District of Columbia Sample Letter regarding Notifying Client of Cancellation of Deed of Trust

Description

How to fill out Sample Letter Regarding Notifying Client Of Cancellation Of Deed Of Trust?

Have you ever found yourself in a situation where you require documents for either business or personal use almost every day.

There are numerous legitimate form templates available online, but finding ones you can trust is challenging.

US Legal Forms offers a vast collection of form templates, including the District of Columbia Sample Letter for Notifying Client of Cancellation of Deed of Trust, which can be tailored to comply with state and federal regulations.

Select the pricing plan you prefer, provide the necessary information to create your account, and complete your order using PayPal or a credit card.

Choose a convenient file format and download your copy. You can find all the form templates you have purchased in the My documents menu. You can obtain an additional copy of the District of Columbia Sample Letter for Notifying Client of Cancellation of Deed of Trust at any time, if needed. Just click the required form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Next, you can download the District of Columbia Sample Letter for Notifying Client of Cancellation of Deed of Trust template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

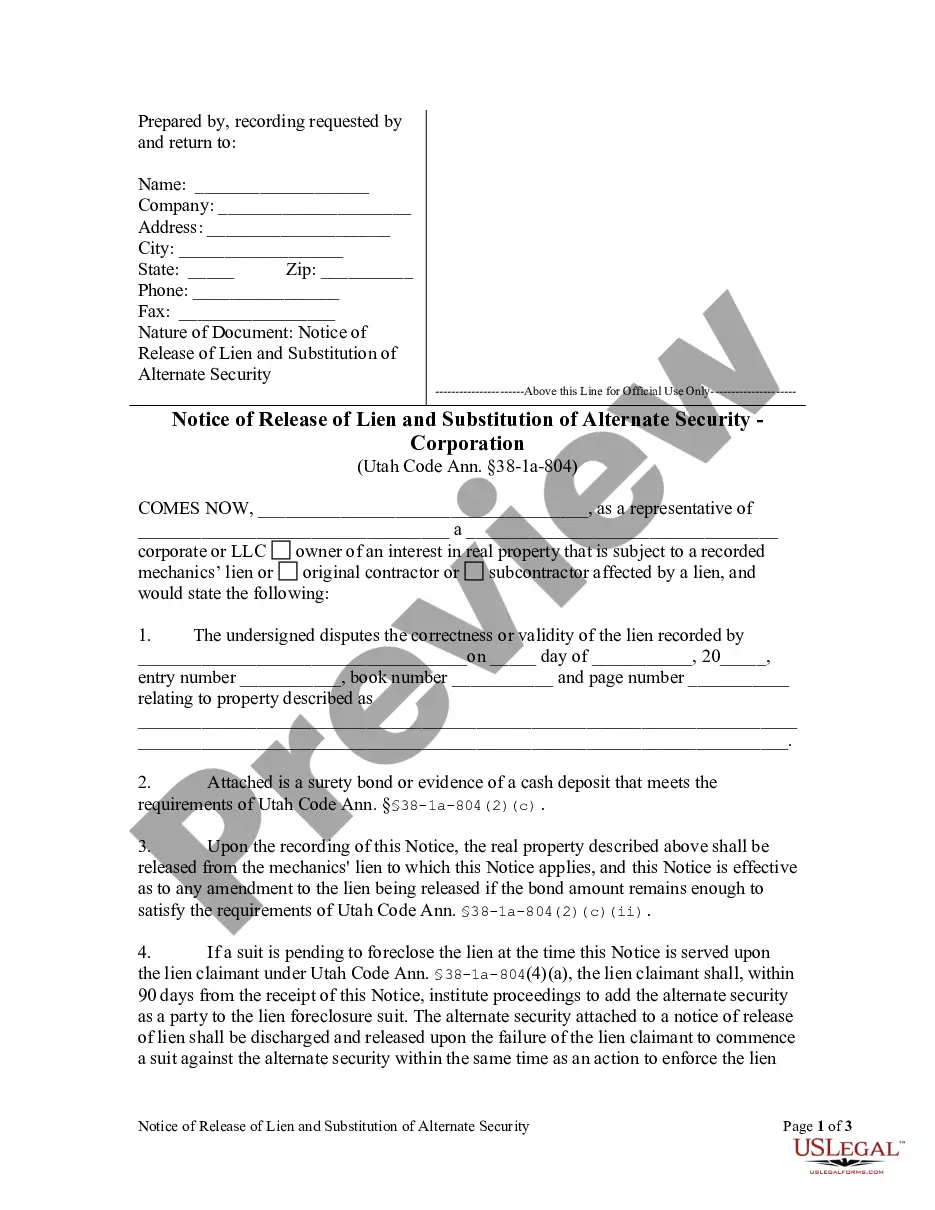

- Use the Preview button to examine the form.

- Review the details to confirm that you have selected the correct form.

- If the form is not what you're looking for, use the Search field to find the form that meets your needs.

- Once you find the right form, click Acquire now.

Form popularity

FAQ

Key Takeaways. You can cancel your deed of trust by getting a deed of surrender in place. This is a legal document which can be used to waive a previous deed or contract between multiple parties. You can't cancel a deed of trust without the consent of all parties named within the deed.

Cancellation of sale deed refers to the revocation of the purchase and sale of property. A sale deed may be cancelled if any party involved is unsatisfied with the deal and makes a claim regarding the same in the court of law.

A trust deed is a legal document that sets out the rules for establishing and operating your fund. It includes such things as the fund's objectives, who can be a member and whether benefits can be paid as a lump sum or income stream.

Six years after the Trust Deed starts, your credit rating will contain no mention of it. It's important to remember, if you have already missed payments or have been paying reduced amounts to your creditors then your credit rating may already have been adversely affected.

Definitions. Trust: A legal document that spells out how a person's assets should be managed during their lifetime or after their death.