District of Columbia Affidavit of Self-Employed Independent Contractor regarding Loss of Wages as Proof of Damages in Personal Injury Suit

Description

How to fill out Affidavit Of Self-Employed Independent Contractor Regarding Loss Of Wages As Proof Of Damages In Personal Injury Suit?

You can spend several hours online trying to locate the legal document template that satisfies the state and federal requirements you need.

US Legal Forms provides a vast array of legal forms that can be assessed by professionals.

You can obtain or print the District of Columbia Affidavit of Self-Employed Independent Contractor concerning Loss of Earnings as Proof of Damages in Personal Injury Litigation from our services.

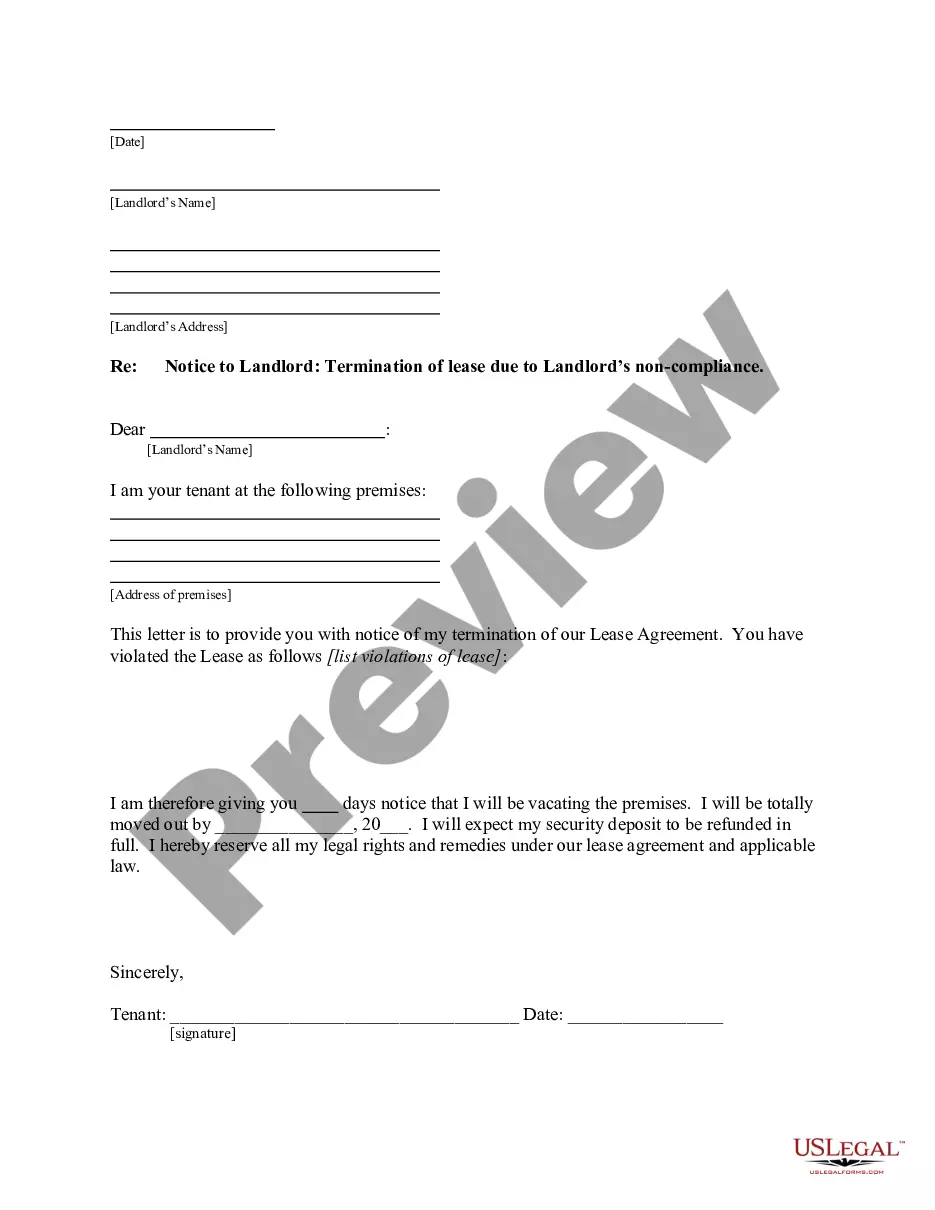

If available, use the Review option to view the document template as well.

