District of Columbia Minimum Checking Account Balance - Corporate Resolutions Form

Description

How to fill out Minimum Checking Account Balance - Corporate Resolutions Form?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By utilizing the website, you will find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the District of Columbia Minimum Checking Account Balance - Corporate Resolutions Form in minutes.

If you already have a subscription, Log In and download the District of Columbia Minimum Checking Account Balance - Corporate Resolutions Form from your US Legal Forms library. The Download button will appear on each form you examine. You have access to all previously downloaded forms from the My documents tab of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Select the format and download the form to your device. Edit. Fill out, modify, and print, and sign the downloaded District of Columbia Minimum Checking Account Balance - Corporate Resolutions Form.

Every document you add to your account has no expiration date and is yours indefinitely. Thus, if you wish to download or print another copy, simply go to the My documents section and select the form you want.

Access the District of Columbia Minimum Checking Account Balance - Corporate Resolutions Form with US Legal Forms, one of the most extensive collections of legal document templates. Utilize a vast array of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/state.

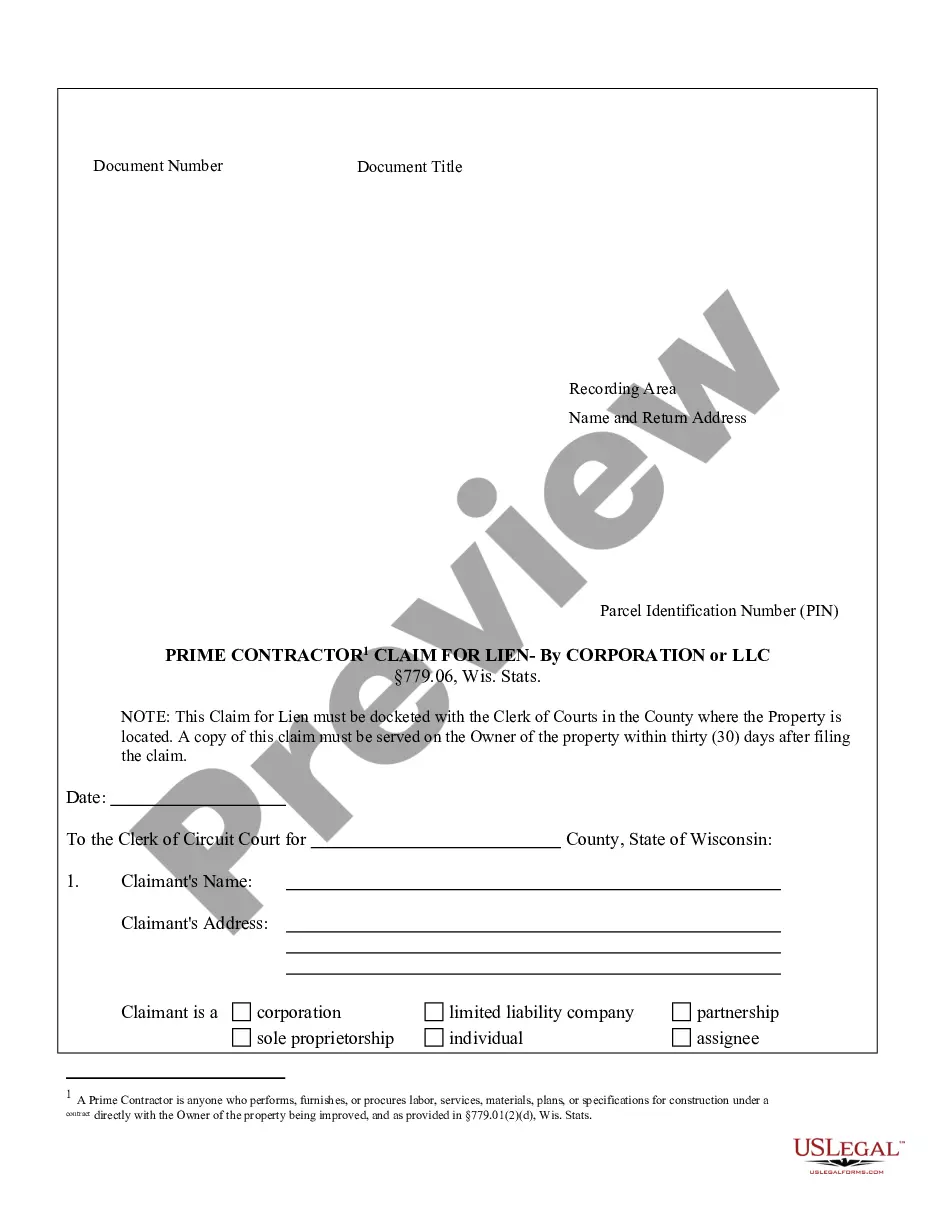

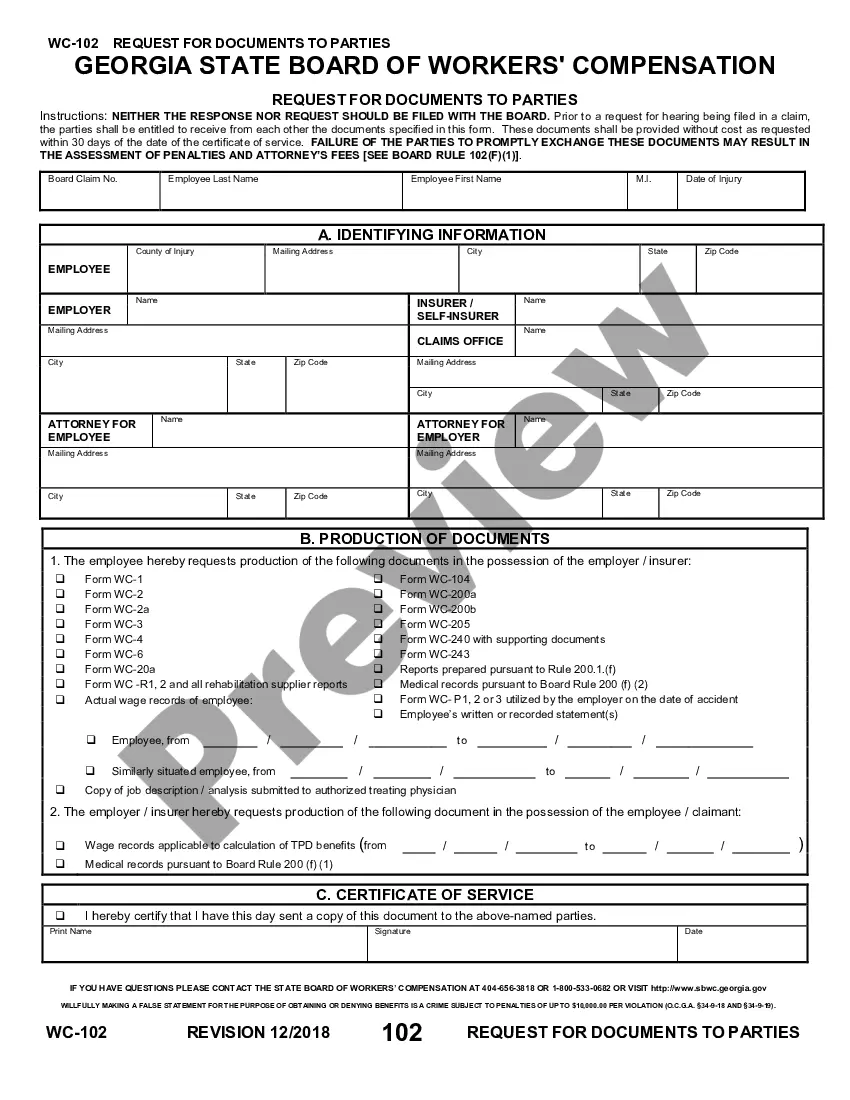

- Click the Review button to read the details of the form.

- Check the information of the form to confirm you have chosen the right one.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- Once satisfied with the form, confirm your choice by clicking the Get now button.

- Choose the pricing plan you prefer and provide your credentials to sign up for an account.

Form popularity

FAQ

Yes, Washington, D.C. has a withholding tax that requires employers to withhold a portion of employees' wages for income tax purposes. This tax applies to all employees working in the District, regardless of where you live. Ensuring proper withholding is essential for compliance and can influence your financial planning, particularly when addressing the District of Columbia Minimum Checking Account Balance - Corporate Resolutions Form.

Your DC refund number is a unique identifier assigned to your tax refund. You can typically find it on the paperwork that was sent to you after filing your tax return. If you're unsure where to look, the DC Office of Tax and Revenue can assist you in accessing this information. This can also be crucial when dealing with any issues related to the District of Columbia Minimum Checking Account Balance - Corporate Resolutions Form.

