District of Columbia Officers Bonus in form of Stock Issuance - Resolution Form

Description

How to fill out Officers Bonus In Form Of Stock Issuance - Resolution Form?

US Legal Forms - one of the most important collections of legal templates in the United States - provides a vast assortment of legal document templates available for download or printing.

By utilizing the website, you can discover a large selection of forms for business and personal needs, organized by categories, states, or keywords. You can acquire the latest versions of forms similar to the District of Columbia Officers Bonus in Stock Issuance - Resolution Form within moments.

If you currently hold a monthly subscription, Log In and retrieve the District of Columbia Officers Bonus in Stock Issuance - Resolution Form from your US Legal Forms library. The Download button will be visible on each form you view.

Once you are satisfied with the form, affirm your choice by clicking the Get now button. Next, choose the payment plan you prefer and provide your credentials to register for an account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment. Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded District of Columbia Officers Bonus in Stock Issuance - Resolution Form.

Each template added to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, just visit the My documents section and click on the form you want.

Gain access to the District of Columbia Officers Bonus in Stock Issuance - Resolution Form with US Legal Forms, the most extensive repository of legal document templates. Utilize a wide range of professional and state-specific templates that cater to your business or personal requirements and specifications.

- You can access all forms previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure that you have selected the appropriate form for your city/state.

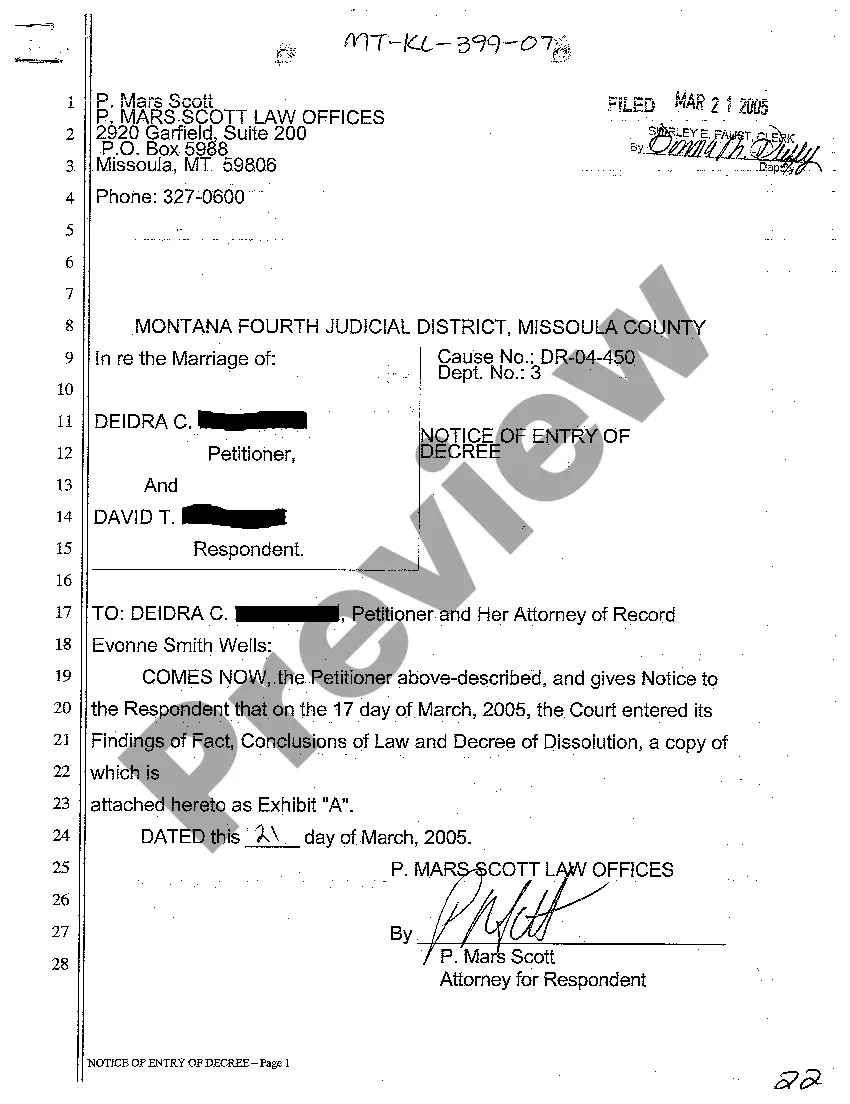

- Click on the Preview button to examine the form's contents.

