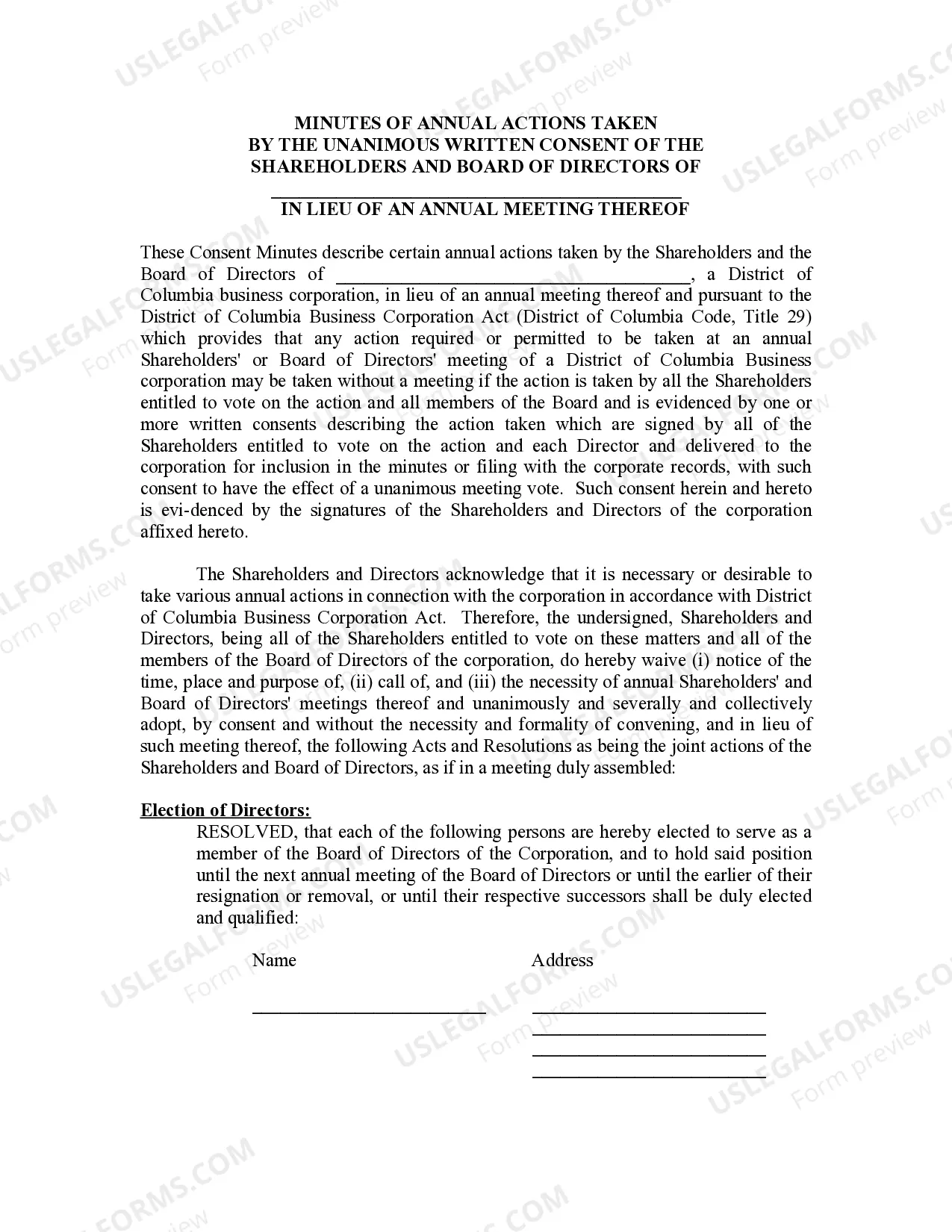

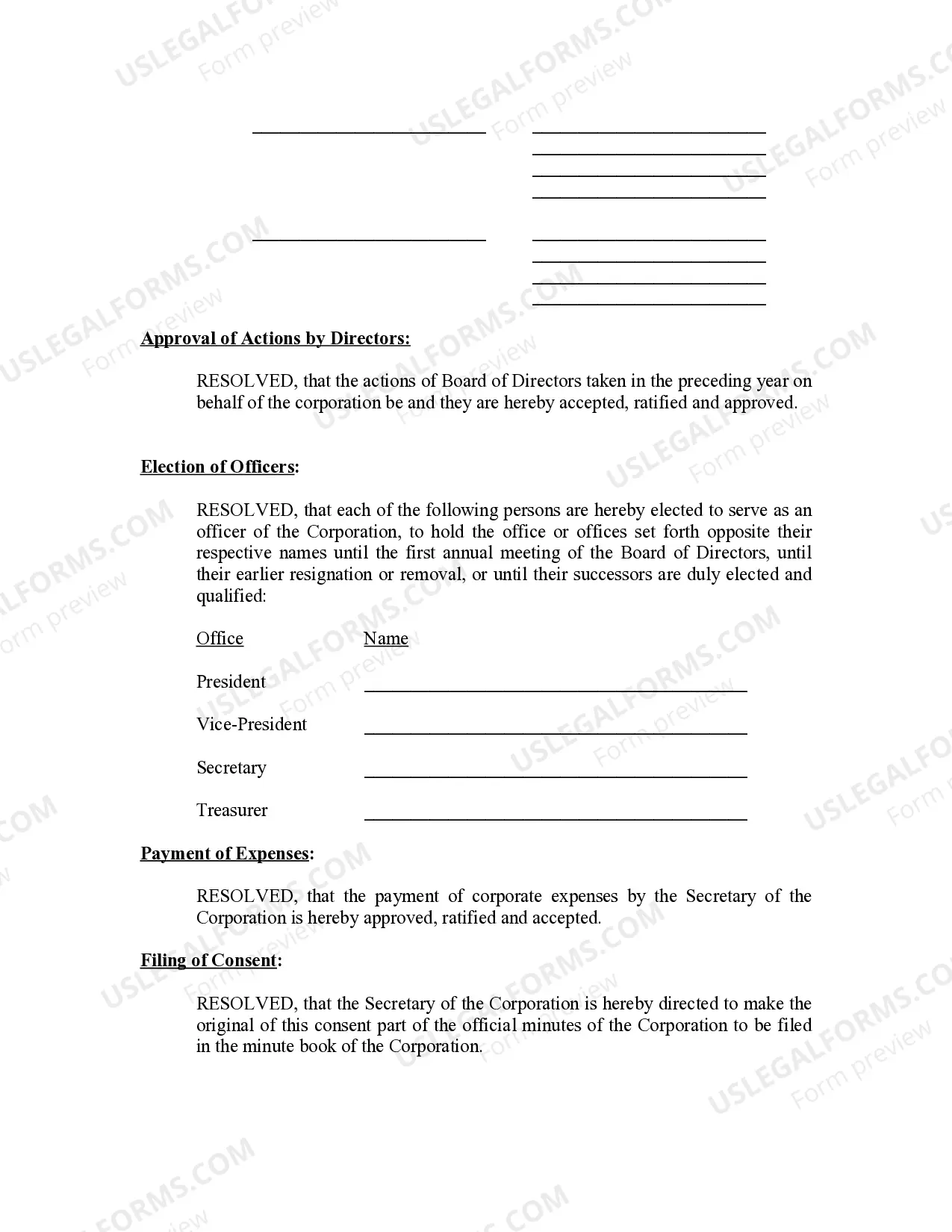

The Annual Minutes form is used to document any changes or other organizational activities of the Corporation during a given year.

District of Columbia Annual Minutes

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out District Of Columbia Annual Minutes?

The greater the number of documents you have to produce - the more anxious you feel.

You can discover numerous Annual Minutes - District of Columbia templates available online, but it's hard to know which ones to trust.

Eliminate the frustration to make finding examples much easier with US Legal Forms.

Enter the requested information to set up your profile and complete the transaction using PayPal or a credit card. Opt for a convenient document format and obtain your template. You can find every sample you've secured in the My documents section. Simply visit to create a new version of your Annual Minutes - District of Columbia. Even with expertly drafted templates, it is still essential to consider consulting a local attorney to review the completed document to ensure accuracy. Achieve more with less effort using US Legal Forms!

- If you already own a subscription to US Legal Forms, Log In to your account, and you will notice the Download button on the Annual Minutes - District of Columbia page.

- If you are a new user on our platform, complete the registration process by following these steps.

- Ensure the Annual Minutes - District of Columbia is applicable in your state.

- Verify your selection by reviewing the description or using the Preview option if available for the chosen document.

- Click Buy Now to initiate the registration process and select a pricing plan that meets your needs.

Form popularity

FAQ

The District of Columbia has seen periods of population decline due to several reasons, including rising living costs and changes in government employment. Economic factors can influence decisions where residents choose to relocate. Analyzing trends in your District of Columbia Annual Minutes can help organizations understand these shifts and plan accordingly for future growth.

The population of the District of Columbia has varied over the decades. Various factors, including job opportunities, education, and urban development, contribute to these changes. Documenting these shifts is advantageous, especially in your District of Columbia Annual Minutes, which can reflect the organization's adjustments to meet the demands of a changing population.

