District of Columbia Personal Property Inventory

Description

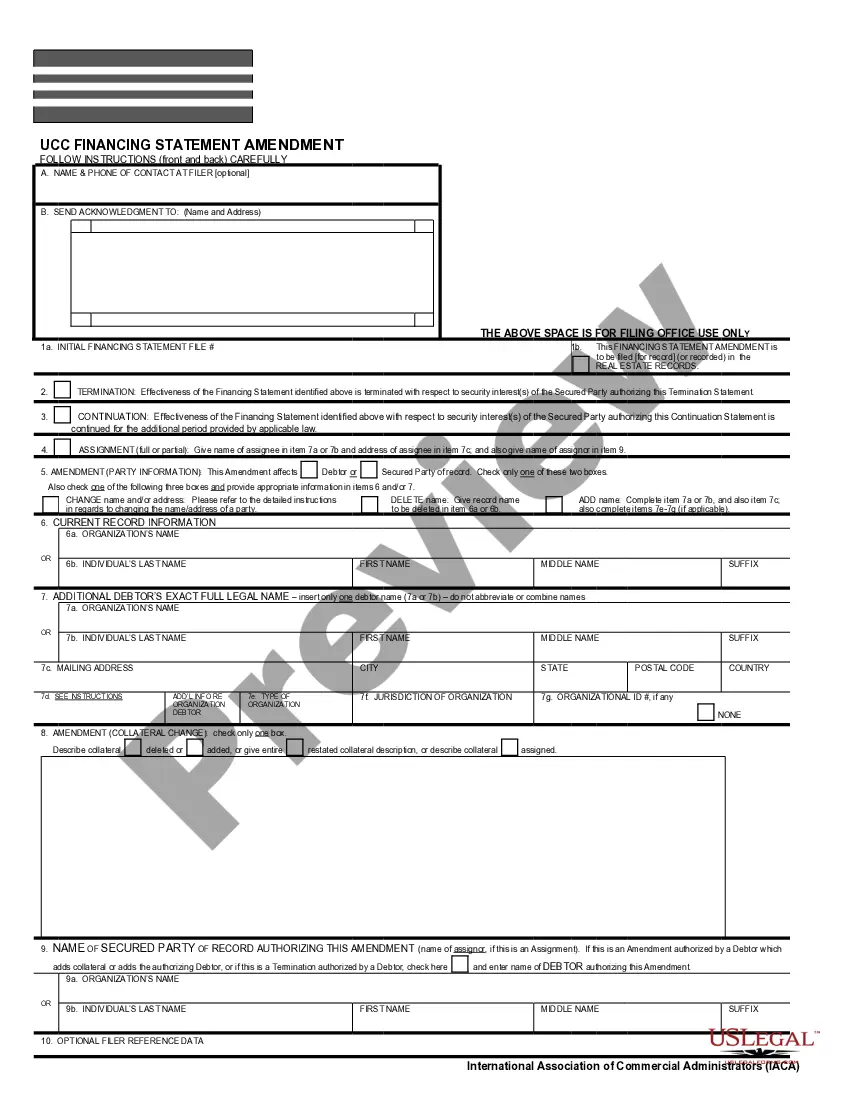

How to fill out Personal Property Inventory?

You can spend hours on the web searching for the approved document template that meets the federal and state requirements you will need.

US Legal Forms provides a multitude of legal forms that have been reviewed by experts.

You can obtain or print the District of Columbia Personal Property Inventory from the service.

First, ensure that you have selected the correct document template for the state/city of your choice. Review the form description to confirm you have chosen the right form. If available, utilize the Review option to preview the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then click on the Download button.

- After that, you can complete, modify, print, or sign the District of Columbia Personal Property Inventory.

- Each legal document template you purchase belongs to you indefinitely.

- To acquire another copy of the purchased form, visit the My documents section and click the relevant option.

- If you're using the US Legal Forms website for the first time, follow the straightforward instructions below.

Form popularity

FAQ

Individuals and businesses with tangible personal property located in the District of Columbia are required to file DC FP 31. This includes all property that is not real estate and serves a business purpose. Completing the District of Columbia Personal Property Inventory helps maintain compliance with local tax requirements and accurately reports your taxable assets.

You should report the sale of personal property directly on your DC tax return. Informing the local tax authority about sales ensures you accurately account for your assets in the District of Columbia Personal Property Inventory. If you need assistance, platforms like US Legal Forms offer resources to help you navigate this process smoothly.

Filing a DC extension may be advisable if you need extra time to prepare your return. An extension allows you to submit your District of Columbia Personal Property Inventory at a later date without incurring immediate penalties. However, remember that any owed taxes are due on the original deadline to avoid interest and penalties.

Residents and businesses that earn income in the District of Columbia must file a DC return. This may include individuals reporting income and corporations doing business in the area. Filing your DC return ensures you fulfill your tax responsibilities while utilizing the District of Columbia Personal Property Inventory to detail your assets.

DC FP 31 is required to be filed by individuals and businesses that own personal property in the District of Columbia. If your property includes items such as machinery, equipment, or any taxable items, you must submit the District of Columbia Personal Property Inventory. It’s crucial to determine your eligibility to avoid any disruptions in your operations.

Yes, you generally need to file personal property tax if you own property in the District of Columbia. The District of Columbia Personal Property Inventory must be submitted annually, as it assists in determining your tax obligations. Filing helps ensure that you remain compliant with local tax laws and prevents potential penalties.

In DC, any personal property valued at over $2,000 is subject to taxation. This threshold applies to each individual item listed in your District of Columbia Personal Property Inventory. Proper documentation is vital to ensure compliance with this threshold. Resources from US Legal Forms can help you stay informed about current tax laws and maintain an accurate inventory to meet reporting requirements.

Several states in the US do not impose personal property taxes, with notable mentions including Delaware and Montana. This means that property owners in these states have a more favorable tax environment concerning their personal inventories. However, it's important to confirm individual state regulations and understand the implications of your residency. For those considering relocating, consulting resources available through US Legal Forms can offer valuable insights.

DC FP 31 refers to the specific form used for reporting personal property tax in the District of Columbia. This form collects detailed information about your personal property inventory, which is essential for tax calculations. Completing this form correctly is crucial for your compliance with local tax regulations. US Legal Forms provides access to this form and helpful guides to ensure you fill it out accurately.

In DC, personal property tax applies to tangible items owned by a business or individual. This includes furniture, fixtures, machinery, and equipment, which should all be documented in your District of Columbia Personal Property Inventory. It's crucial to understand what is taxable to avoid unexpected fees. Check with US Legal Forms for templates that can help you maintain detailed inventory records.