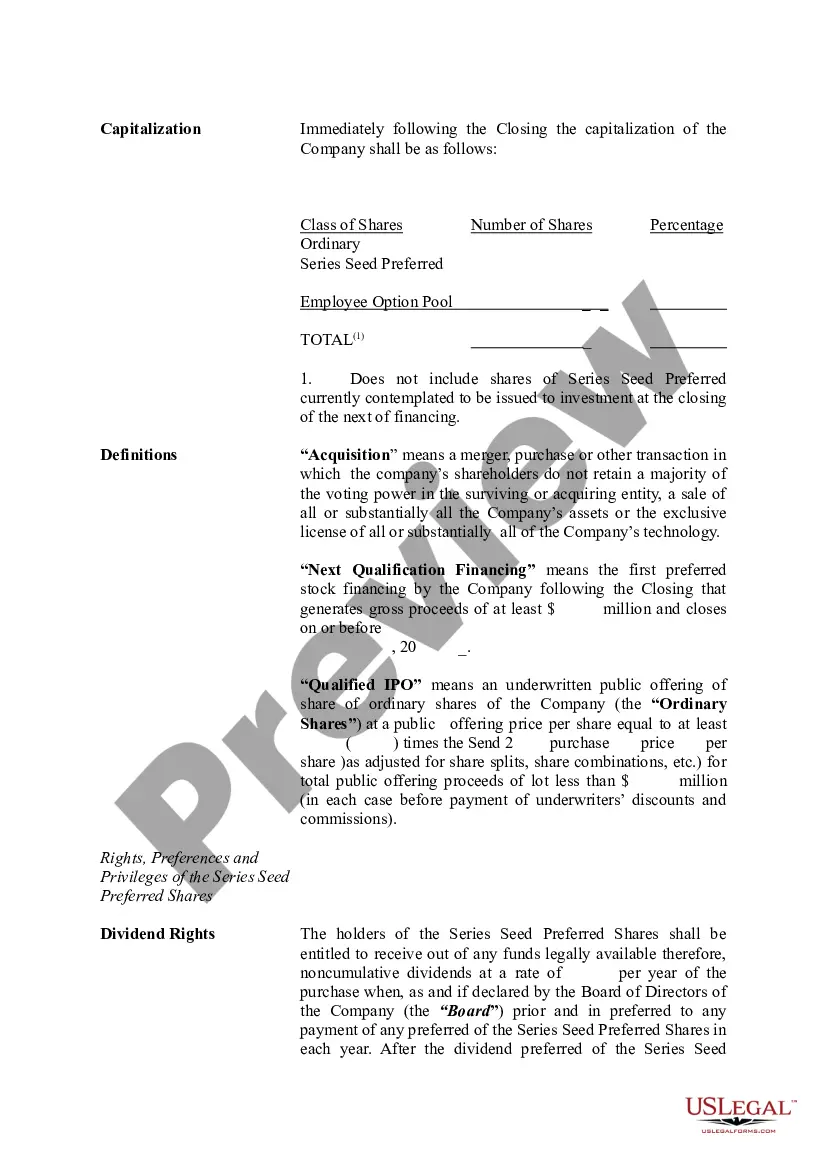

Connecticut Term Sheet - Series Seed Preferred Share for Company

Description

How to fill out Term Sheet - Series Seed Preferred Share For Company?

US Legal Forms - one of several greatest libraries of legitimate forms in America - provides an array of legitimate papers layouts you may download or produce. Using the web site, you can find a huge number of forms for business and person functions, sorted by categories, claims, or key phrases.You will find the most up-to-date models of forms like the Connecticut Term Sheet - Series Seed Preferred Share for Company in seconds.

If you already possess a registration, log in and download Connecticut Term Sheet - Series Seed Preferred Share for Company through the US Legal Forms library. The Download switch will appear on each and every develop you see. You have accessibility to all in the past downloaded forms inside the My Forms tab of your own profile.

In order to use US Legal Forms the very first time, here are easy directions to obtain began:

- Be sure you have picked out the proper develop for your town/region. Go through the Preview switch to examine the form`s articles. Browse the develop information to ensure that you have chosen the proper develop.

