This is an official form from the District of Columbia Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by District of Columbia statutes and law.

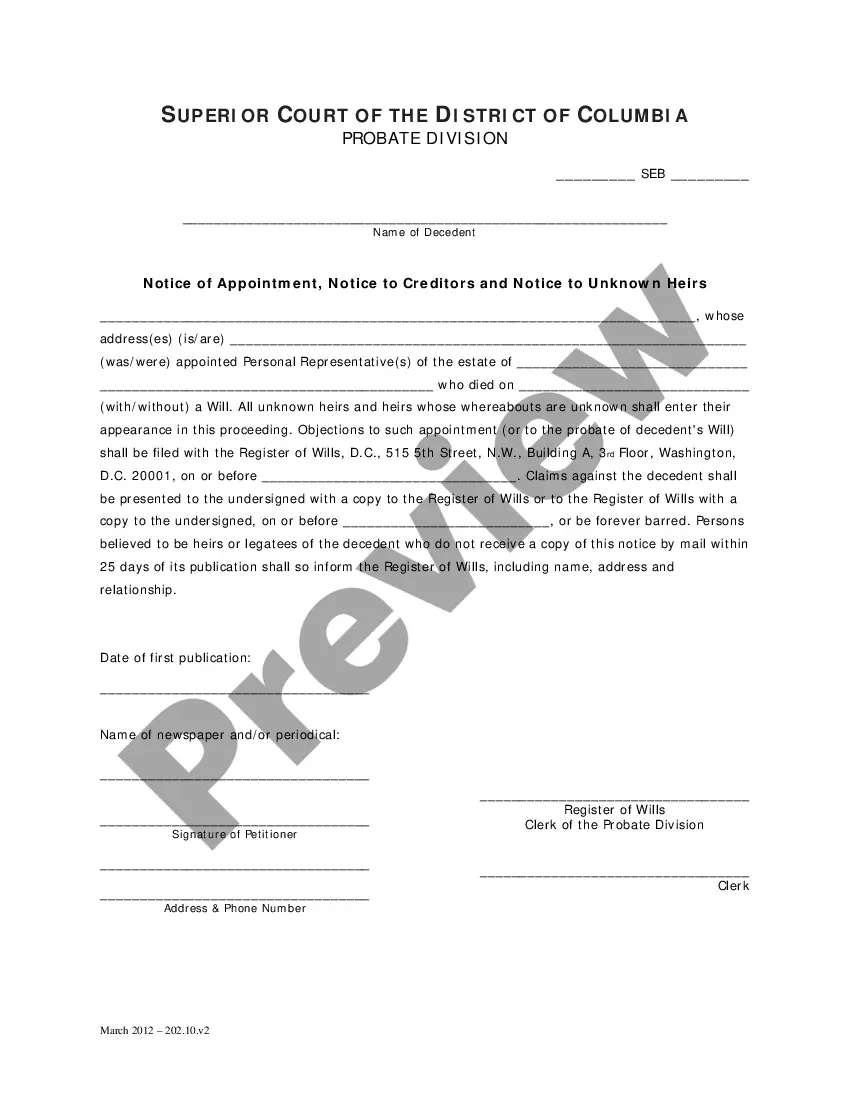

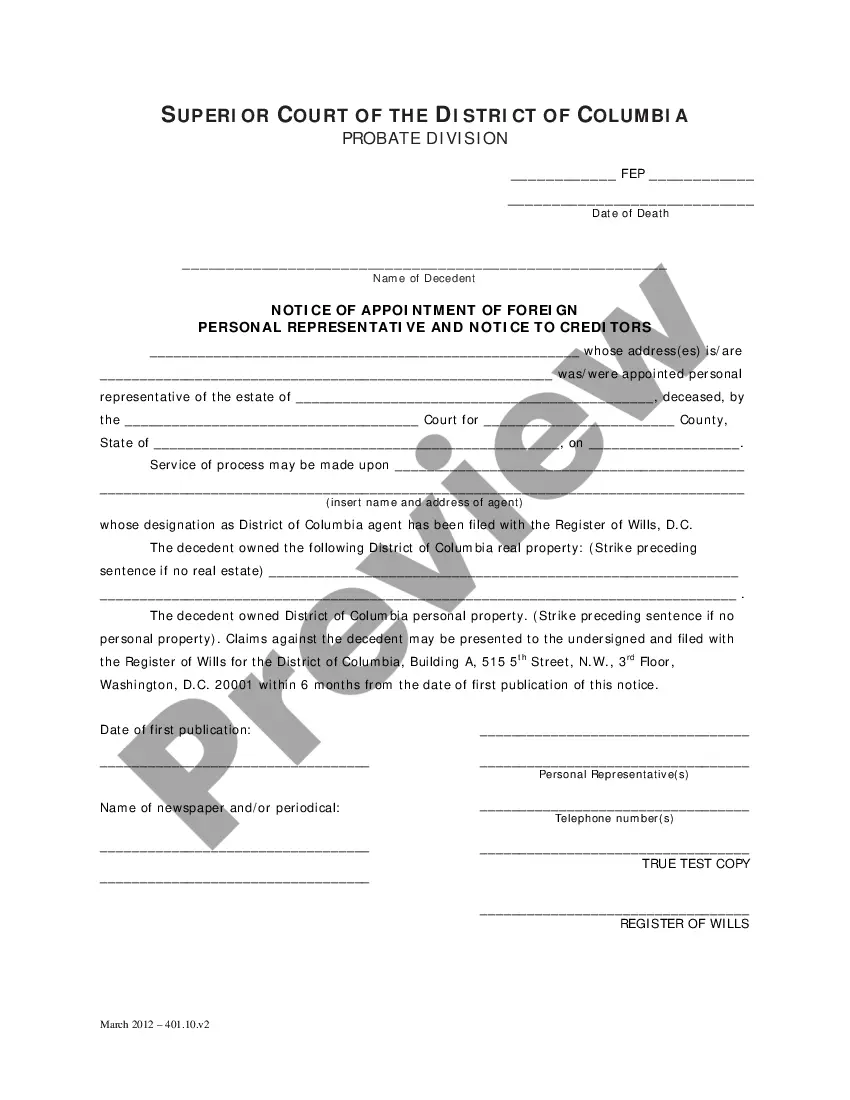

District of Columbia Notice of Appointment, Notice of Creditors and Notice of Creditors and Notice to Unknown Heirs

