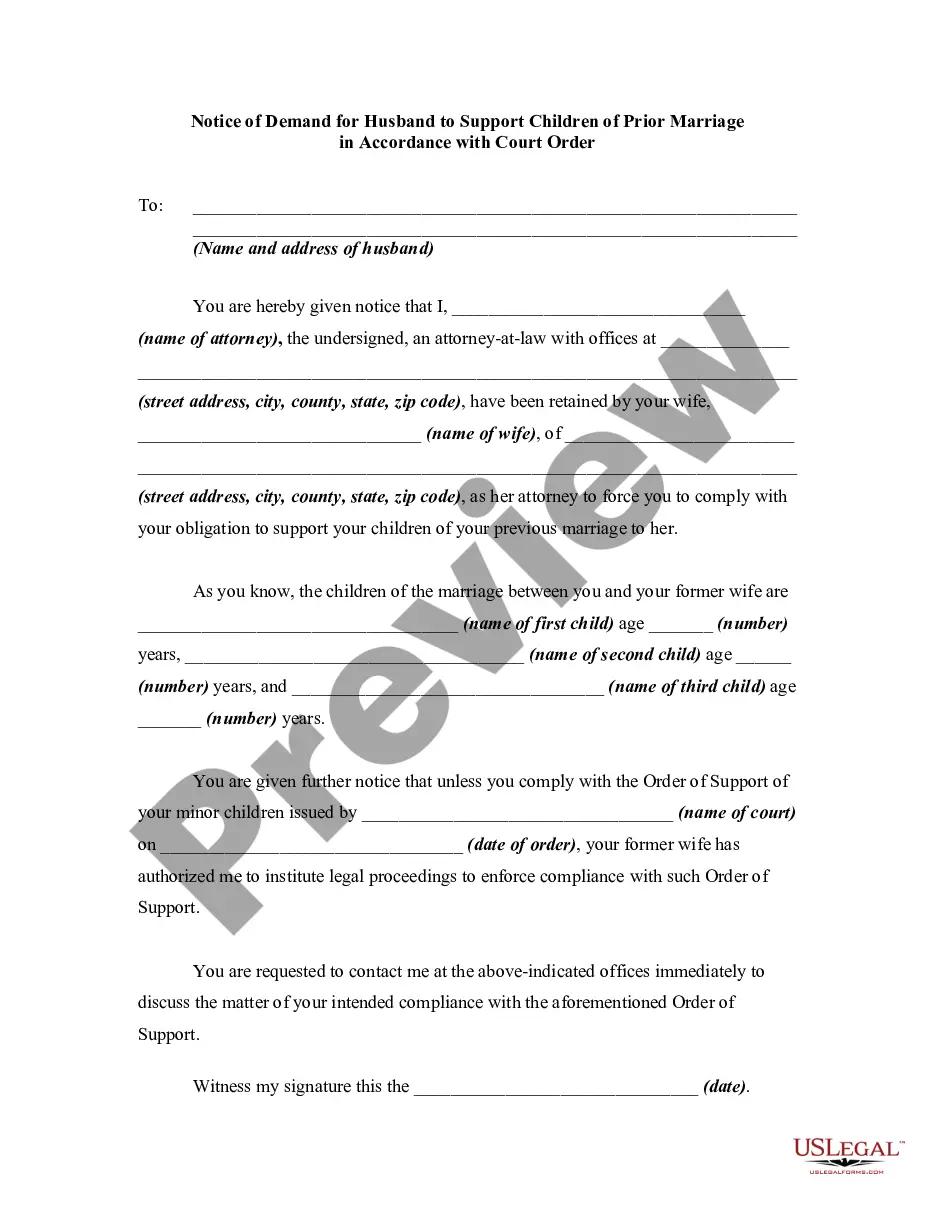

US Legal Forms provides thousands of form templates, such as the District of Columbia Sample Letter for Withheld Delivery, designed to comply with federal and state regulations.

Choose a convenient format and download your copy.

Find all the document templates you have purchased in the My documents section. You can obtain another copy of the District of Columbia Sample Letter for Withheld Delivery at any time if required. Just click on the relevant form to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the District of Columbia Sample Letter for Withheld Delivery template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Acquire the form you need and ensure it is for the correct city/county.

- Utilize the Preview button to review the form.

- Check the description to confirm you have selected the correct form.

- If the form does not meet your requirements, use the Search field to find the document that aligns with your needs.

- Once you locate the appropriate form, click Get now.

- Select the pricing option you want, fill out the necessary information to create your account, and complete the transaction using your PayPal or credit card.

Form popularity

FAQ

Yes, form D-40B can be filed electronically through various online platforms. This convenience streamlines the filing process and provides instant confirmation. Consider using UsLegalForms to ensure your submission is accurate and fully compliant with D.C. tax laws.

Many states across the U.S. have mandatory state tax withholding, including California, New York, and Illinois. Each state's rules may differ regarding withholding rates and regulations. To stay compliant, keep abreast of your state’s requirements and consider using the District of Columbia Sample Letter for Withheld Delivery for guidance.

To file your D.C. taxes by mail, complete the necessary forms, including the D-40 or D-40B, depending on your residency status. Make sure to include any required documentation and send copies to the address specified for tax returns. If you have questions, UsLegalForms can assist you in preparing the District of Columbia Sample Letter for Withheld Delivery.

To file a non-resident tax return, start by gathering all income documents related to your D.C. earnings. Complete the appropriate forms, typically the D-40B for non-residents. Utilizing the District of Columbia Sample Letter for Withheld Delivery can be beneficial if you need to communicate with tax authorities.

Yes, D.C. requires employers to withhold local income tax from employee wages. This ensures that individuals contribute to public services and infrastructure in the district. For clarification on your tax situation, consider using the District of Columbia Sample Letter for Withheld Delivery.

Washington, D.C. does collect local income taxes, often referred to as state taxes. These taxes are based on your residency and income earned within the district. Properly addressing and filing these taxes is vital for compliance, and platforms like UsLegalForms provide valuable resources.

Yes, Washington, D.C. imposes payroll taxes, similar to state income tax. Employers are required to withhold this tax from employees’ paychecks. Understanding payroll taxes ensures you meet your financial obligations, and using tools like the District of Columbia Sample Letter for Withheld Delivery can help clarify your responsibilities.

The residency rule for District of Columbia taxes depends on where you live for more than half of the tax year. If you establish residency in Washington, D.C., you are subject to local income taxes. Whether you file as a resident or a non-resident can significantly affect your tax obligations, so it’s crucial to understand these distinctions.

Yes, non-residents must file a DC tax return if they earn income within the district. This requirement helps ensure that anyone benefiting from the D.C. economy contributes fairly. Be sure to follow the correct guidelines, such as using the District of Columbia Sample Letter for Withheld Delivery if required.

Filing a nonresident DC tax return is simple. First, complete the form D-40B, which is specifically designed for nonresidents. Remember, if you earn income in Washington, D.C., it is essential to file, and you can use the District of Columbia Sample Letter for Withheld Delivery for any additional correspondence with tax authorities.