Washington, D.C. has shown rapid growth in specific areas, particularly in technology and development sectors. This growth can attract new residents, but it may also lead to challenges such as housing shortages. Keeping track of these developments through your District of Columbia Annual Minutes can provide you with valuable insights into the city's trajectory.

The minutes of the board of directors' annual meeting serve as a formal record of discussions, decisions, and actions taken during the meeting. These minutes are crucial for accountability and future reference. Utilizing a service like USLegalForms can help you ensure that your District of Columbia Annual Minutes adhere to legal standards and capture all necessary details.

The population of the District of Columbia changes annually, influenced by various socio-economic factors. Government data provides insights into this dynamic population trend. Tracking these figures can be beneficial for local businesses and organizations, particularly when they prepare their District of Columbia Annual Minutes, which encapsulate critical decisions made each year.

Washington, D.C. has seen fluctuations in its population over recent years. It has experienced periods of growth as well as decline. Understanding these trends is important, especially when considering factors like the District of Columbia Annual Minutes. These minutes may reflect significant changes in the local economy and demographics.

DC form FR 500 is a tax form used for the filing of the Franchise Tax in the District of Columbia. This form is essential for both corporations and limited liability companies, and it helps ensure compliance with local laws. Keeping your records and your District of Columbia Annual Minutes organized will ease the filing process.

Entities operating in the District of Columbia that are either domestic or foreign corporations need to file a franchise tax return. This requirement ensures that all businesses contribute their fair share to the local economy. To streamline your obligations, consider integrating uslegalforms to manage your annual minutes and tax filings effectively.

Individuals and businesses that own personal property in the District of Columbia must file a personal property tax return. This includes items such as equipment, furniture, and fixtures with a certain value. Proper documentation and timely filing, including your District of Columbia Annual Minutes, can save you from penalties.

For tax purposes, the standard deduction for the District of Columbia can vary based on filing status. It's important for residents to be aware of these deductions, as they can significantly impact tax calculations. Utilizing services like uslegalforms can help you accurately determine your tax obligations and prepare your District of Columbia Annual Minutes.