District of Columbia Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will)

Description

How to fill out Certificate Of Heir To Obtain Transfer Of Title To Motor Vehicle Without Probate (Vehicle Not Bequeathed In Will)?

If you wish to total, download, or create legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the site's straightforward and user-friendly search to locate the paperwork you require.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you require, select the Purchase now option. Choose the pricing plan you prefer and enter your details to register for the account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction. Step 6. Choose the format of your legal form and download it to your device. Step 7. Complete, edit, and print or sign the District of Columbia Certificate of Heir to secure Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will). Every legal document template you purchase is yours forever. You have access to every form you downloaded with your account. Click on the My documents section and select a form to print or download again. Complete and download, and print the District of Columbia Certificate of Heir to secure Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will) with US Legal Forms. There are many professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to find the District of Columbia Certificate of Heir to secure Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will) in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to access the District of Columbia Certificate of Heir to secure Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will).

- You can also find forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps listed below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Review option to examine the content of the form. Always remember to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other types of your legal form template.

Form popularity

FAQ

A surviving joint owner or owners of a vehicle may apply for a new certificate of title for that vehicle by presenting a certificate of title in the names of the surviving and deceased joint owners and an authenticated death certificate.

Vehicles: Motor vehicles, such as cars, boats, and motorcycles, can be subject to probate unless there are specific arrangements, such as joint ownership or transfer-on-death provisions.