DC income tax refers to taxes imposed on the income earned by residents and businesses within Washington, D.C. The rates vary based on income levels, and both individuals and corporations are required to file returns. Understanding these tax obligations can greatly affect your financial strategy, including when you work with the District of Columbia Minimum Checking Account Balance - Corporate Resolutions Form.

Your DC withholding account number identifies your business with the District of Columbia tax authorities. You can find this number on past tax filings or correspondence from the Office of Tax and Revenue. If you need to retrieve it, consider visiting the DC government's website or contacting their customer service. Knowing your withholding account number is crucial, especially when managing the District of Columbia Minimum Checking Account Balance - Corporate Resolutions Form.

The minimum tax in the District of Columbia, specifically for D 20, is subject to changes each fiscal year. In recent years, the minimum corporate franchise tax has been set at $250. For businesses looking to navigate these regulations smoothly, utilizing the District of Columbia Minimum Checking Account Balance - Corporate Resolutions Form offers a structured approach to ensuring compliance.

The perception of whether DC has low taxes varies among residents and businesses. While some argue it has higher rates compared to neighboring states, there are various deductions and credits available. Knowing the taxation landscape can aid in decisions such as maintaining the District of Columbia Minimum Checking Account Balance - Corporate Resolutions Form, which can help you meet regulatory requirements.

The tax structure in the District of Columbia is progressive, meaning that rates increase with higher income levels. Generally, the income tax rates range from 4% to 10.75%. If you're considering how taxes affect your financial planning, understanding the District of Columbia Minimum Checking Account Balance - Corporate Resolutions Form can assist in managing these obligations more effectively.

The DC withholding form is known as Form D-4, which employers use to report and withhold taxes from employee wages. This is a vital part of managing payroll tax obligations. For businesses, understanding the proper forms, including the District of Columbia Minimum Checking Account Balance - Corporate Resolutions Form, can greatly aid in compliance and financial management.

Form FR 500 is the District of Columbia's income tax filing form specifically designed for businesses. It is crucial for reporting income and calculating taxes owed. Accessing the right forms, like the District of Columbia Minimum Checking Account Balance - Corporate Resolutions Form, ensures timely and accurate submissions.

Corporate franchise tax in D.C. is a tax imposed on corporations operating within the district, based on their revenue and net income. This tax is essential for supporting public services and infrastructure. Understanding your obligations can be facilitated by referencing forms such as the District of Columbia Minimum Checking Account Balance - Corporate Resolutions Form.