The District of Columbia Instruction Sheet for Application for Certificate of Authority for Foreign Non-Profit Corporation Form FNP-1 is a document used by a foreign non-profit corporation to apply for a Certificate of Authority in the District of Columbia. This document provides the instructions and requirements for submitting an application for a Certificate of Authority. It includes information on who is eligible to apply, the documents to be included in the application, the fees required for the application, and the timeframe for completing the process. There are two forms of the District of Columbia Instruction Sheet for Application for Certificate of Authority for Foreign Non-Profit Corporation Form FNP-1: one for non-profit corporations with an address in the District of Columbia and one for non-profit corporations with an address outside the District of Columbia.

District of Columbia Instruction Sheet for Application for Certificate of Authority for Foreign Non-Profit Corporation Form FNP-1

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

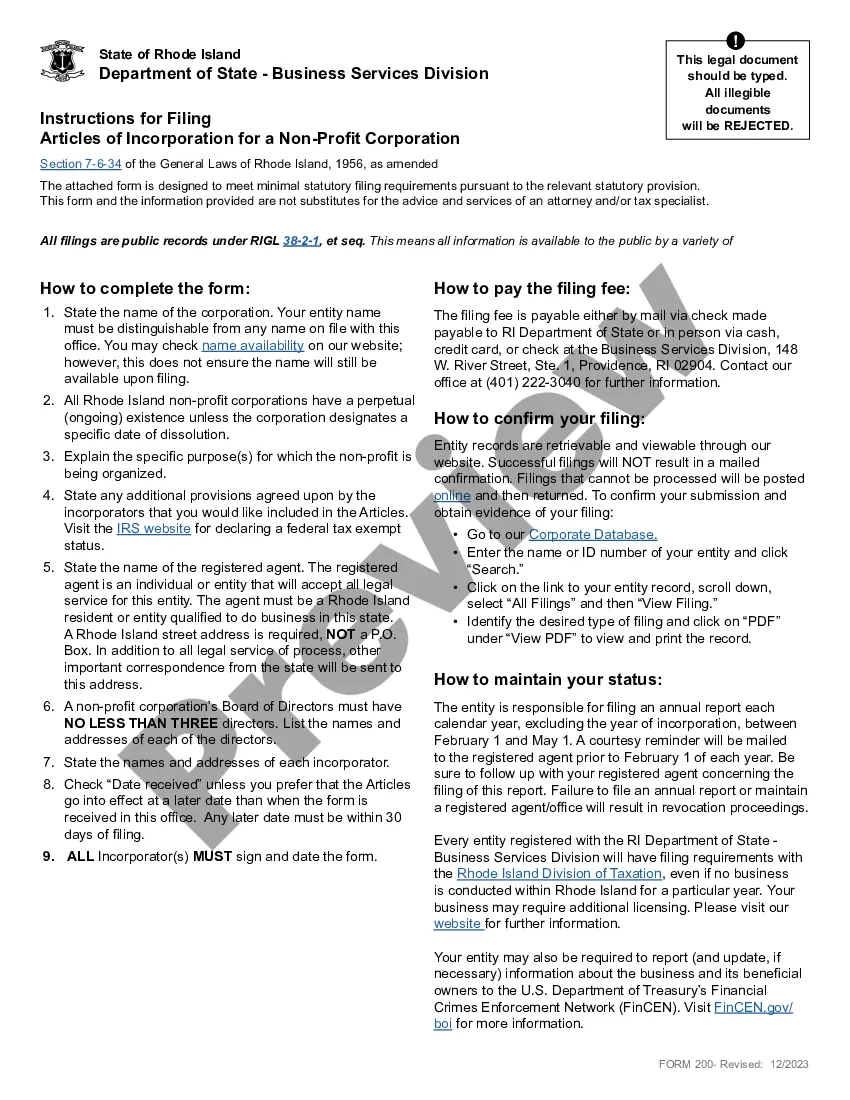

How to fill out District Of Columbia Instruction Sheet For Application For Certificate Of Authority For Foreign Non-Profit Corporation Form FNP-1?

If you’re looking for a method to correctly prepare the District of Columbia Instruction Sheet for Application for Certificate of Authority for Foreign Non-Profit Corporation Form FNP-1 without employing a lawyer, then you’ve arrived at the perfect destination.