- In the event the develop doesn`t fit your specifications, make use of the Research area on top of the screen to get the one which does.

- In case you are pleased with the shape, confirm your decision by clicking on the Buy now switch. Then, select the pricing program you favor and provide your credentials to register on an profile.

- Procedure the purchase. Use your Visa or Mastercard or PayPal profile to accomplish the purchase.

- Pick the format and download the shape on your own system.

- Make modifications. Complete, edit and produce and signal the downloaded Connecticut Term Sheet - Series Seed Preferred Share for Company.

Every single web template you added to your money does not have an expiration date and is also your own property permanently. So, if you want to download or produce an additional version, just visit the My Forms portion and click on around the develop you will need.

Gain access to the Connecticut Term Sheet - Series Seed Preferred Share for Company with US Legal Forms, the most substantial library of legitimate papers layouts. Use a huge number of professional and express-particular layouts that fulfill your company or person demands and specifications.

Form popularity

FAQ

A term sheet is a nonbinding agreement that shows the basic terms and conditions of an investment. The term sheet serves as a template and basis for more detailed, legally binding documents.

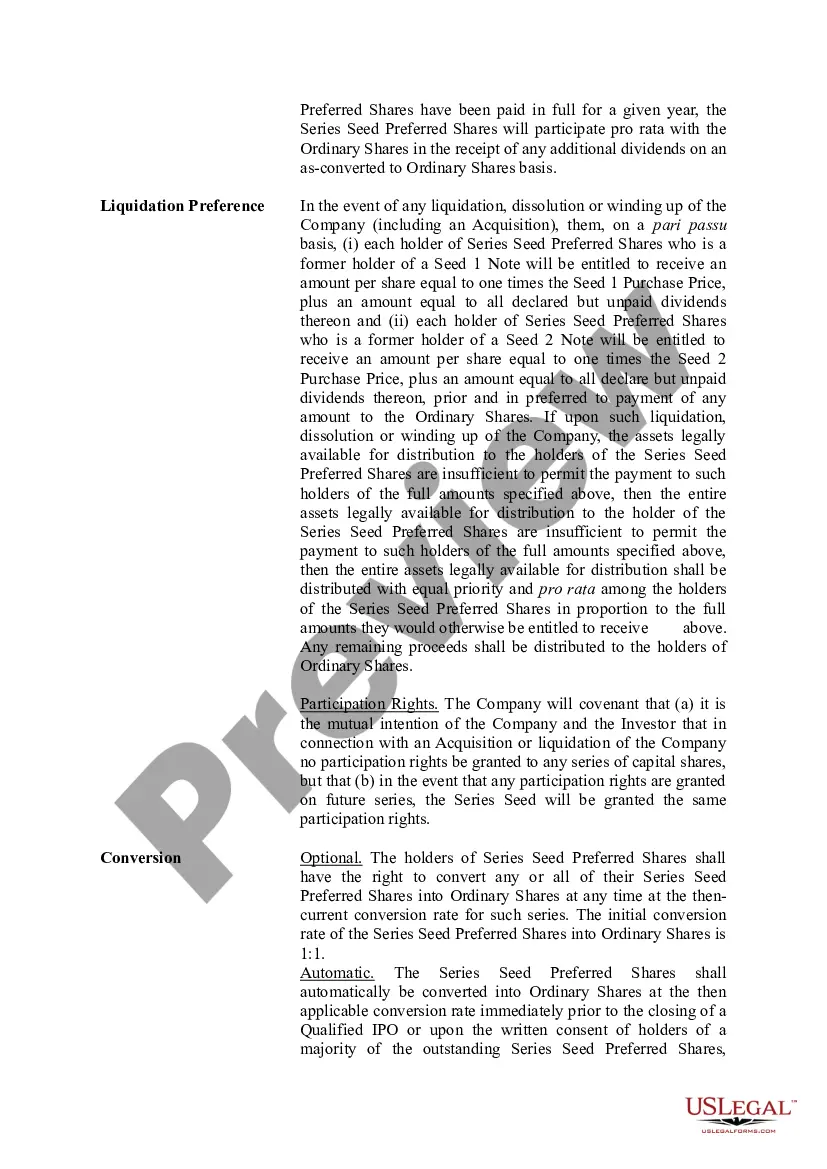

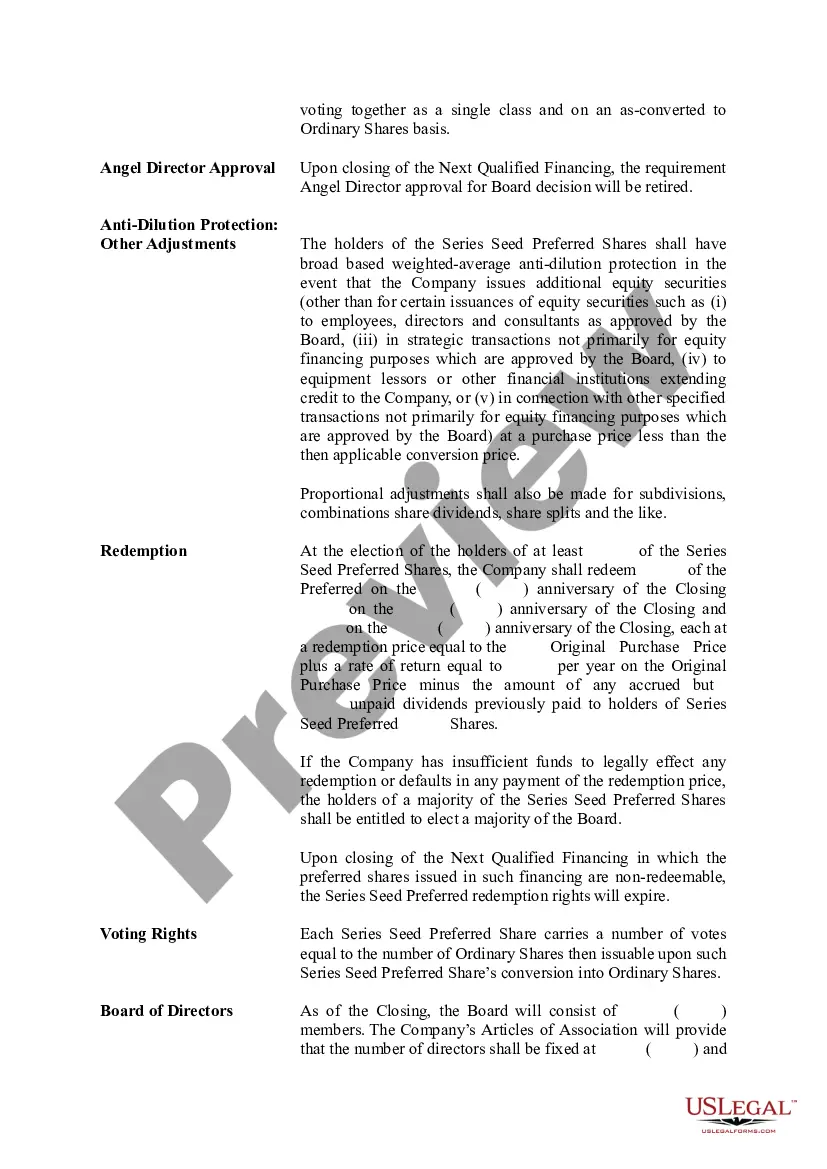

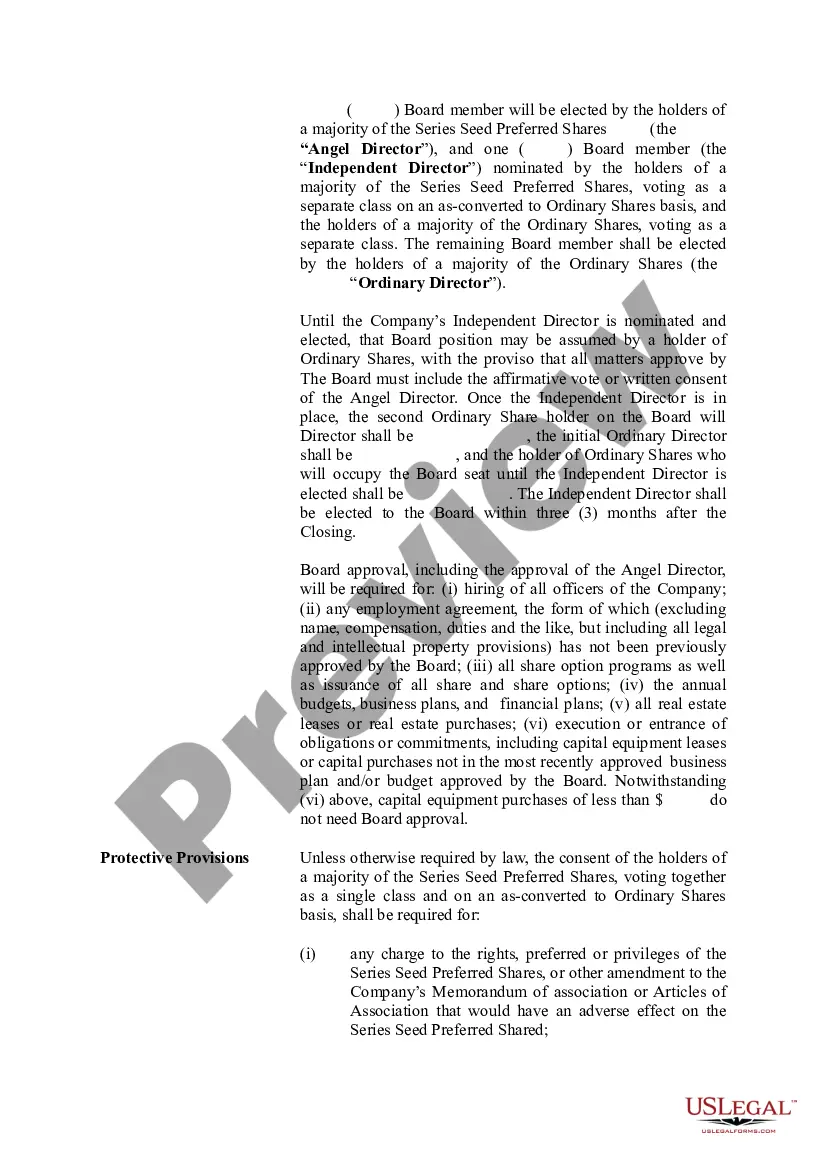

Format of Term Sheet Business Information. This section includes the name of the parties involved. ... Security Type. This segment identifies the type of security offered and the price per share of that security. ... Valuation. ... Amount. ... Liquidation Preference. ... Stake in Percentage. ... Voting Rights. ... Miscellaneous.

Hear this out loud PauseA Preference Shares Investment Term Sheet is a record of discussions between the founders of a business and an investor for potential investment by preference shares. A Preference Shares Investment Term Sheet is not legally binding, except for confidentiality and exclusivity obligations (if applicable).

Hear this out loud PauseThe first round of stock offered during the seed or early stage round by a portfolio company to the venture investor or fund. This stock is convertible into common stock in certain cases such as an IPO or the sale of the company.

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

6 Tips in Making a Term Sheet Make A List Of Terms. Condense The Terms. Describe The Dividends In Detail. Determine And Include Liquidation Preference In Your Term Sheet. Include Agreement On Voting And Closing Issues. Read, Amend, And Prepare For Signatures.

Hear this out loud PauseSeries Seed Preferred Stock is a type of preferred stock issued by startups during their early stage of development. Preferred stock is a hybrid security that combines elements of both debt and equity.

Term sheet examples: What's included? Along with setting the valuation for the company, a term sheet details the amount of the investment and detailed terms around the calculations of pricing for the preferred shares the investor will receive for their money. A term sheet also establishes the investor's rights.