- If you possess a US Legal Forms account, you may Log In and select the Download option.

- Subsequently, you can complete, modify, print, or sign the District of Columbia Affidavit of Self-Employed Independent Contractor regarding Loss of Earnings as Proof of Damages in Personal Injury Litigation.

- Every legal document template you purchase becomes your property indefinitely.

- To obtain a duplicate of any purchased form, visit the My documents tab and select the corresponding option.

- If you are utilizing the US Legal Forms website for the first time, follow the simple steps outlined below.

- First, ensure that you have selected the correct document template for your area/city of choice.

- Review the form description to make sure you have picked the right form.

Form popularity

FAQ

Yes, you can claim compensation for loss of earnings as part of your personal injury suit. It is essential to provide clear evidence of your income, including any contracts or work records. Utilizing the District of Columbia Affidavit of Self-Employed Independent Contractor regarding Loss of Wages as Proof of Damages in Personal Injury Suit can strengthen your claim. Working with a knowledgeable platform like uslegalforms can help you create the necessary documentation to support your case.

Yes, there is a time limit, known as the statute of limitations, for making a personal injury claim in the District of Columbia. Typically, you have three years from the date of the injury to file your claim. If you fail to file within this timeframe, you may lose your right to seek compensation. To effectively document your loss of wages, consider using a District of Columbia Affidavit of Self-Employed Independent Contractor regarding Loss of Wages as Proof of Damages in Personal Injury Suit.

To calculate loss of earnings for personal injury, you begin by gathering accurate financial records that demonstrate your typical income. This includes tax returns, invoices, and any documentation that clearly outlines your earnings as a self-employed independent contractor. Next, the District of Columbia Affidavit of Self-Employed Independent Contractor regarding Loss of Wages as Proof of Damages in Personal Injury Suit can serve as crucial evidence in establishing the impact of your injuries on your income. Ultimately, you may also need to estimate future losses based on your earning potential and the duration of recovery, ensuring you present a comprehensive picture of your financial losses.

To provide proof of income as a self-employed individual, you should gather financial documents reflecting your business operations. This includes tax returns, profit and loss statements, and client contracts. Additionally, completing the District of Columbia Affidavit of Self-Employed Independent Contractor regarding Loss of Wages as Proof of Damages in Personal Injury Suit will help present your income data clearly and effectively.

You can prove loss of income as a self-employed person by assembling your financial records, such as previous years' tax returns and business statements. Additionally, keeping detailed records of your earnings before and after the injury will support your claim. The District of Columbia Affidavit of Self-Employed Independent Contractor regarding Loss of Wages as Proof of Damages in Personal Injury Suit provides an official means to validate your loss.

Yes, you can claim a loss on self-employment income when injuries prevent you from working. It's crucial to accurately document your earnings and the period of your inability to work. The District of Columbia Affidavit of Self-Employed Independent Contractor regarding Loss of Wages as Proof of Damages in Personal Injury Suit can serve as significant evidence when claiming these losses.

To provide proof of loss of income, collect relevant financial documents that illustrate your earnings before the incident. This can involve compiling tax returns, profit and loss statements, and any contracts showing expected income. Utilizing the District of Columbia Affidavit of Self-Employed Independent Contractor regarding Loss of Wages as Proof of Damages in Personal Injury Suit can streamline this process by presenting a structured overview of your losses.

Proving loss of income when you are self-employed requires you to gather documentation that reflects your earning history. This may include tax returns, invoices, and bank statements. The District of Columbia Affidavit of Self-Employed Independent Contractor regarding Loss of Wages as Proof of Damages in Personal Injury Suit serves as a credible tool to present your case effectively.

To calculate lost wages as a self-employed individual, start by determining your average earnings over a specific period, such as the previous year. Then, identify the time lost due to the injury. Utilizing the District of Columbia Affidavit of Self-Employed Independent Contractor regarding Loss of Wages as Proof of Damages in Personal Injury Suit can help formalize your claim and ensure you include all relevant income details.

Generally, compensation for lost wages is considered taxable income by the IRS. However, the specifics can vary based on your circumstances, such as whether the compensation covers lost wages due to a personal injury. Consulting a tax professional can clarify how the District of Columbia Affidavit of Self-Employed Independent Contractor regarding Loss of Wages as Proof of Damages in Personal Injury Suit interacts with your potential tax obligations.