US Legal Forms has established itself as the most comprehensive and trustworthy repository of official templates for all personal and business scenarios. Every document you discover on our online service is crafted in accordance with national and state laws, ensuring that your paperwork is correct.

Another great advantage of US Legal Forms is that you never misplace the documents you acquired - you can find any of your downloaded forms in the My documents section of your profile whenever necessary.

- Verify that the document displayed on the page aligns with your legal circumstances and state laws by examining its description or exploring the Preview mode.

- Enter the form name in the Search tab at the top of the page and select your state from the list to find an alternative template in case of any discrepancies.

- Confirm the content once more and click Buy now when you feel assured about the paperwork’s adherence to all requirements.

- Log in to your account and click Download. If you do not have an account yet, sign up for the service and select a subscription plan.

- Use your credit card or the PayPal option to buy your US Legal Forms subscription. The form will be ready for download immediately after.

- Choose the format you want to save your District of Columbia Instruction Sheet for Application for Certificate of Authority for Foreign Non-Profit Corporation Form FNP-1 in, and download it by clicking the appropriate button.

- Upload your template to an online editor for quick completion and signing, or print it out to prepare a physical copy manually.

Form popularity

FAQ

To obtain a copy of your articles of incorporation in D.C., you should contact the D.C. Department of Consumer and Regulatory Affairs (DCRA). They will provide you with the necessary information and forms, which can often be completed online. Additionally, consider using the District of Columbia Instruction Sheet for Application for Certificate of Authority for Foreign Non-Profit Corporation Form FNP-1 to guide you through the process. This will help ensure you have all the required documentation.

To become a 501(c)(3) organization in Washington, D.C., start by forming a non-profit corporation. You can follow the instructions in the District of Columbia Instruction Sheet for Application for Certificate of Authority for Foreign Non-Profit Corporation Form FNP-1. Once established, you will need to apply for federal tax-exempt status with the IRS. This process ensures you meet all necessary requirements, allowing you to operate as a recognized charitable organization.

The 33% rule refers to the guideline suggesting that a nonprofit organization should only spend up to one-third of its total budget on administrative costs. By adhering to this rule, organizations ensure more funds are directed toward programs and services that fulfill their mission. Understanding this rule is vital for sustainable nonprofit management and maintaining donor trust. For your foreign nonprofit, review the District of Columbia Instruction Sheet for Application for Certificate of Authority for Foreign Non-Profit Corporation Form FNP-1 to ensure compliance with local regulations.

Yes, you can begin and operate a nonprofit by yourself. However, most states, including the District of Columbia, require at least three board members for legal compliance. Forming a board can enhance your nonprofit's credibility and provide diverse perspectives for decision-making. Ensure that you follow the District of Columbia Instruction Sheet for Application for Certificate of Authority for Foreign Non-Profit Corporation Form FNP-1 for proper registration and ongoing compliance.