Description

How to fill out District Of Columbia Notice Of Appointment, Notice Of Creditors And Notice Of Creditors And Notice To Unknown Heirs?

The larger volume of documentation you are required to complete - the more anxious you become.

You can acquire numerous District of Columbia Notice of Appointment, Notice of Creditors, and Notice to Unknown Heirs forms online, but you might be uncertain which ones to trust.

Remove the difficulty and simplify the process of locating templates with US Legal Forms. Obtain expertly prepared documents that comply with state regulations.

Fill in the required information to set up your account and process the payment using your PayPal or credit card. Choose a convenient file format and obtain your copy. Access all documents you download in the My documents section. Simply navigate there to complete a new copy of the District of Columbia Notice of Appointment, Notice of Creditors, and Notice to Unknown Heirs. Even with professionally crafted forms, it's still advisable to consult your local attorney to verify the completed document is correctly filled out. Achieve more for less with US Legal Forms!

- If you are already a subscriber to US Legal Forms, Log In to your account, and you will find the Download option on the webpage for the District of Columbia Notice of Appointment, Notice of Creditors, and Notice to Unknown Heirs.

- If this is your first time using our service, follow these steps to complete the registration process.

- Verify if the District of Columbia Notice of Appointment, Notice of Creditors, and Notice to Unknown Heirs is applicable in your jurisdiction.

- Reconfirm your selection by reviewing the details or by utilizing the Preview feature if available for the chosen document.

- Click Buy Now to initiate the registration and choose a pricing plan that meets your requirements.

Form popularity

FAQ

In the District of Columbia, a small estate is typically defined as an estate valued at $40,000 or less. This threshold allows for a simplified probate process, bypassing some of the formalities associated with larger estates. The District of Columbia Notice to Unknown Heirs may still be necessary, but the process can be less cumbersome. US Legal Forms offers helpful templates to streamline small estate procedures and ensure compliance with local laws.

In the District of Columbia, the probate tax applies to the estate's value and varies depending on the total assets involved. Generally, the probate tax is assessed on the gross estate prior to any deductions. Understanding these tax implications is essential to properly navigate the District of Columbia Notice of Appointment of a personal representative. For more details on calculating the probate tax and associated fees, you can consult with professionals or use helpful resources from US Legal Forms.

Writing a notice to creditors involves providing clear and specific information about the estate and the deadline for claims. You should include details such as the decedent's name, the case number, and the specific notice regarding the District of Columbia Notice of Creditors. Be sure to notify creditors of their rights and the process for submitting their claims. Utilizing resources from US Legal Forms can guide you through creating an accurate and compliant notice.

The DC Code 20 704 B outlines the procedures required for the District of Columbia Notice of Appointment. It details the legal requirements for appointing a personal representative in probate cases. Following these guidelines ensures that the interests of all parties, including creditors and heirs, are respected and protected. This section is crucial for managing estates effectively within the District.

To locate a notice to creditors, you should start by checking public records in the District of Columbia. You can visit the Office of the Register of Wills or their official website, where notices related to the District of Columbia Notice of Appointment, Notice of Creditors, and Notice to Unknown Heirs are often posted. Additionally, exploring local legal resources and online databases can provide access to current notices and updates. Platforms like USLegalForms can help simplify this process by offering templates and guidance for understanding your rights and responsibilities regarding these important legal documents.

To avoid probate in the District of Columbia, individuals can use strategies such as creating living trusts, joint ownership of property, or naming beneficiaries on accounts. These methods can help bypass the formal probate process and simplify asset transfer after death. Awareness of estate planning options can save time and reduce costs associated with probate. Consulting with a legal professional can further assist in crafting an effective estate plan.

In the District of Columbia, a formal District of Columbia Notice of Creditors is sent to inform creditors of the probate proceedings. This notice allows creditors to present their claims against the estate. Proper notification is crucial for ensuring that all debts are settled before the distribution of assets. Utilizing platforms like uslegalforms can help streamline this process and ensure compliance with legal requirements.

Yes, probate is often required in the District of Columbia, especially if the deceased owned assets solely in their name. The process ensures proper distribution of assets and notification of creditors through the District of Columbia Notice of Creditors. However, certain small estates may qualify for simplified procedures. It is advisable to consult a professional to determine the necessity of probate in your specific situation.

Section 20-704 of the DC Code addresses the appointment and qualification of personal representatives for estates. This section outlines the necessary procedures for managing the estate in the District of Columbia, including the issuance of the District of Columbia Notice of Appointment. Understanding this section is vital for ensuring compliance with state laws during the probate process. It helps maintain clarity for all parties involved.

Probate Rule 125 in the District of Columbia streamlines the process of serving notice to interested parties. This rule outlines the requirements for notifying heirs and creditors about the probate proceedings. Following this guideline ensures proper execution of the District of Columbia Notice of Creditors and helps prevent disputes. This proactive communication is essential for a smooth probate process.