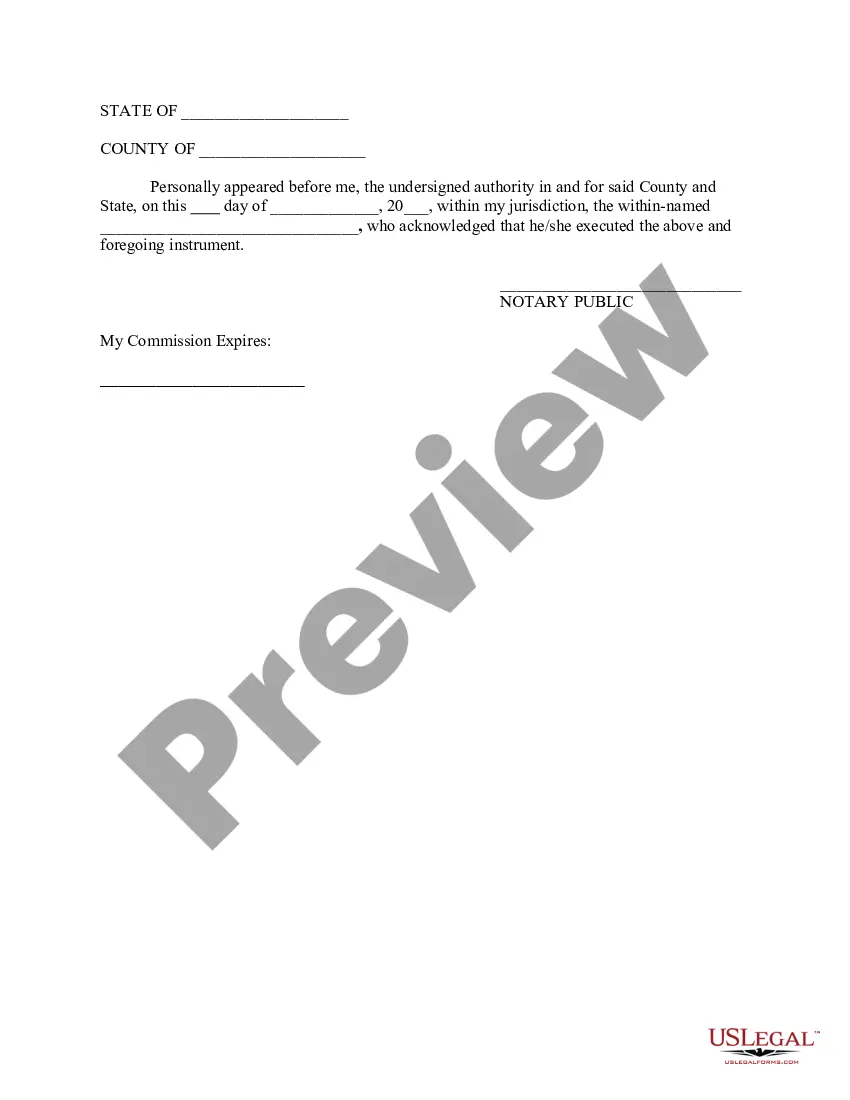

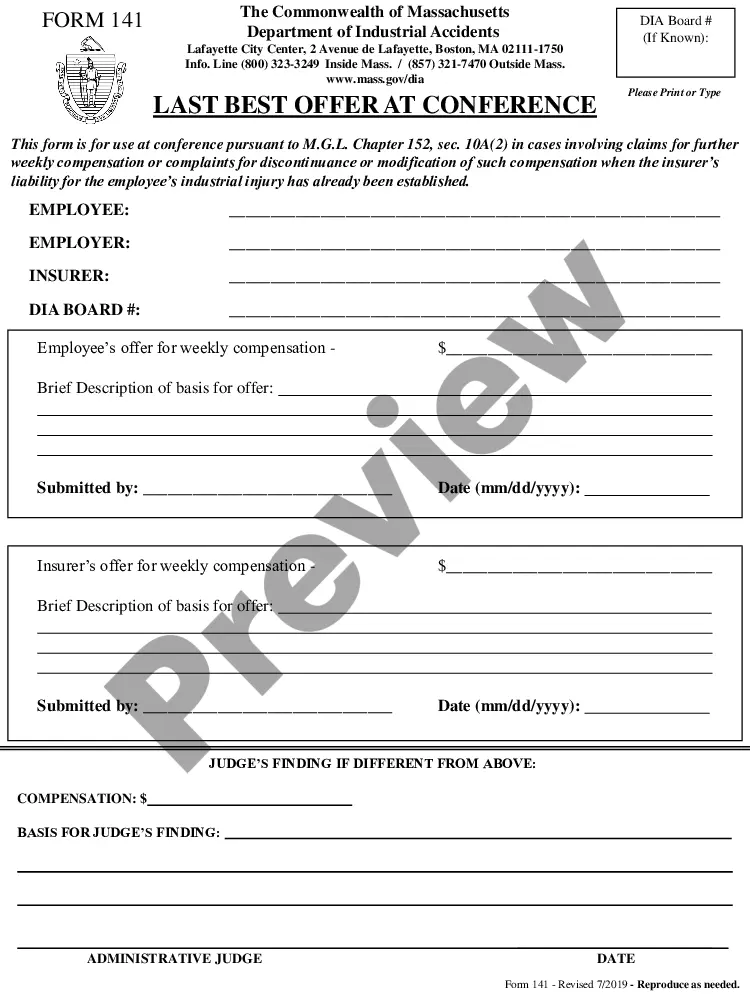

If an executor or administrator has not been appointed, to receive a new title and registration in your name, submit the following to DMV: Certified or notarized death certificate. Vehicle title. ... Proof of address. Payment of appropriate fees. ... One of the following:

No will and no probate In cases when either no one has applied to be the administrator of the estate, the probate court has deemed it not necessary, or the probate court has determined administration of the decedent's property is not required, the vehicle title will be transferred through heirship.

If there isn't a will or if there is a will, but there isn't a need to go through the time and expense of probating the will, then the heirs or heirs of the person who died can get the title transferred by using Form 130-U along with Form VTR-262 ?Affidavit of Heirship for a Motor Vehicle?.

To claim the vehicle, the beneficiary must submit an Application for Texas Title and/or Registration (Form 130-U), the $28 or $33 title application fee, the Texas title in the deceased owner's name listing the beneficiary, and a death certificate.

In addition to completing Form 130-U, Application for Texas Title and/or Registration (PDF), both the donor and person receiving the motor vehicle must complete a required joint notarized Form 14-317, Affidavit of Motor Vehicle Gift Transfer, describing the transaction and the relationship between the donor and ...

The family member needs the title, a certified copy of the death certificate or the letter (form VR-278 or VR-264P) sent by the MVA notifying the surviving vehicle owner that the title must be transferred to remove the deceased owners name.