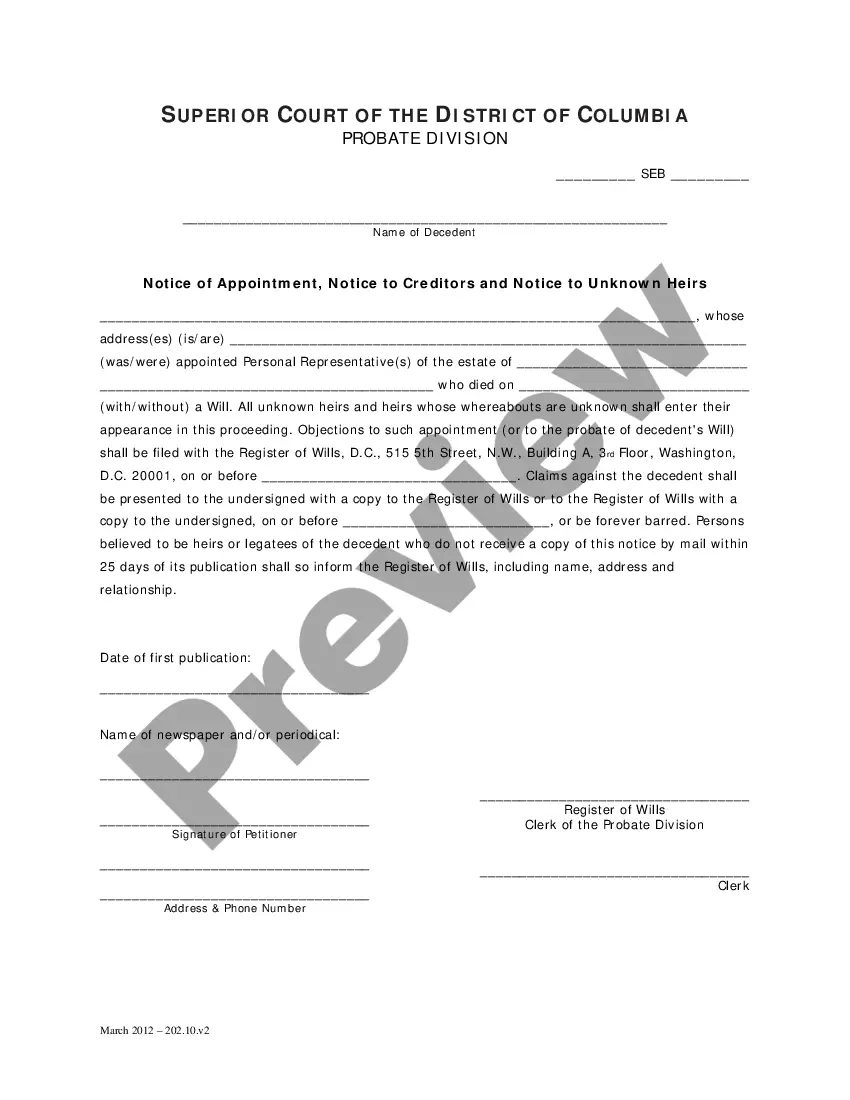

This is an official form from the District of Columbia Court System, which complies with all applicable laws and statutes. This Probate form is for estates of those who died between July 1, 1995 and the present. USLF amends and updates forms as is required by District of Columbia statutes and law.

District of Columbia Notice of Appointment, Notice to Creditors and Notice to Unknown Heirs

Description

How to fill out District Of Columbia Notice Of Appointment, Notice To Creditors And Notice To Unknown Heirs?

The greater number of documents you need to create - the more anxious you feel.

You can find a vast array of templates for the District of Columbia Notice of Appointment, Notice to Creditors, and Notice to Unknown Heirs online, but you may be unsure which ones to trust.

Eliminate the stress and simplify the process of finding samples by using US Legal Forms. Obtain properly prepared documents that are designed to comply with state regulations.

Submit the required information to create your account and settle the payment for your order using PayPal or a credit card. Choose a preferred file format and download your document. Access all the files you acquire in the My documents section. Simply navigate there to create a new copy of your District of Columbia Notice of Appointment, Notice to Creditors, and Notice to Unknown Heirs. Even when using well-crafted templates, it’s still advisable to consult a local attorney to review your completed document to ensure it is accurately filled out. Achieve more for less with US Legal Forms!

