Connecticut Form - Term Sheet for Series C Preferred Stock

Description

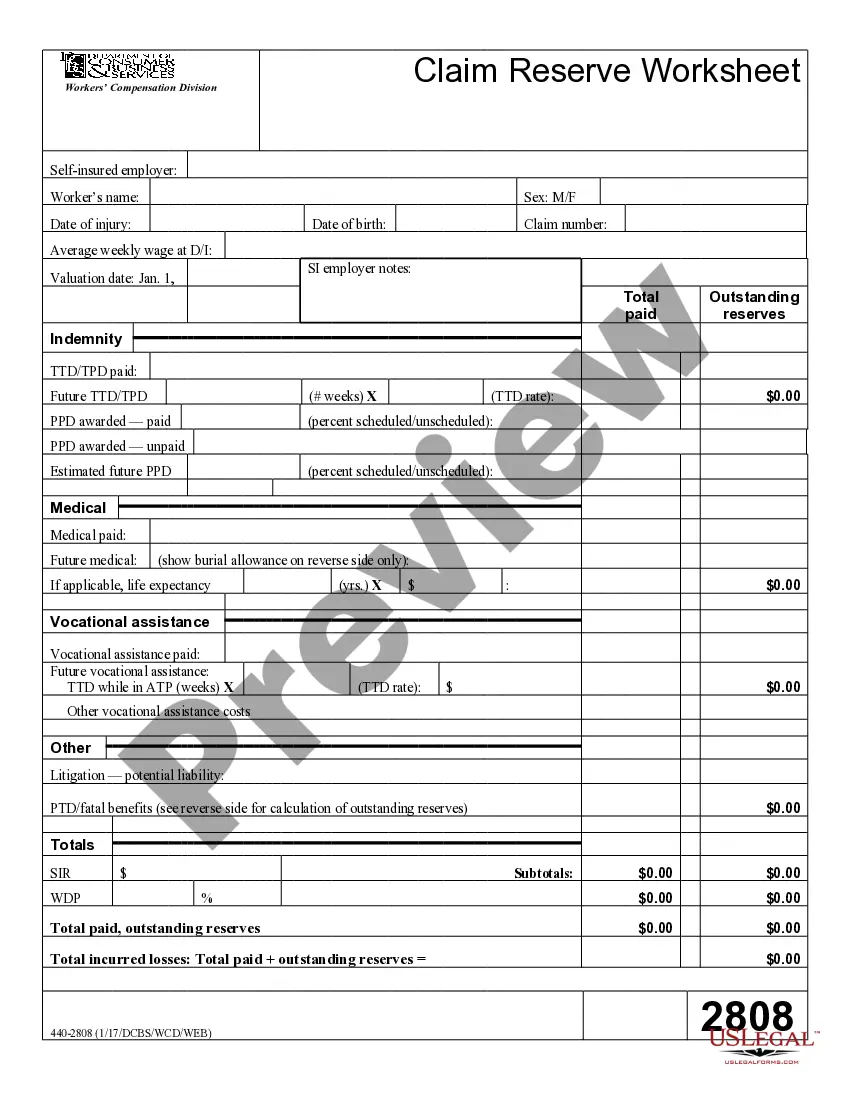

How to fill out Form - Term Sheet For Series C Preferred Stock?

If you wish to comprehensive, download, or produce lawful papers web templates, use US Legal Forms, the largest selection of lawful forms, that can be found on the web. Use the site`s basic and hassle-free lookup to get the paperwork you require. Various web templates for enterprise and individual uses are categorized by classes and states, or keywords. Use US Legal Forms to get the Connecticut Form - Term Sheet for Series C Preferred Stock in just a number of mouse clicks.

Should you be previously a US Legal Forms buyer, log in to your bank account and click on the Down load switch to find the Connecticut Form - Term Sheet for Series C Preferred Stock. You can even entry forms you in the past acquired inside the My Forms tab of your respective bank account.

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form for that right metropolis/region.

- Step 2. Use the Review solution to look over the form`s content. Never overlook to learn the explanation.

- Step 3. Should you be not satisfied with the kind, utilize the Search industry near the top of the display to find other variations of your lawful kind web template.

- Step 4. When you have identified the form you require, click on the Get now switch. Pick the costs program you favor and add your qualifications to sign up to have an bank account.

- Step 5. Procedure the purchase. You can utilize your Мisa or Ьastercard or PayPal bank account to complete the purchase.

- Step 6. Find the file format of your lawful kind and download it in your system.

- Step 7. Complete, revise and produce or indication the Connecticut Form - Term Sheet for Series C Preferred Stock.

Every lawful papers web template you purchase is your own property for a long time. You may have acces to each kind you acquired with your acccount. Click the My Forms segment and decide on a kind to produce or download once more.

Compete and download, and produce the Connecticut Form - Term Sheet for Series C Preferred Stock with US Legal Forms. There are thousands of skilled and status-certain forms you can utilize for your personal enterprise or individual needs.

Form popularity

FAQ

Preferred stock is a type of stock that has characteristics of both stocks and bonds. Like bonds, preferred shares make cash payouts, often at a higher yield than bonds, while offering higher dividend returns and less risk than common stock.

Term sheets for venture capital financings include detailed provisions describing the terms of the preferred stock being issued to investors. Some terms are more important than others. The following brief description of certain material terms divides them into two categories: economic terms and control rights.

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.

Preference shares, more commonly referred to as preferred stock, are shares of a company's stock with dividends that are paid out to shareholders before common stock dividends are issued. If the company enters bankruptcy, preferred stockholders are entitled to be paid from company assets before common stockholders.

A Preference Shares Investment Term Sheet is a record of discussions between the founders of a business and an investor for potential investment by preference shares. A Preference Shares Investment Term Sheet is not legally binding, except for confidentiality and exclusivity obligations (if applicable).

Series C Preference Shares means the number of shares of Parent Common Stock obtained by adding (a) the number of shares of Parent Common Stock equal to the product of (i) the number of shares of Series C Preferred Stock outstanding immediately prior to the Effective Time, multiplied by (ii) the quotient of (A) the sum ...

What Is a Term Sheet? A term sheet is a nonbinding agreement that shows the basic terms and conditions of an investment. The term sheet serves as a template and basis for more detailed, legally binding documents.

4 Steps to Create a Term Sheet Investment amount. Timing. Company valuation. Form of investment. Stock option plans. Parties' rights and responsibilities. Board representation. Time frame for deal completion.