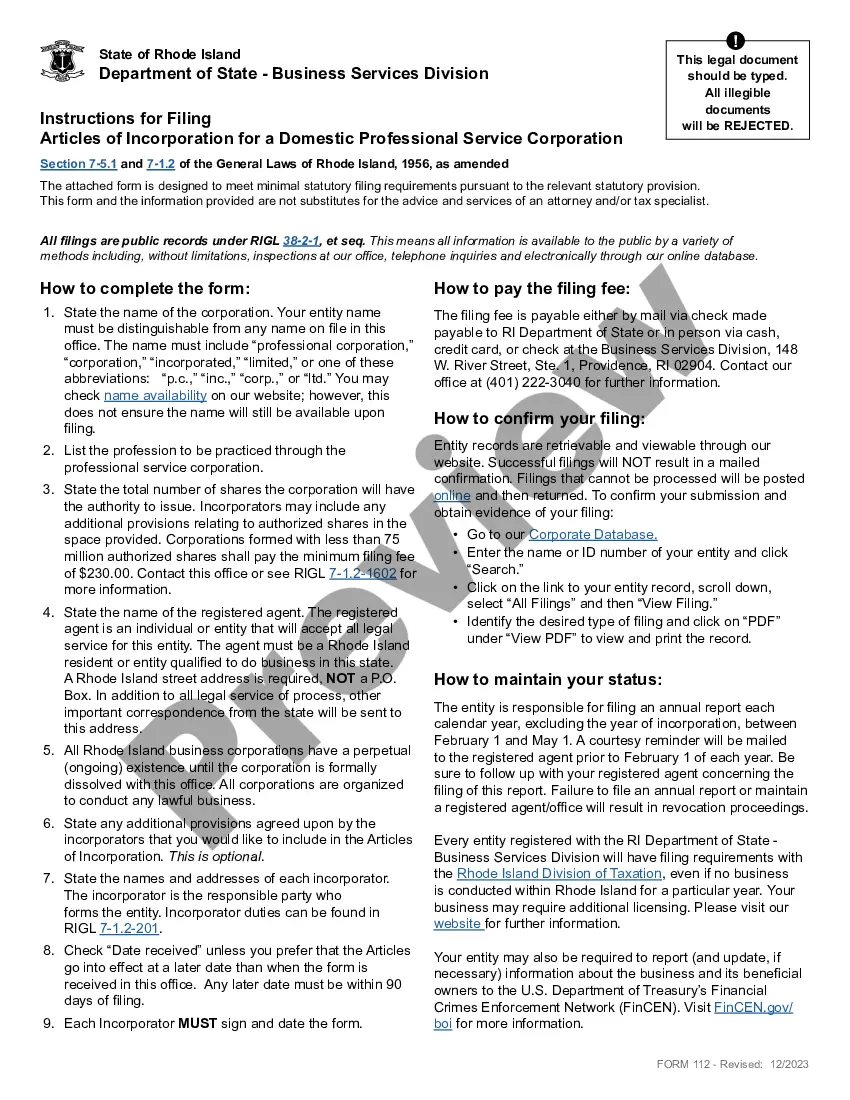

To register a foreign nonprofit in the United States, you must first complete the necessary paperwork, including the District of Columbia Instruction Sheet for Application for Certificate of Authority for Foreign Non-Profit Corporation Form FNP-1. After filling out the form, submit it along with any required documentation and fees to the appropriate state authority. It is crucial to ensure compliance with state laws and regulations, as each state may have different requirements. Utilizing platforms like uslegalforms can simplify this process and help you navigate the forms accurately.

In the District of Columbia, a certificate of good standing typically remains valid for a period of one year from the date of issuance. However, it is advisable to check with the Department of Consumer and Regulatory Affairs for any updates or specific conditions that may affect its validity. Utilizing the District of Columbia Instruction Sheet for Application for Certificate of Authority for Foreign Non-Profit Corporation Form FNP-1 can help ensure you're aware of all related timelines.

No, a certificate of good standing does not come from the IRS. It is issued by the Secretary of State or a similar state agency, confirming your organization is in compliance with state requirements. Consulting the District of Columbia Instruction Sheet for Application for Certificate of Authority for Foreign Non-Profit Corporation Form FNP-1 can provide clarity on obtaining this important document in DC.

To obtain a certificate of good standing in the District of Columbia, you must request it from the Department of Consumer and Regulatory Affairs. Ensure that your organization is in compliance with all applicable taxes and regulations before making the request. Referencing the District of Columbia Instruction Sheet for Application for Certificate of Authority for Foreign Non-Profit Corporation Form FNP-1 can assist you with any requirements you need to meet.

An alternative to a certificate of good standing is a Certificate of Existence or a Certificate of Status, which serves a similar purpose in verifying the legal status of an organization. This certificate can provide information about whether the organization is authorized to conduct business within the state. It is essential to consult resources such as the District of Columbia Instruction Sheet for Application for Certificate of Authority for Foreign Non-Profit Corporation Form FNP-1 for specific details related to DC.

To register a foreign LLC in the District of Columbia, you must file an application with the DC Department of Consumer and Regulatory Affairs. This process involves providing information about your LLC, including its name, principal address, and purpose. Utilizing the District of Columbia Instruction Sheet for Application for Certificate of Authority for Foreign Non-Profit Corporation Form FNP-1 can also offer you valuable directions on completing your registration.