- If you currently possess a US Legal Forms membership, Log In to your account, and you will notice the Download button on the District of Columbia Notice of Appointment, Notice to Creditors, and Notice to Unknown Heirs page.

- If you haven't utilized our service before, complete the registration process with these steps.

- Ensure the District of Columbia Notice of Appointment, Notice to Creditors, and Notice to Unknown Heirs is acceptable in your jurisdiction.

- Verify your choice by examining the description or by utilizing the Preview option if available for the selected document.

- Click Buy Now to initiate the registration process and select a pricing plan that meets your needs.

Form popularity

FAQ

In DC, a small estate typically refers to an estate with a value of less than $40,000, which does not require full probate proceedings. Small estates can often be settled more swiftly through simplified procedures that bypass some of the usual legal requirements. When preparing for estates under this threshold, the District of Columbia Notice of Appointment, Notice to Creditors, and Notice to Unknown Heirs can simplify the process. USLegalForms offers invaluable resources to help manage small estate situations seamlessly.

A notice to creditors serves as an official announcement that a deceased person's estate is undergoing probate. This notice informs all potential creditors of the estate, providing them an opportunity to file any claims against the estate’s assets. In the context of the District of Columbia Notice of Appointment, Notice to Creditors, and Notice to Unknown Heirs, this document is crucial for protecting the rights of both creditors and heirs. Using USLegalForms can streamline the creation and distribution of these notices effectively.

In the District of Columbia, the probate tax applies to the value of the estate being probated. This tax is calculated based on the total assets of the estate, excluding certain deductions and allowances. When dealing with estate matters, understanding the District of Columbia Notice of Appointment, Notice to Creditors, and Notice to Unknown Heirs becomes vital, as these documents can affect the tax process. Consulting resources like USLegalForms can help clarify these costs and facilitate the probate process.

The probate process for a will in the District of Columbia typically takes six months to a year, depending on various factors. These factors include the complexity of the estate, any disputes among heirs, and adherence to the requirements set forth in the District of Columbia Notice of Appointment. Timely communication with creditors and other parties can help expedite the process. Consider exploring USLegalForms for clear guidance to streamline your steps in this procedure.

In the District of Columbia, the code related to unlawful disclosure is outlined in D.C. Code § 44-310. This section addresses breaches of confidentiality and the unauthorized sharing of sensitive information. If you are involved in the estate management process, be mindful of how this relates to your District of Columbia Notice of Appointment, Notice to Creditors and Notice to Unknown Heirs requirements. Understanding these codes ensures you protect both yourself and the estate.

To write a notice to creditors, begin by clearly stating it is a Notice to Creditors concerning the estate of the deceased. Include the name of the deceased, date of death, and a request for creditors to submit their claims. It is important to specify the deadline for claims submission, aligning with the District of Columbia Notice of Appointment requirements. Utilizing resources like USLegalForms can simplify this process, ensuring you meet all legal standards.

DC Code 22 704 addresses the criminal penalties for certain violations related to estate management. It emphasizes the significance of fulfilling obligations, including issuing the District of Columbia Notice of Appointment, Notice to Creditors, and Notice to Unknown Heirs. Being aware of these legal repercussions can motivate executors to adhere to all probate procedures carefully.

To become an executor of an estate in DC, you need to be appointed by the probate court. This involves filing a petition and providing the necessary documentation to the court, which includes the District of Columbia Notice of Appointment, Notice to Creditors, and Notice to Unknown Heirs. Using resources from USLegalForms can streamline the application process and ensure completeness.

DC Code 20 101 G defines the criteria for intestacy and the distribution of assets when a person dies without a will. This code highlights the importance of issuing the District of Columbia Notice of Appointment and the Notices to Creditors and Unknown Heirs to ensure proper notification and administration of the estate. Familiarity with this section can help navigate the complexities of intestate succession.

Section 20 704 of the DC Code pertains to the administration of estates after the appointment of a personal representative. This section further explains the responsibilities of executors and includes provisions for filing the District of Columbia Notice of Appointment, Notice to Creditors, and Notice to Unknown Heirs. Understanding these details can help in managing the estate effectively.