- Check the form description to confirm you have chosen the correct form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

Form popularity

FAQ

An unincorporated business in DC is a business entity that operates without formal incorporation, often as a sole proprietorship or partnership. These businesses are subject to different regulations and tax obligations compared to incorporated entities. If you’re exploring options like the District of Columbia Officers Bonus in form of Stock Issuance - Resolution Form, understanding the dynamics of unincorporated businesses can help you make informed decisions about your business structure and tax responsibilities.

Form D 20 is a tax return form that individuals and businesses operating in the District of Columbia are required to submit. This form reports individual income, helps to calculate the city’s personal income tax, and is vital for compliance with local tax laws. When dealing with financial strategies, including the District of Columbia Officers Bonus in form of Stock Issuance - Resolution Form, being informed about forms like D 20 can simplify your tax reporting process.

Yes, you can file the DC D-30 electronically. This feature simplifies the filing process, allowing you to submit your documents from the comfort of your home or office. Moreover, using the electronic filing system streamlines your experience when managing the District of Columbia Officers Bonus in form of Stock Issuance - Resolution Form. By leveraging modern technology, you can save time and ensure your forms are submitted accurately.

Yes, Washington, D.C. allows bonus depreciation as part of its tax code. This provision helps businesses recover the costs of certain capital investments more quickly. It can be a beneficial strategy for optimizing your tax situation, especially if your business plans to issue bonuses. When structuring these bonuses, referencing the District of Columbia Officers Bonus in form of Stock Issuance - Resolution Form can be advantageous to ensure compliance and clarity.

The main difference between a company and an unincorporated business lies in their legal structure. A company, such as a corporation, is a separate legal entity that offers liability protection to its owners. In contrast, an unincorporated business does not provide such separation, leaving the owner fully liable for business debts. Business owners should consider these factors when deciding on compensation methods, especially using the District of Columbia Officers Bonus in form of Stock Issuance - Resolution Form.

An unincorporated business is one that does not have a legal structure like a corporation or limited liability company. This means the owner directly manages the business without formal separation between personal and business liabilities. Many individuals choose this model for its simplicity and reduced regulatory requirements. If you are offering bonuses, using the District of Columbia Officers Bonus in form of Stock Issuance - Resolution Form may enhance clarity in your compensation practices.

Yes, if you hire DC residents, your business must withhold DC income tax from their wages. This requirement applies even if your business is unincorporated. Complying with local tax obligations demonstrates your commitment to managing your business responsibly. To simplify processes, you might consider utilizing the District of Columbia Officers Bonus in form of Stock Issuance - Resolution Form to ensure proper documentation.

An unincorporated business with just one owner is often referred to as a sole proprietorship. This type of business exists without formal incorporation, meaning the owner is personally liable for all business debts. It is a straightforward structure that allows you to operate your business independently. For many, filing the District of Columbia Officers Bonus in form of Stock Issuance - Resolution Form is essential when planning compensation strategies.

The unincorporated business franchise tax in Washington, D.C. applies to businesses operating without incorporation. This tax supports city services and infrastructure. Understanding this tax is important, especially when considering the District of Columbia Officers Bonus in form of Stock Issuance - Resolution Form. For clear guidance and official forms, check uslegalforms, which offers comprehensive resources tailored for your needs.

Yes, you can still take bonus depreciation under current tax regulations. This allows businesses to accelerate their depreciation, providing financial relief. The District of Columbia Officers Bonus in form of Stock Issuance - Resolution Form is an essential tool for businesses looking to maximize these benefits. Visit uslegalforms to find templates that can help you navigate this process effectively.