District of Columbia Agreement to Store Certain Personal Property in Portion of Garage

Description

How to fill out Agreement To Store Certain Personal Property In Portion Of Garage?

Finding the correct legal document template can be a challenge. Clearly, there are numerous formats accessible online, but how do you locate the legal form you require? Utilize the US Legal Forms website.

This service provides thousands of templates, such as the District of Columbia Agreement to Store Specific Personal Property in Part of Garage, which can be utilized for both business and personal purposes. All documents are verified by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to retrieve the District of Columbia Agreement to Store Specific Personal Property in Part of Garage. Use your account to browse the legal documents you have previously acquired. Go to the My documents section of your account to download an additional copy of the required document.

Select the format and download the legal document template onto your device. Complete, modify, print, and sign the retrieved District of Columbia Agreement to Store Specific Personal Property in Part of Garage. US Legal Forms is the largest repository of legal documents where you can find various record templates. Utilize the service to obtain correctly crafted papers that meet state requirements.

- First, ensure you have selected the correct document for your location/state.

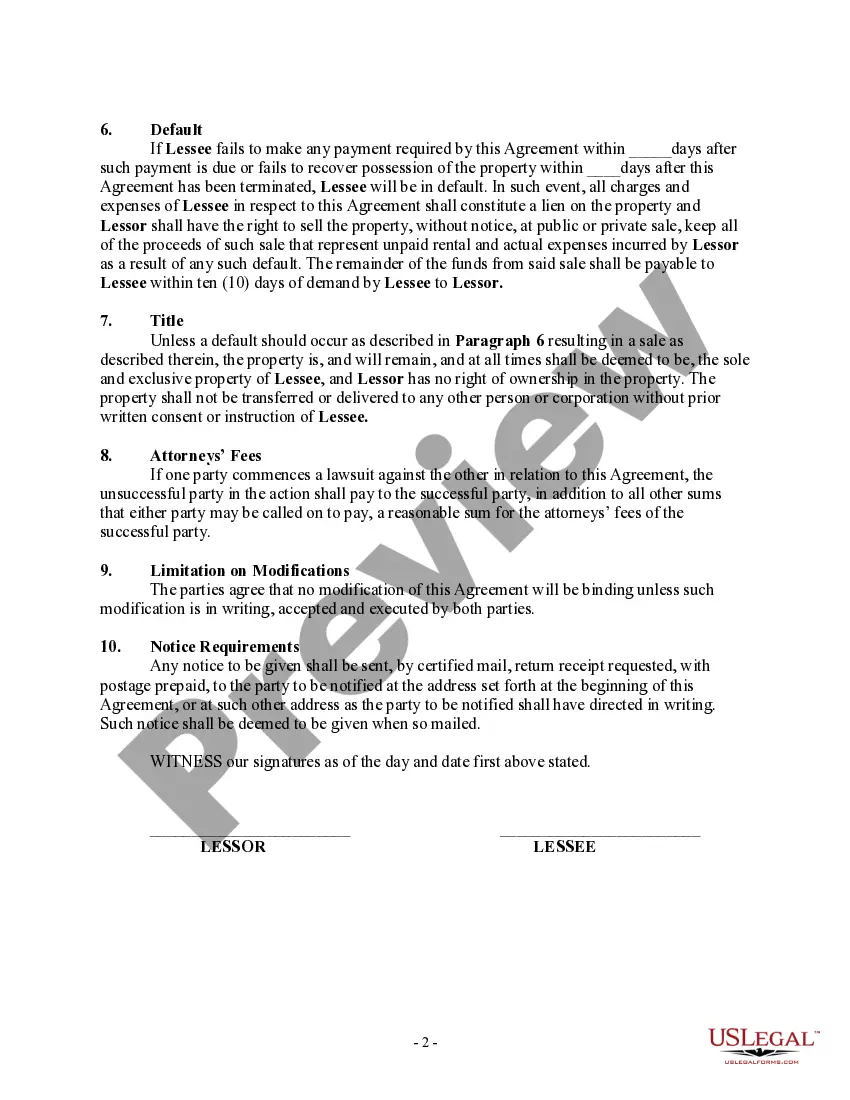

- You can review the form using the Preview button and read the document details to confirm it is suitable for your needs.

- If the form does not suit your requirements, use the Search field to locate the correct document.

- Once you are certain that the document is correct, click on the Download Now button to obtain the form.

- Choose your preferred pricing plan and enter the necessary details.

- Create your account and complete your order using your PayPal account or credit card.

Form popularity

FAQ

In DC, various services are subject to sales tax, including but not limited to personal services, repair services, and rental services. It is essential to distinguish between taxable and non-taxable services to ensure compliance. Utilizing platforms like uslegalforms can provide clarity on these services, similar to how a well-defined District of Columbia Agreement to Store Certain Personal Property in Portion of Garage can streamline your storage process.

Yes, the District of Columbia imposes a sales tax on most goods and certain services. The current sales tax rate can vary, so it's vital to stay updated on the specific rates applicable to your purchases. Being aware of sales tax obligations can help you better plan your finances, much like understanding a District of Columbia Agreement to Store Certain Personal Property in Portion of Garage can help with your storage needs.

When considering shipping in Canada, it's important to know that shipping charges can be taxable based on the nature of the goods. Goods that fall under specific exemptions may not incur tax. However, when shipping services are used for taxable items, charges typically incur GST and/or PST. Understanding these details helps ensure compliance, similar to knowing the implications of a District of Columbia Agreement to Store Certain Personal Property in Portion of Garage.

The personal property tax rate in the District of Columbia is determined annually and is based on the assessed value of your personal property. Typically, the rate hovers around $1.65 per $100 of assessed value. When entering into a District of Columbia Agreement to Store Certain Personal Property in Portion of Garage, understanding this tax can help you budget for any associated costs.

While vehicle tax rates can vary widely by state, currently, states like New Jersey and Pennsylvania are reported to have among the highest vehicle taxes in the nation. These taxes can be based on various factors, such as vehicle age and performance. If you are considering a District of Columbia Agreement to Store Certain Personal Property in Portion of Garage, knowing about vehicle taxes can help you make informed decisions about your assets.

The District of Columbia does have a personal property tax that applies to various types of personal property, including tangible assets like vehicles and furniture. The tax is assessed based on the value of the property you possess. If you are storing personal property under a District of Columbia Agreement to Store Certain Personal Property in Portion of Garage, be aware of any tax implications that may arise.

Filing FP 31 in the District of Columbia requires you to complete the appropriate form and submit it to the Office of Tax and Revenue. It's best to gather all necessary documentation, such as identification and financial records, to ensure a smooth filing process. For those engaging in a District of Columbia Agreement to Store Certain Personal Property in Portion of Garage, keeping organized records will help in filling out forms correctly.

In the District of Columbia, personal property includes items that you own but are not permanently affixed to real estate. This typically covers furniture, appliances, vehicles, and any other movable property. If you are considering a District of Columbia Agreement to Store Certain Personal Property in Portion of Garage, it's important to know what items qualify as personal property.

Yes, the District of Columbia has a personal income tax that applies to residents and non-residents earning income within its borders. This tax is based on a progressive rate structure, which means that the more you earn, the higher your tax rate may be. Understanding your tax obligations is essential, especially if you are considering entering into a District of Columbia Agreement to Store Certain Personal Property in Portion of Garage.